Property has long been considered a popular path of wealth creation for Australians.

Buying their own home is often the first significant investment most people make, and purchasing another property may well be the second, even before shares and other assets. This article gives you an introduction to property investment and some of the key points to consider before buying your first property.

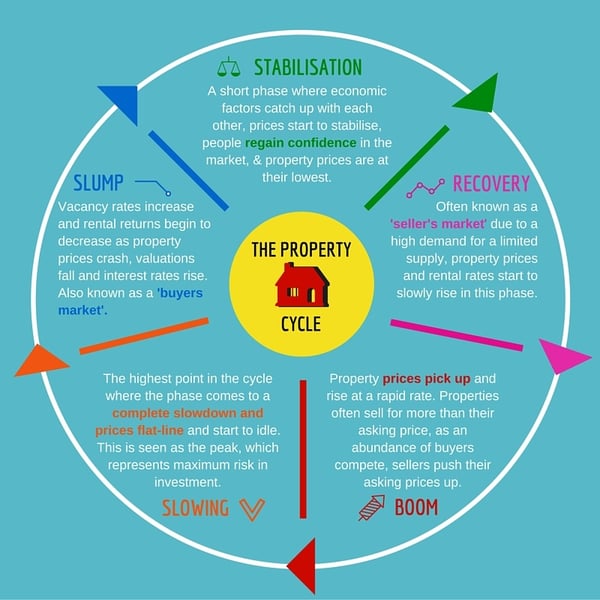

Property is a cyclical investment. History shows that the property market in Australia moves through a cyclical pattern.

As the market passes through the typical ‘boom and bust’ scenarios, outstanding investment opportunities are presented to astute and patient investors who have the tools and strategies in place to take advantage of the market conditions.

The impact of sentiment and confidence

Sentiment plays a significant role during these ‘bottom of the cycle’ periods, and the real estate market can easily be talked down on rumour and negative media reporting rather than reacting to factual data.

Property investors must appreciate the Australian market is made up of micro-markets, each of which responds differently to the various economic factors.

During a downturn there will always be property investment opportunities which buck the trend and can be a worthy addition to your portfolio – if you can find, research and analyse them using accurate, timely data before the rest of the market.

As the market turns upwards, confidence returns, building approvals rise and the situation can change quickly.

There are many benefits of property investment including;

- Generating wealth though rental income and/or capital growth.

- Tax advantages through depreciation, after-tax tax losses and the resultant reduction in your personal tax paid.

- Helping you to create financial security and create long term wealth.

- Allowing you to leverage your equity and borrow against your property to buy more property and grow your portfolio over time.

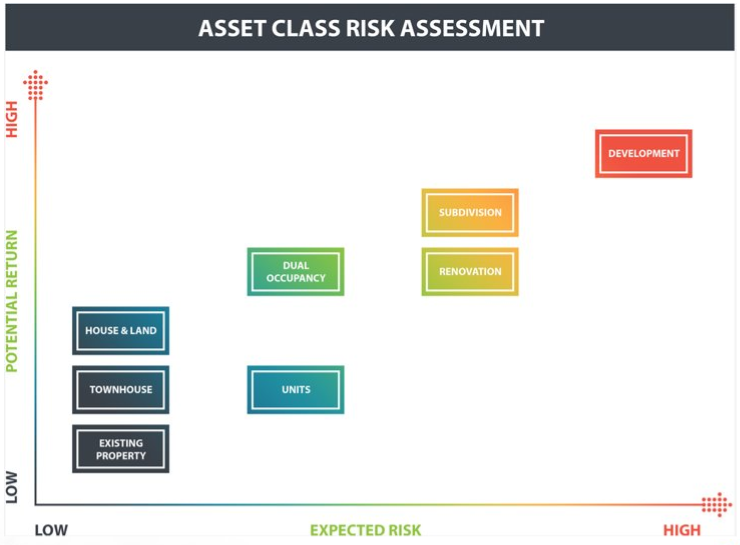

Selecting a property investment strategy

Before you embark on your property investment journey, consider selecting a strategy that best suits your current circumstances.

For example, do you want to invest in property to;

-

Generate a new income stream to live off?

-

Create long-term capital growth to help fund your retirement?

-

Generate relatively quick profits through buying renovation properties and on-selling (trading) them?

-

Create larger potential profits through development projects - but which tend to have higher degrees of risk?

Next, you will need to work out how much, in dollars, you will need to achieve this goal.

For example;

How much equity and/or cashflow do you want from your portfolio be in order to keep you happy in your retirement?

