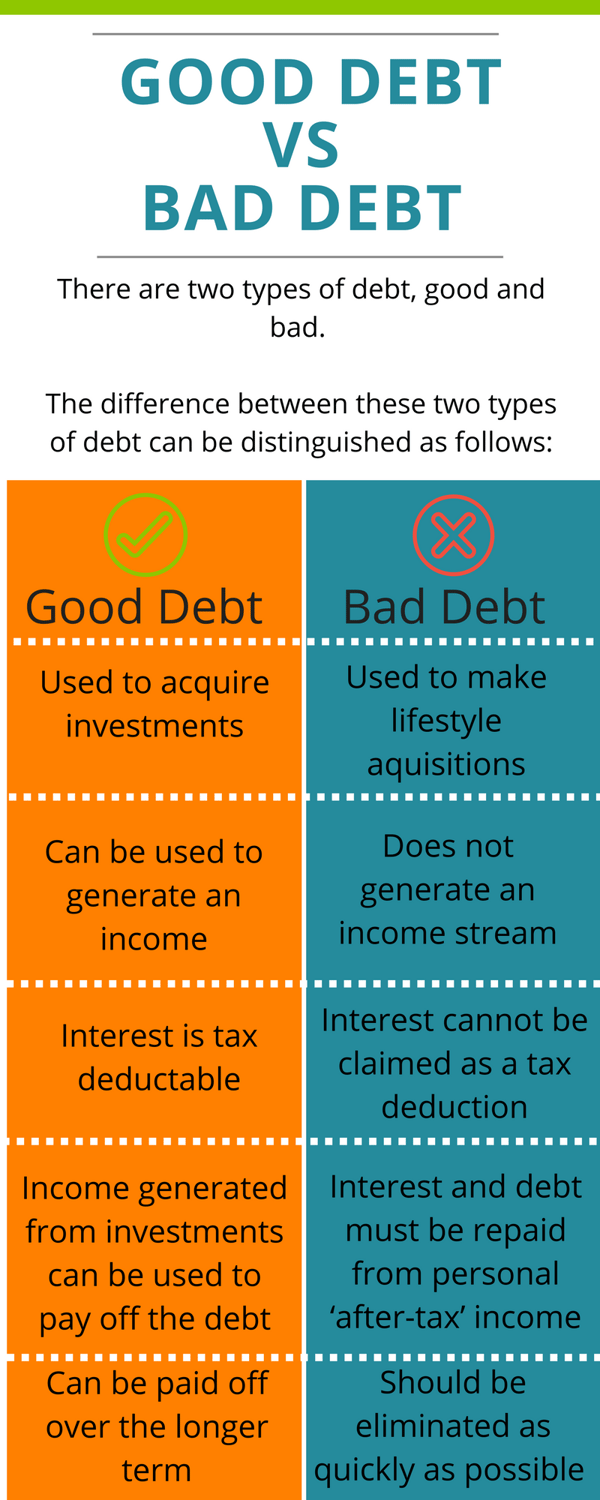

Debt is created by living life. However there is a difference between good and bad debt and knowing a distinguished difference will enable you to build a debt elimination strategy and a customised plan of action.

Debt is created by living life. However there is a difference between good and bad debt and knowing a distinguished difference will enable you to build a debt elimination strategy and a customised plan of action.

From owning your home, to cars and dining out, these all cost money which you earn through your income or borrowed from a financial institution.

When in deep in debt, individuals restrict the ability to build wealth before you've had the chance to start.

Asking yourself these questions will help determine if you are able to service the mortgage repayments, thus crucial for building a successful property portfolio:

- Can I withstand interest rate rises? If not should I fix in my rate?

- Is my income secure enough to repay a mortgage?

- Are my expenses too steep? What can I cut down on?

- What is my back up plan if the mortgage payments gets to be too much?

- Do I have the right type of insurance?

- Am I borrowing this money for the right property, in the right place at the right price?

If you make the wrong decision at the outset and borrow money for a property that is overpriced and you pay too much - then you already have negative equity before you start out.

Seeking advice from mortgage brokers, accountants, lending institutions, financial advisors and your legal experts before you sign on the dotted line for your next property investment loan or mortgage can help eliminate this risk.

Here are 6 tips you can use to help you eliminate bad debt:

- Make a list include all of your debts and split them into Good and Bad. Bad would include things like car loans (cars are depreciating assets), higher education debts and consumer credit card bills.

- Place values and calculate the monthly value of each debt.

- Calculate your after tax income each month - and compare this to the total value of outgoings you have to make to service your debts. If the income outweighs the debts you are in the black, but if you work out your debts are currently outweighing your income - it could be time to make some budgeting changes.

- Consolidate - would it make more sense to consolidate some of your bad debts so that you're only making one repayment? Mortgage lenders often like debts to be consolidated before they lend money to potential home-buyers or property investors.

- Set a budget and work to eliminate your personal and consumer debt so that you can start to move forward with your financial future and acquire only good debt.

- Be smart - if you happen to get some surplus income, use it to pay off your bad debts first and foremost - it's hard to move forward and plan for your financial future when you're laden down by debt.

.png)

.png?width=200&height=100&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)