Property investment comes in many different forms; commercial property investing covers shops, factories, offices and warehouses, while residential property investing includes holiday lets, short stay, long-term rentals and student accommodation.

Both are feasible options depending on your financial situation and level of experience.

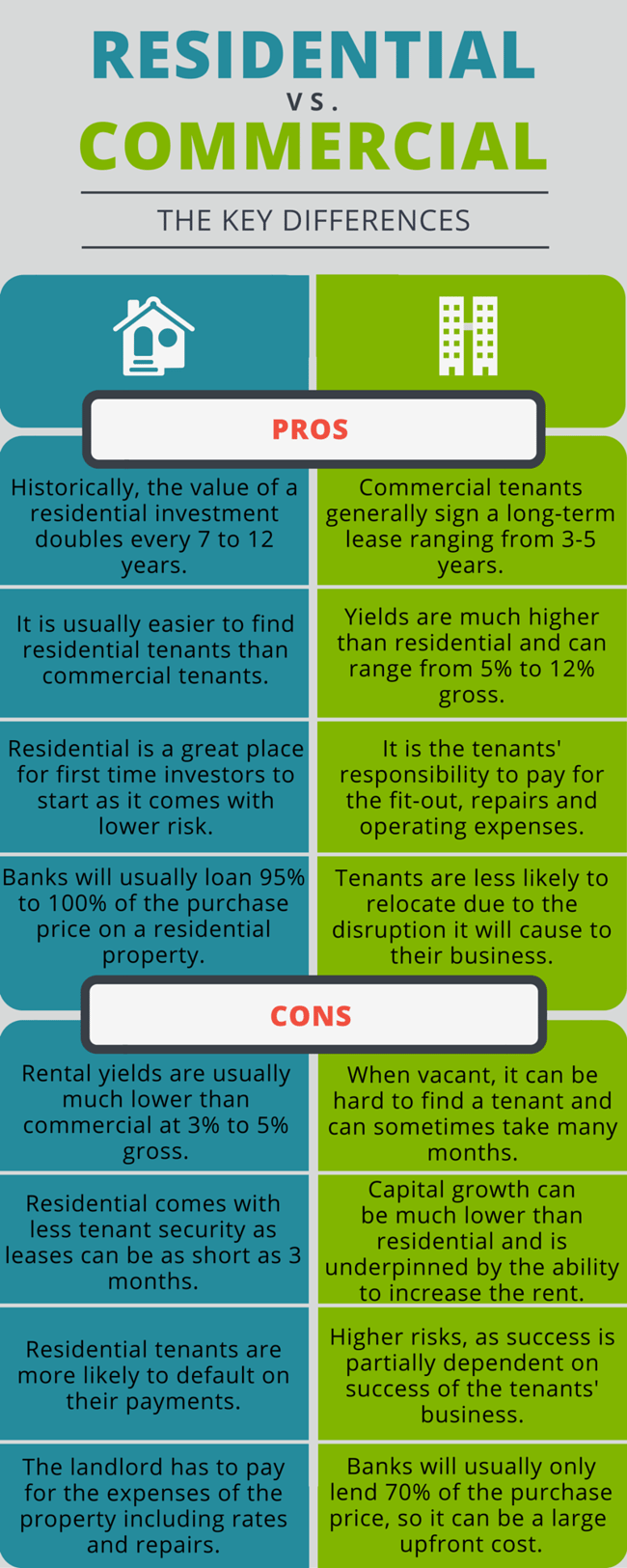

This infographic lists some general pros and cons that you can consider when it comes to commercial and residential property investing to help weigh up which is the better option for you.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)