Successful real estate investors rarely become so by chance, but are usually savvy, hard-working people who conduct lots of research, take calculated risks, and keep their ultimate goal in mind at all times.

Building a team to work with

Because raising the initial capital to buy your first real estate investment can be difficult, it is tempting to bypass identifying professionals whose help will be needed.

Real estate investment is much like running your own small business – you are in the “business of property”.

Whether you have 1 or 100 properties in your portfolio you will need to make decisions about tenants, property management and maintenance and keep thorough records of all transactions and dealings for management, accounting, tax and legal reasons.

Value your own time highly

When you come to making a decision about whether or not you will hire a contractor to carry out maintenance work, weigh up the benefit of using a property manager for these and the other decisions that face real estate investors every day, before deciding to take on these tasks yourself.

Think about the impact on your own time. You are a valuable commodity. Can you really afford to do the work yourself when you could hire a professional and minimise the true costs by writing them off as tax deductible anyway?

As a general rule, choose a team of experts including

- Accountant

- Lawyer

- Independent mortgage broker

- Independent valuer

- Contractors such as plumbers, painters, cleaners, pest controllers

- Property manager

Forge long-standing relationships with people you trust very early on in the piece and seek advice before you even start making conditional offers on properties.

Be finance ready

Real estate investment costs a considerable amount of money and for many investors raising capital and sourcing funding is the major impediment to forging ahead.

Determining the right financier is partly about relationships, but more importantly about aligning your borrowing strategy and structure with your long-term investment goals.

An experienced broker or banker is an essential member of your team.

You wouldn't choose your next house or car on price alone and you should not choose a mortgage just because it offers the cheapest rate.

Lenders that offer specialist loan products for investors should be considered.

Approaching a bank

A bank lender can be directly approached and it can be as easy as making an appointment with the loans manager at your local bank branch.

Using a mortgage broker

A mortgage broker will essentially shop around for the right loan for you and your individual financial situation.

Look for one who is accredited as entirely independent and not attached to a real estate or property development sales office. You can learn more about financing your next purchase in this article.

Impact of interest rates

Interest rates move, so you will need to allow room in your budget for interest rate increases and other unforeseen additional spending.

When interest rates drop, simply maintaining the same repayments is one of the fastest ways of paying off more of your loan and building a buffer if they rise again.

Think very carefully about the different loan product offerings available and how these relate to you and your spending and saving habits.

Consider options such as an offset account that will enable you to take advantage of using any excess cash to save on interest.

Finding the right location

The location that you choose will depend on the property investment strategy you are pursuing.

Every property will have compromises, but when you are choosing the location to invest in, consider:

-

Population growth

-

The ripple effect

-

Future zoning and development plans

-

Statistical indicators

-

Levels of supply and demand

It is critically important to perform thorough research of any location. The more time and effort you invest in researching the suburb or location, the less risk you will be taking.

Narrowing the search and shortlisting properties

The type of property you target will depend on lots of factors, including;

- Location: is it close to schools, shops, day care and sporting facilities?

- Transport: is it close to bus stops and train stations?

- Demographics: especially population numbers, growth and density.

- Suitability to rent: are the rooms big enough and are there usable living spaces inside and outside and other features such as garaging and storage?

- Future potential: can the property be renovated or developed? Are there any plans to develop surrounding properties, e.g. high density dwellings?

Whilst it is hard to generalise, all of these factors will influence your property search during your investing career.

Once you have targeted a property, at the very least, ensure you research

- How long the property has been on the market for

- Its on the market history; any changes in advertised price since it was placed on the market

- Its sales history i.e how much the previous owners bought it for

- The median sales price for similar properties in the area and historical capital growth rates of the location

- How much comparable properties are selling for (and renting for if you plan to let it as an investment property

- If you are planning on renovating the property then selling it on quickly, how much similar properties are selling for that already have the features you intend to add

- An estimated market value

Due diligence

Depending on the type of property you have targeted, you will then need to;

Analyse the initial costs of the property

- Purchase price

- Stamp duty

- Your time and travel

- Building and pest inspection

- Legal costs

- A depreciation schedule

Analyse the ongoing costs of the property

- Utility bills

- Repairs and maintenance

- Renovations and capital improvements

- Property management

- Interest on your loans

- Insurance

- Rates

- Body corporate

- Unplanned vacancies

Evaluate the costs and benefits of the investment over the life-time of the investment, and consider your ability to service the loan that is needed to finance the investment

Accurately forecasting all of these factors will give an you a good indication of whether or not your investment is going to be viable.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)