One of the largest outlays you will have when you buy your next investment property is the deposit.

This blog gives you some quick ideas to help you save more efficiently if you are using a cash deposit.

If you are growing your property portfolio, you can use genuine savings, gifts from family members, your SMSF, investments in shares or equity in other properties towards your deposit.

The exact amount you will need to save for a deposit will depend on several factors, including:

- How much you can afford to pay regularly in interest repayments

- How high your loan to value ratio (LVR) is

- The type of loan you apply for and

- The lender you choose

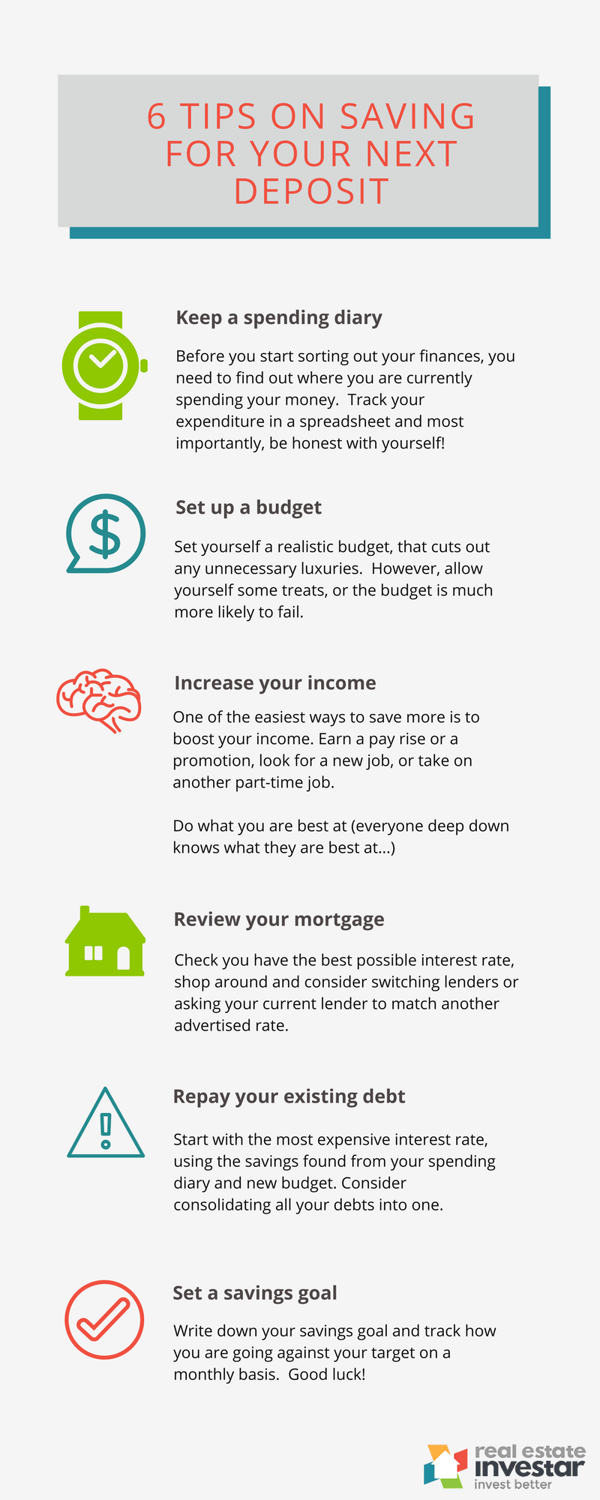

Here are some tips to help you add to your savings more efficiently.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)