Early in the year, 2020 was shaping up as another very strong one for property investors.

On the back of a big end to 2019, where house prices in Sydney and Melbourne in particular, started to rebound strongly, there was a lot of positivity in the air. Then come mid-March, COVID hit and the ensuing lock-downs across the country ground real estate activity to a halt.

As the saying goes, ‘crisis breeds opportunity’ and the current market is now offering up a range of possibilities for investors that weren’t present only months ago.

Here are a few ways to take advantage of the current market conditions in 2020.

Record Low Interest Rates

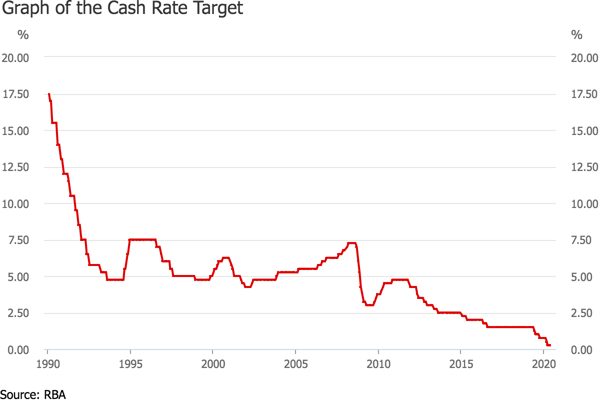

When COVID first hit, the RBA was quick to act, and Governor Lowe and the board slashed the cash rate to 0.25 per cent - a record low level.

What this meant was mortgage rates fell and we are now seeing some lenders offering interest rates in the low 2's.

This presents a couple of different opportunities for property investors.

Strong Cash Flow

The most obvious is that currently, most properties will be either positively geared or at worst neutrally geared.

What that means, is the payments on your mortgage, will be covered by the income you receive from renting out your investment property.

While rental yields are low in the likes of Sydney and Melbourne after nearly a decade of strong growth, there are plenty of other cities and regional areas where you can find properties that have five per cent plus yields - meaning instant cash flow.

Cash flow positive properties are important for investors who are looking to build a large property portfolio as it allows you to hold those properties and wait for future capital growth, while putting money in your pocket every month.

The second advantage of low interest rates, is it means you may actually be able to borrow more money. Lenders will assess your borrowing capacity based on your ability to make your repayments, which is a function of your income and expenses.

In the current interest rate environment, it is possible you can get your hands on more money than you might have been able to only a year or two ago.

Of course, lenders do add in a buffer for protection, but overall, this is probably the best time we’ve seen to get access to credit and we can almost be certain we won’t be seeing these types of interest rates again for some time when they do finally rise.

Distressed Sales

One of the most important parts of identifying good investment opportunities is to understand the vendor’s motivation.

If they are highly motivated, because of unfortunate circumstances such as a divorce of financial worries, they are likely to be keen to take a discount on the sale price in order to get a quick sale.

At the same time, the fact that many people have lost their jobs as a result of COVID lock-down measures means that there is the possibility that there will be some distressed sales coming up in the next few months.

This will be highly likely when the Government winds back some of the support measures such as JobSeeker and JobKeeper and certainly when any mortgage holidays come to an end.

Buying distressed properties or mortgagee in possession type properties is a great way to buy well under market value.

This can lead to both instant equity and also significantly boost your yield, especially when combined with a quick cosmetic renovation.

Learn more about how to target distressed property here.

Government Incentives

In times of crisis, Governments are very quick to start injecting stimulus into the economy and as we’ve already seen they also put a big focus on looking after the property sector.

What we’ve seen is the release of stimulus packages such as HomeBuilder, which is a grant of up to $25,000 if you are looking to build or to do a substantial renovation.

We are also seeing some of the states rolling out programs of their own, such as WA who has offered up $20,000 for investors and homeowners who chose to build.

These Government grants and exemptions are also able to be stacked on top of each other, making it a windfall for certain segments of the market.

While the requirements for these grants are restrictive in some areas, the sheer value of some of them makes it an enticing proposition. For example, a first home buyer in WA is currently able to access around $65,000 in Government grants and stamp duty exemptions if they choose to build.

That’s a pretty good way to get a big boost in your equity. A number of these grants have been targeted at owner-occupiers, but certainly not all of them.

There is also an opportunity to take up the grants (if you qualify), live in the home after it’s built and then ultimately rent it out as an investment down the track.

Looking for a property with subdivision potential is another smart way to take advantage of some of these Government offers.

But you’ll need to act quickly as these incentives won’t be around long and if you’re looking to subdivide first, you’ll need to consider whether you’ll have time to get the process done.

While the events of 2020 could not have been predicted, the fallout will certainly lead to some excellent opportunities for property investors who are ready and willing to act in the coming months.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)