The positive cash flow property investment strategy involves purchasing property that will create surplus cashflow pre-tax.

This blog is aimed at property investors of all levels of experience, and covers:

- Some goals you can aim to achieve if you are looking to find and purchase positive cashflow property.

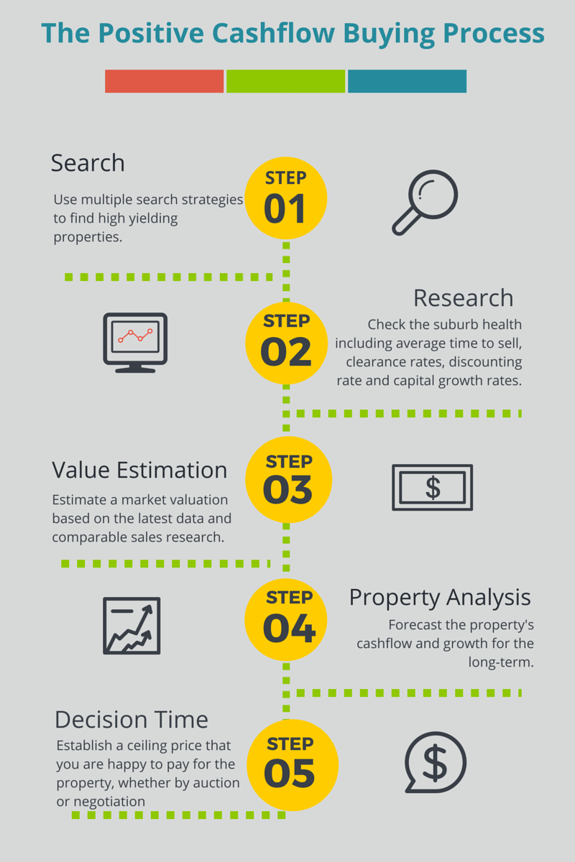

- A process to follow to help you find, analyse and research positive cashflow opportunities

- How-to videos which demonstrate how we can help you find high yielding property.

Strategies for finding positive cashflow properties

There are many strategies that you can follow to target positive cashflow properties when starting your search and also to manage these properties to help boost cashflow.

They include:

- Looking in high yielding suburbs.

- Buying properties 20 - 40% below the median price for the suburb.

- Targeting multiple income properties - e.g. properties with a granny flat.

- Buying in regional areas or targeting student accommodation.

- Renovating and adding value to increase rents.

- Managing interest rates and fixing when we think the current interest rate is at the bottom of its cycle.

Key goals when buying property for cashflow

- To find and purchase a property that produces surplus cash flow (pre-tax). So we are not talking about depreciation or tax at this stage, the property needs to produce cash upfront.

- To understand key suburb fundamentals and property facts that will help us make a good buying decision.

- Accurately analyse the long term cashflow and set a maximum purchase price whether we are buying by auction or negotiation.

Rental yield is a measure of how much cash an investment property produces each year as a percentage of the property's value.

Rental yield can be calculated as a

- gross percentage i.e. before expenses are deducted, or

- net percentage i.e. with costs accounted for.

The gross rental yield is a simple calculation to use, it doesn't take into account the expenses of the property.

Formula for gross rental yield

(Weekly rent x 52) / Property purchase price x 100

A property may have a high gross yield for example, but also have high expenses, making the net yield low when these are taken into consideration.

To work out the net rental yield, you will need to know the total expenses of the property. You can then use this formula.

Formula for net rental yield

(Annual income - Annual expenses) / (Total property costs) x 100

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)