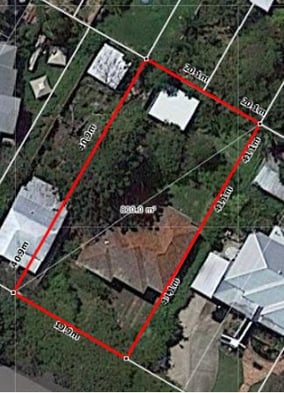

Widow blocks still currently exist and allow property owners to subdivide the lot in to smaller blocks.

This is a great strategy to manufacture equity and provides property owners with a number of options - land banking, sell the land or build to sell and/or hold. Widow blocks exist throughout Brisbane from the times of World War 1. These lots are rectangular in shape and split diagonally with two triangular portions so the rear allotment does not have street frontage.

Widow blocks are effectively 2 lots on 1 title.

Why was the block split like this?

World War 1 soldiers split their blocks diagonally (with the rear block in the wife's name) to prevent them from selling the house while they were away at war.

Can you subdivide a widow block?

Widow blocks are 2 lots on 1 title which means the buyers purchased 2 lots and built 1 dwelling across both lots. The original lot numbers remain and over time the 2 titles were combined to form a single title.

If you research the lot/plan reference for the lot, it will show the property description with 2 lot numbers, for example: L286-287 RP33003.

These blocks can be split into 2 lots and are generally easier than a full subdivision where it only requires a reconfiguration of the lot.

The typical size of a widow block in Brisbane is 810m² and post subdivision, the 2 lots will be 405m² each in size.

Learn more with this quick video

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)