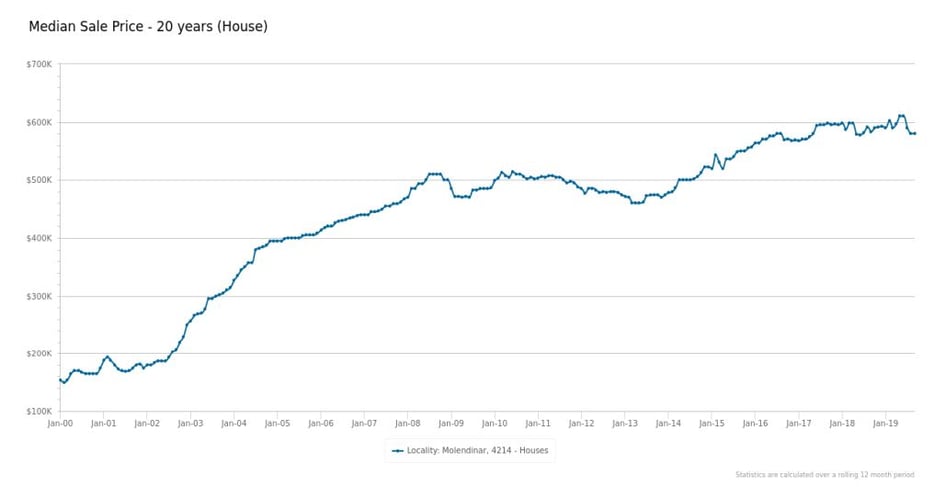

Being able to review the growth trends of a suburb over a long period of time can help you identify suburbs that will provide potential long-term growth.

Past growth isn't an indicator of guaranteed future growth but it does provide an indication that there has been demand in the area.

Access to median prices over a long period of time provides investors with an idea on demand for a suburb and the opportunity to compare the growth of the area to other suburbs and the growth of the greater area.

How do I obtain this information?

Through Real Estate Investar's Professional Subscription, you'll have access to CoreLogic RP Data and can run a Signature Sales CMA Report.

You can compare Real Estate Investar, RP Data and Pricefinder in this blog article.

This report will provide the following data:

- Median sale price over the past 20 years

- For each year, it will include:

- Number of properties sold

- Median price

- Growth % compared to previous year

- Average days on market

- Number of listings

- Asking rent

Source: CoreLogic 2020

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)