With so many different types of property investment loans and lenders available it is difficult to know where to begin and how much to borrow.

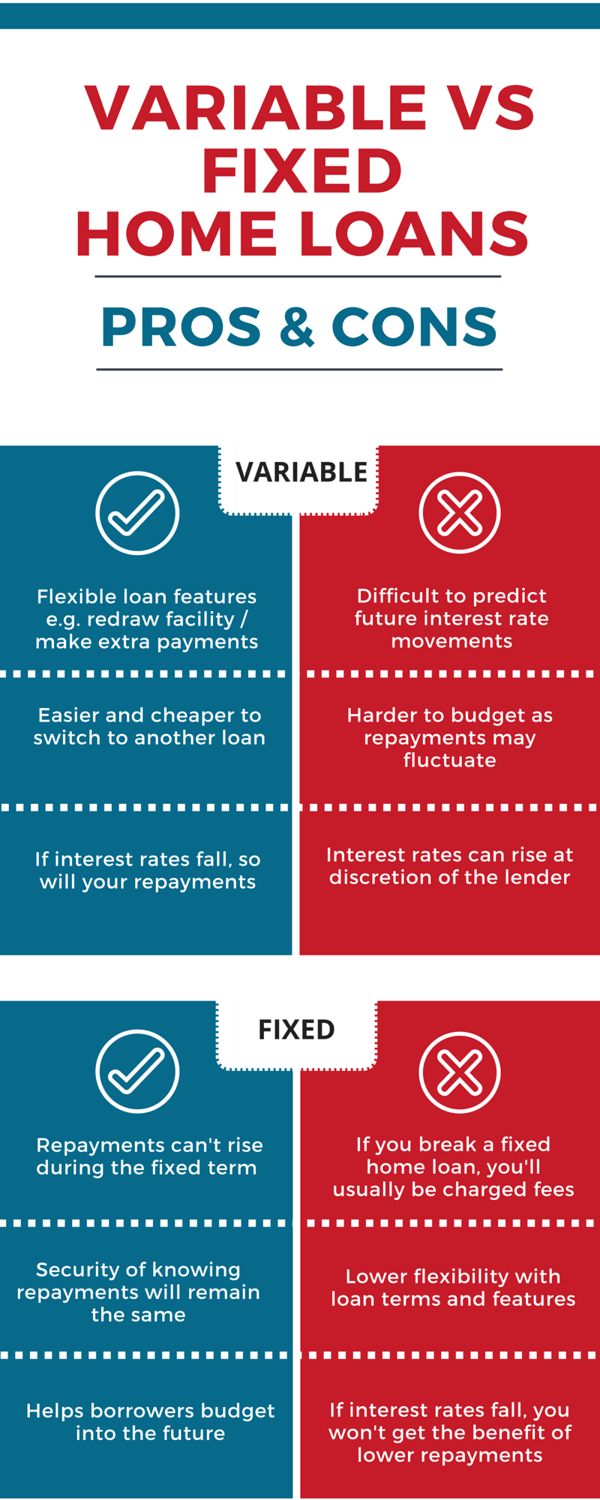

This infographic lists some pros and cons that you can consider when it comes to deciding between a variable and a fixed rate loan to help weigh up which is the better option for you.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)