Which is better for Property Investors?

Which is better for Property Investors?

The decision between fixed and variable rate loans is a very important one for property investors.

It can be overwhelming for property investors with the amount of different types if loans and lenders available and knowing where to start.

The decision is an important one from the start as it has the potential to save investors thousands in repayments, help you reduce risk and can help you ultimately build a successful property investment portfolio.

What influences interest rates?

Variable home loan interest rates fluctuate according to the Reserve Bank of New Zealand (RBNZ) Official Cash Rate (OCR).

The increased borrowing costs eventually result in reduced buyer demand and sales activity in the property market followed by lower numbers of building approvals and downward pressure on property prices.

When the economy slows, the RBNZ does the opposite and reduces the OCR.

When interest rates are comparatively low, it is the Reserve Bank’s intention that housing affordability improves, buyer and investor demand will pick up, and the market receives fresh demand and upward pressure on prices.

While the Reserve Bank sets the prevailing official cash rate, interest rates for home finance are also influenced by market forces, both local and international, and as a consequence banks will require smaller or larger lending margins depending on market risk factors, creating additional volatility in interest rate levels.

Variable rate loans

The rate of interest can rise and fall, this is made at the discretion of the lender on a variable home loan.

This type of loan is the most flexible on the market and allows lenders to make extra repayments, redraw funds from the loan and split the loan if need be.

Fixed rate loans

The rate of interest charged on this type of loan does not change for the duration of the loan.

At the end of the fixed loan period, the borrower can decide to revert to the variable rate or continue on another fixed rate interest period.

To provide fixed rate home loans, lenders access funds with relatively fixed costs over longer terms - which means fixed mortgage rates depend on the market’s expectations on the projected average interest rates over the new few years.

Split rate loans

A split rate loan offers you best of both worlds, you can take part of the loan at a variable interest rate and part of your loan as a fixed interest rate.

Enabling investors to pay different repayment amounts on each split component.

When deciding between fixed and variable loans, consider the benefits of the introductory rates some lenders will offer to kick start standard variable loans for their borrowers.

A low 'honeymoon' rate can be applied to the loan for an introductory period of 6 to 12 months before the rate changes back to the standard variable.

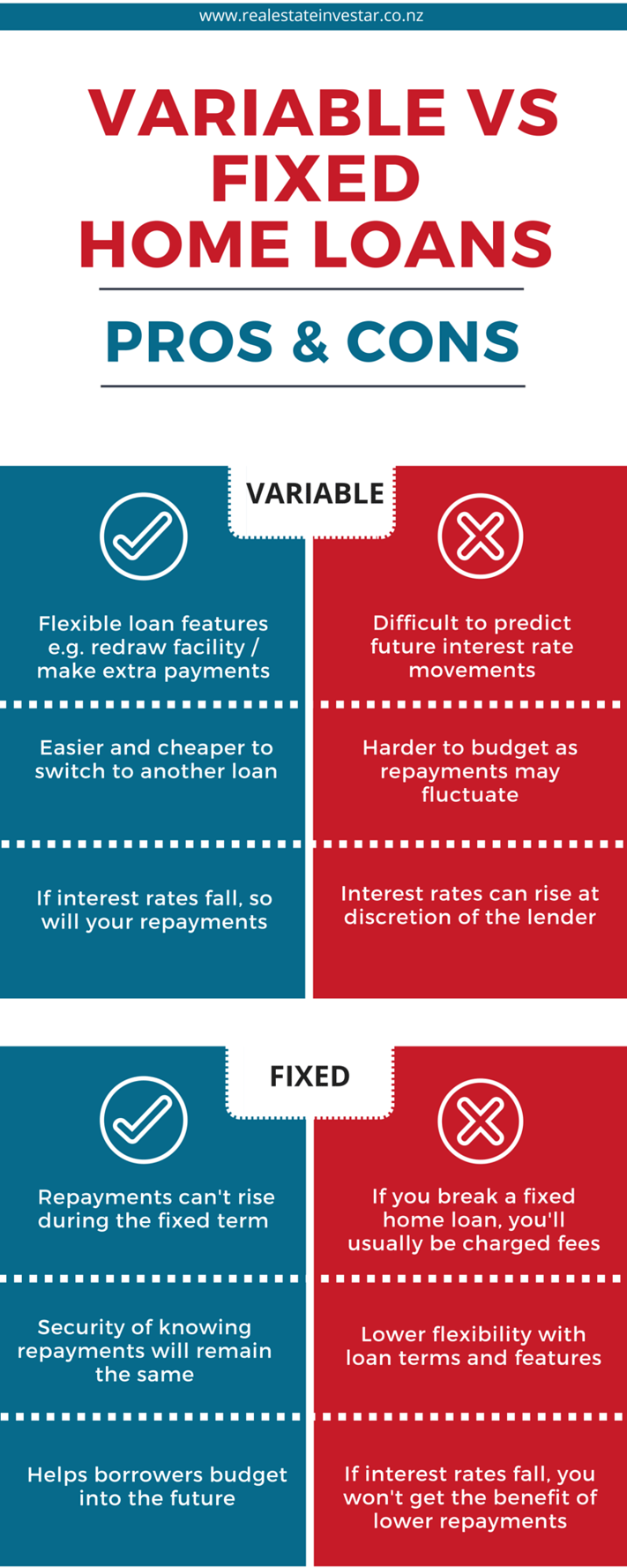

So how do you choose which type of loan is best for you? We have all the pros and cons for you in this infographic.

.png)

.png?width=200&height=100&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)