Saving for a deposit is one of the largest outlays you will have when purchasing an investment property.

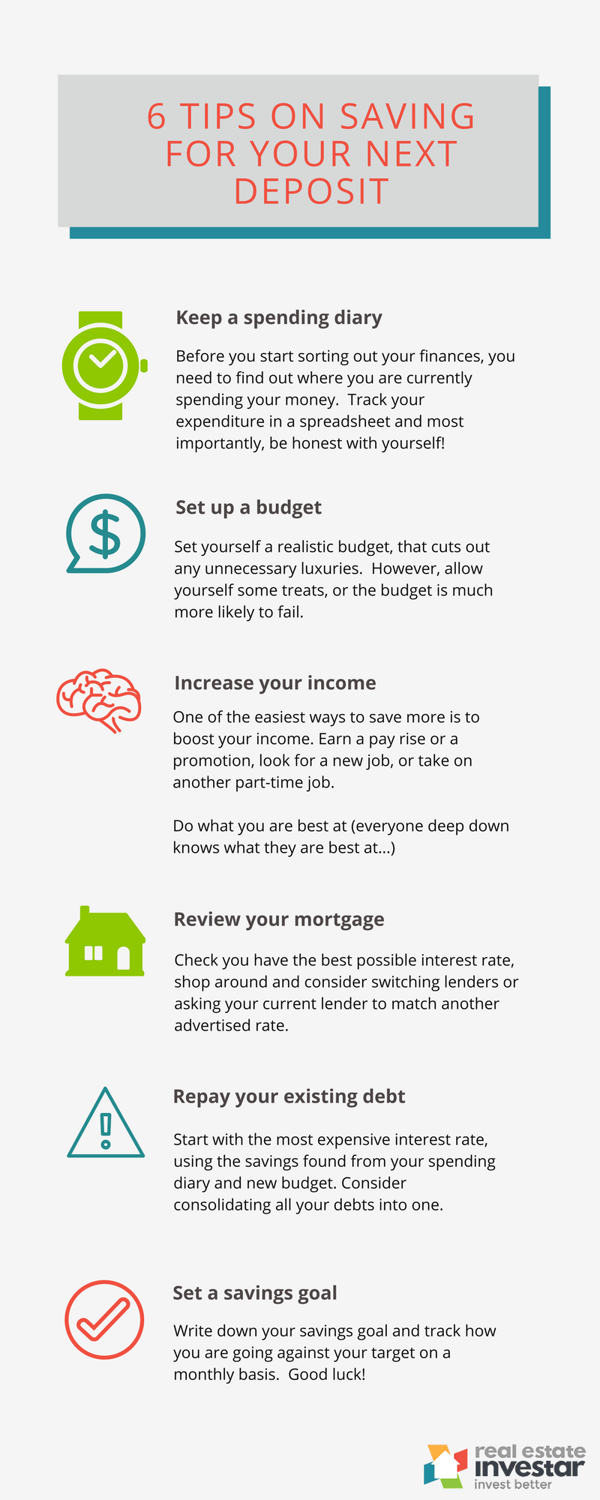

Get your finances on track easily with these six ideas to help you secure a cash deposit for you next investment in no time..

You can use genuine savings, gifts from family members, your SMSF, investments in shares or equity in other properties towards your deposit.

You can calculate the amount you will need to save for a deposit by:

- How much you want to pay regularly in interest repayments

- How high your loan to value ratio (LVR) is

- The type of loan you apply for and

- The lender you choose

Start saving more efficiently today with these tips.

In addition to saving for a deposit you might find these articles helpful.

- [Infographic] 8 Reasons Why You Should Use a Buyers Agent

- [On Demand Webinar] How to Find, Analyse, & Research Renovation Opportunities

- Average Auckland House Price Soon Hitting $1M an Overstatement

Do you have additional saving tips you'd like to share?

We'd love to hear from you in the comments below.

Thanks for reading!

.png)

.png?width=200&height=100&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)