Property investment can be a sustainable and lucrative way to generate long term wealth.

It is crucial to get the fundamentals right and judge the market dynamics to suit what are your long-term strategy is. Here are 5 tips to help you get started. Hope they help!

1. What do you want to achieve?

Before you embark on your property investment journey, you should select a strategy that best suits your financial circumstances.

Ask yourself, do you want to invest in property to;

- Generate a new income stream to fund your lifestyle?

- Create long-term capital growth to help fund your retirement or eliminate bad debt.

- Generate relatively quick profits through buying renovation properties and on-selling them?

2. Understand the market

You need to understand the prevailing market conditions to understand what you should be paying for your target property.

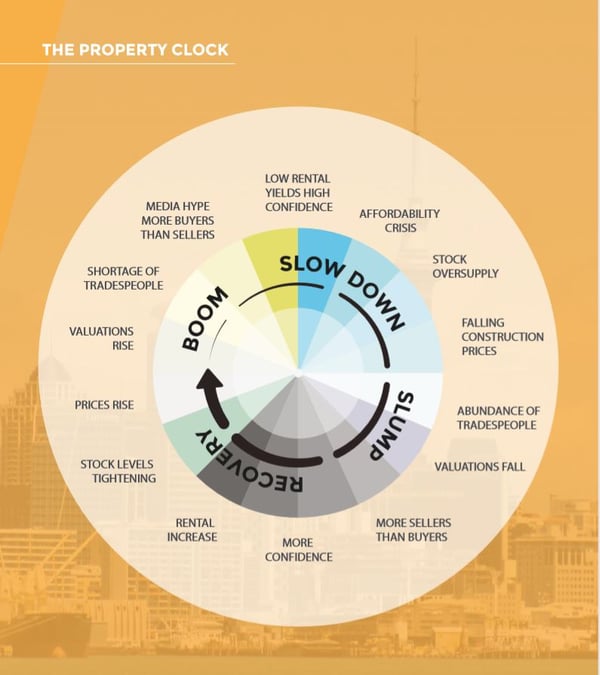

Another item to consider is the suburbs that are best to invest in, based on their historical capital growth rates and projected future performance. You can also use a property clock, such as this example, to help decide when and where to invest.

3. Crunch the numbers

Depending on your goals, you’ll need to work out what makes financial sense.

For example, if you are planning to buy and hold the property, then you will need to consider the holding costs of the property, such as including mortgage repayments, rates, body corporate fees, insurance etc and then see what your cash flow would look like after receiving your projected rental income.

Potential to use your equity

Equity is the difference between what your home is worth and how much you owe on it.

This is a crucial concept in property investment.

If you are interested in purchasing your next investment property, it’s possible to use the equity in your home or other investment properties to help you do so.

If your home is valued at $500,000 and there is $150,000 still owing on the mortgage, your total equity is $350,000.

Keep in mind that you can’t use all of your available equity.

The bank is lending you money against the value of your home, but they won’t lend you the full amount.

This is because if property prices decline, they will not want an outstanding loan that is worth more than the property the loan is secured against.

In general, banks will lend you 80% of the value of your home, less any debt you still owe on it.

This is your usable equity. However, under certain circumstances, you can borrow more than 80% if you take out Lenders Mortgage Insurance.

Example

Existing borrowings - represented by the blue section of diagram 1.

If your home is worth $500,000 and you have $150,000 remaining on your loan, your existing borrowings would represent 30% of your home value.

20% equity - Represented by the orange section of your home.

This is the safety net that lending institutions like to have as their safeguard against the borrowings on your home.

In this example 20% equity of $500,000 is $100,000.

Usable equity

If you are planning on using equity to buy property, you can potentially access 80% of your total equity as security.

In this example, the green section of diagram 1 represents the usable equity of $250,000.

You may have usable equity in your properties, but that does not necessarily mean you can borrow against it.

Your lender will take into account your income, number of dependents, any other debts you have and a range of other items to decide the amount of equity you can access.

Real Estate Investar can help you with this process.

The first step is to register for a free consultation with a senior property strategist.

4. Understand the potential risks

As with all types of investment, there are risks, but with the right strategy and support, you can mitigate these risks to give yourself the best chance of success.

The risks include:

Market risk: which can affect all investments in an asset class, such as in the event of a market-wide price crash.

This means market risk that cannot easily be mitigated through diversification.

Liquidity risk: Equates to the possibility that an investor may be unable to buy or sell an investment when desired (or in sufficient quantities) due to limited opportunities.

Illiquidity is a salient risk in real estate. It is difficult to sell a property quickly should the need arise, which is not the case for stocks and shares. Liquidity risk in New Zealand property can be mitigated through investing in suburbs with strong demand and limited supply.

Interest rate risk - In New Zealand investment property, the interest rate risk instead lies in variable rate mortgages as the cost of debt capital can materially increase when the Reserve Bank increases the cash rate. The risk can be reduced through the use of fixed-rate loans and cash flow management.

5. Build a team of experts around you

If you are just starting out in property investment, it’s crucial that you use a team of experts to help.

For example, you will need a good mortgage broker, property manager, lawyer etc.

If you would like to learn more, you can register for a free consultation with a senior property strategist. This no-obligation service includes:

- How to build a property portfolio with no cash deposit & no weekly outlay

- How to use investment property to pay off your current mortgage

- How to structure the mortgage to protect you, your family and your home

- Where to look and what to buy for the best return

- And most importantly we’ll discuss how much you will need to be financially secure and show you how property can take you there

.png)

.png?width=200&height=100&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)