There’s been plenty of attention on this week’s Federal Budget after Treasurer Josh Frydenberg put a clear focus on creating jobs and lifting the economy out of recession.

However, was there enough in the budget to help property markets?

At first glance, the actual assistance to property investors does appear to be minimal. The obvious first opportunity would have been an extension to the $680 million HomeBuilder scheme, which did not eventuate.

The Government believes the program did bring forward housing demand and when we look at the uptake in states like Western Australia, South Australia and Queensland, it certainly has done its job to stimulate the building and construction sector.

The extension of the First Home Loan Deposit scheme, was one measure that is likely to assist the property market and so far this has been a very positive program.

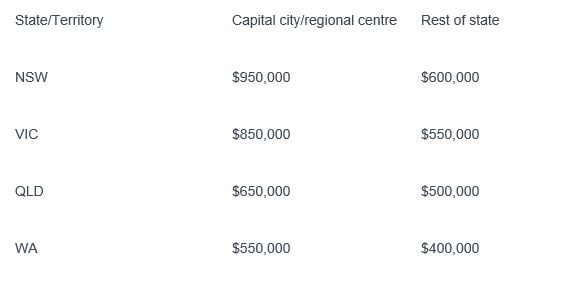

The First Home Loan Deposit scheme allows first home buyers to access finance with LVRs as high as 95% and not pay Lenders Mortgage Insurance (LMI). The Government will make this program available to another 10,000 home buyers in the next financial year.

At the same time, the caps on eligible properties have been increased across the countries, which will allow more people to engage with the program.

First Home Loan Deposit scheme caps

The Federal Government committed to further cheap finance to help build affordable housing, increasing its guarantee for the National Housing Finance and Investment Corporation (NHFIC) by $1 billion. This program is about boost social housing measures and is targeted at lower-income households.

At the same time, we did see some small tax concessions for granny flats. The changes will be aimed to help assists families and those likely to occupy a granny flat which includes the elderly or people with disabilities.

Aboriginal and Torres Strait Islander’s received a $150 million boost to the Indigenous Home Ownership Program - which is targeted at home loans for new housing construction in regional areas.

There has clearly been a focus on first home buyers, social housing programs and encouraging job creation specifically in the building and construction industries.

However, it is important to note that the real estate industry is one of the largest employers across the board in Australia. So there has been some criticism that there has been little assistance for the established market.

In reality, the budget will likely do little to assist existing property investors, but at the same time, we have already seen a number of reforms and policy changes that are looking like they are going to be very beneficial to investors.

These include the changes to responsible lending criteria, which has had a stifling effect on the ability to get finance for many investors. It’s expected these changes will take place by March 2021 which was outlined last week by Treasurer Josh Frydenberg.

The RBA has slashed the cash rate to 0.25% and has recently flagged the possibility of that falling even further - perhaps even at the November meeting.

We’ve also seen the tapering of assistance programs such as JobKeeper and JobSeeker, while APRA is facilitated home loan deferrals through to 2021.

For the time being, property markets are holding up strongly with strong demand for good properties and low supply in most areas.

Arguably, it will be the next Federal Budget which will be the real opportunity for the Government to assist the property market and it’s clear they will be hoping that the borders are open and demand can finally return to pre-COVID levels.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)