Thousands of Australian investors have taken control of their super funds and are using them to invest in property.

Self-managed super funds (SMSFs) have become the single biggest asset class in Australia. 2013 statistics show that the number of self-managed super funds registered each week in Australia is now over 1000.

This essential guide includes SMSF pros and cons, frequently asked questions and how to learn more if you are interested in setting one up yourself and this pursuing this strategy.

What is a self-managed super fund (SMSF)?

A self-managed super fund is defined as a fund established by one to four people for the sole purpose of providing retirement benefits.

While SMSFs enjoy the same financial benefits and concessions as retail, corporate or industry super funds, the key difference and the attraction for many people is the ability for members to take personal control of the assets invested.

Investment decisions are made by the trustees who have the capacity to develop a range of financial strategies designed to cater for the specific needs of each member and to revise these approaches as circumstances change. An advantage is the ability to react quickly and decisively if an investment opportunity arises.

The members are also trustees of the fund, which means that they exercise full control over the investment and they are responsible for investment decisions.

Increase in popularity of self-managed super funds

While SMSFs enjoy the same financial benefits and concessions as retail, corporate or industry super funds, the key difference and the attraction for many people is the ability for members to take personal control of the assets invested.

ATO Self-managed Super Fund Statistics, show that the number of self-managed super funds registered each week in Australia is now over 1000, with the total number of SMSFs now over 500,000, with more than 1 million members.

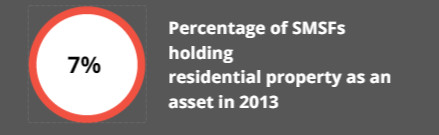

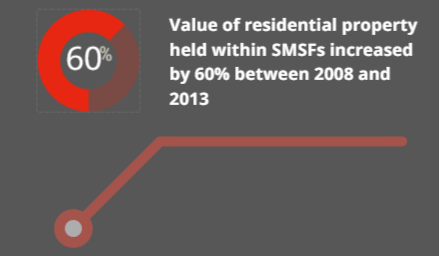

7% of self managed super funds now hold residential property as an asset, whilst the value of residential property held within SMSFs has increased by 60% between 2008 and 2013.

7 steps to setting up a self-managed super fund:

Setting up a SMSF means you need to follow a number of important steps in the correct order.

- Make sure that you understand all of your obligations and responsibilities. This preparatory step is very important when it comes to ensuring the smooth functioning of the SMSF in the future.

- Choose the members. There can be up to three other people involved in a SMSF. Typically, most people choose members of their family but you have lots of freedom and flexibility.

- Select a trust deed. The trust deed should be chosen with the intention of maximising the SMSF potential.

- Put your documentation in order. This is important in legal and regulatory terms.

- Get insurances that will be owned by the SMSF.

- Let your current employer know that you have set up a SMSF. Typically, you will have to provide your employer with a letter of compliance and a letter that lists the manners in which contributions can be made to the SMSF.

- Work on your investment strategy and begin implementing it

SMSFs and property investment

Investing in property with a Self-managed super fund can involve both residential and commercial real estate. Several important rules affect the property purchase:

- The property cannot be the residence of a fund member.

- The property cannot be used as a holiday home.

- The property should be purchased solely for investment purposes.

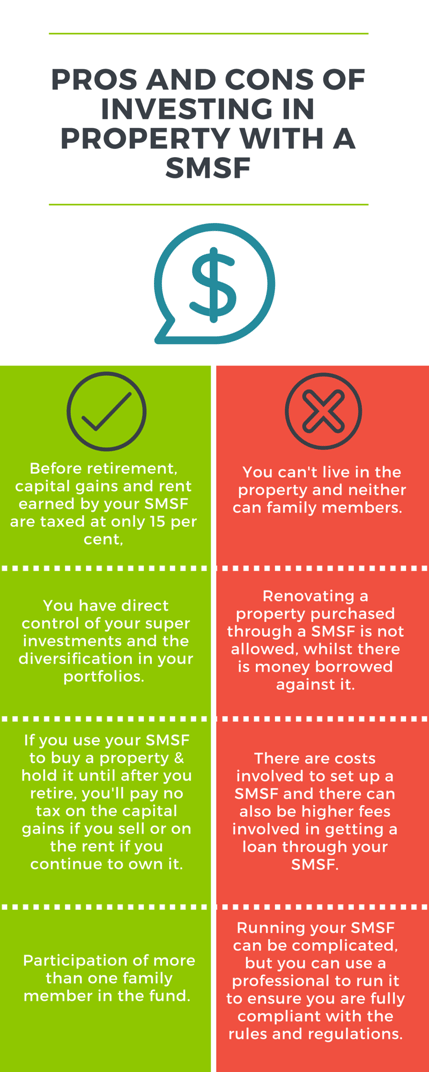

Buying property with self-managed super fund has been a popular strategy for SMSF investments in recent years, and if you are interested in pursuing this strategy there are a number of pros and cons to be aware of.

Self-managed super funds frequently asked questions

What are the potential tax benefits of owning property inside my superannuation?

Within the superannuation environment rental income from investment properties is taxed at 15%. This rate also applies for Capital Gains tax in the first year of ownership, after which it drops to 10% and no capital gains tax is payable on the sale of a property in pension phase.

Can I borrow to purchase property with my superannuation?

Yes. Most banks provide loans to people buying property with SMSF of up to 80% of the property value.

Who pays the mortgage and other expenses of the property?

The SMSF covers interest, maintenance, insurance, rates, body corporate fees, property management and any other associated property expenses. These expenses will usually be deductible to the fund.

Can I buy a property before my SMSF is set-up?

No. You can not purchase a property before you have all the correct SMSF documents in place.

Who pays the deposit when buying my next investment property?

The SMSF pays all deposits on investment property. No out of pocket expense are required.

Who can rent my superannuation property?

The only rule when renting an investment property owned by an SMSF is you cannot rent the property to a related party. This means a member’s relative, or spouse.

How much will the bank lend me to buy a property with my SMSF?

Generally, banks will lend between 70% and 80% of the property value. Each loan is assessed on a case-by-case basis.

How does borrowing to buy a property inside superannuation affect my personal portfolio?

Buying property with a self-managed super fund could have an impact on your personal portfolio if you are required to contribute more money into the SMSF to cover expenses. It’s extremely important that members choose the right property to match your SMSF capacity (income and expenses).

Can I claim depreciation inside a SMSF?

Yes. Standard deductions such as depreciation are allowable inside an SMSF.

What happens if I can’t pay the loan for my superannuation property?

Loans for superannuation property are non-recourse, this means that the lender is only able to take the property and has no right to the remaining assets or funds in your SMSF.

Source Data - ATO, Self-managed Super Fund Statistics

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)