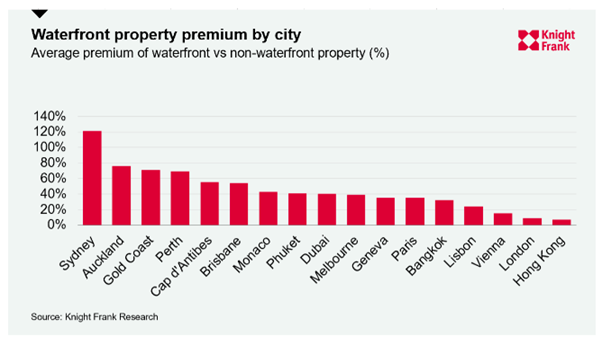

Sydney is leading the world in premium waterfront properties, with buyers in the Harbour city prepared to pay more for those famous water views.

The 2022 Knight Frank International Waterfront Index saw Sydney at number one in the world, with the Gold Coast and Perth following closely behind.

A waterfront property in Sydney with iconic views across the harbour attracts an average premium of 121% compared to an equivalent home set away from the water.

On the Gold Coast, buyers were prepared to pay a 71% premium for a glimpse of the water while in Perth there was a hefty 69% premium for a look at the ocean or the Swan River.

Brisbane (55%) and Melbourne (39%) were also in the top 10 list.

Source: Knight Frank Research

Head of residential research at Knight Frank Australia, Michelle Ciesielski, said Sydney typically attracts a premium for waterfront properties.

"Regardless of the season in Sydney, there is always a strong appetite for waterfront homes, especially those with uninterrupted iconic views of the Sydney Harbour Bridge and Opera House," Ms Ciesielski said.

"A waterfront property also offers the potential for maritime facilities, and we've seen elevated enquiries since the pandemic. There's only limited number of prestige properties on the harbour due to nature reserves and parklands."

During the pandemic, house prices in premium locations such as those with water views continued to attract strong demand as buyers were forced to stay inside for long periods of time.

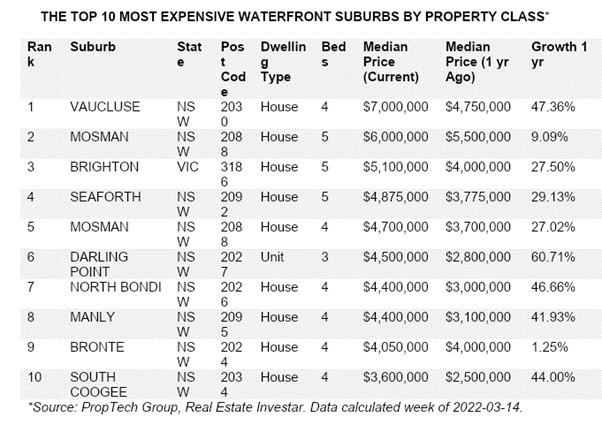

In 12 months, prices of some of the most expensive waterfront suburbs in Australia saw growth of nearly 60 per cent according to PropTech Group.

The average premium paid for a waterfront property across the 17 cities included in the Knight Frank Index was 40 per cent, with prices for waterfront homes increasing an average of 10.9 per cent over the year to June.

Beachfront homes were the most in-demand, receiving a premium of 63 per cent.

With properties in harbour locations coming in a close second, with a 62 per cent premium, while coastal homes commanded a 40 per cent premium.

In Sydney, harbourside homes typically see the greatest premium, as they are closer to the city and were more likely to offer direct water access than beach homes, which typically sat across the street.

According to PropTech Group, forty of the top fifty of Australia's most expensive suburbs for waterfront property are located in New South Wales.

With buyers in Sydney's prime waterfront markets expecting to pay more than double to get a home on the water.

Across Sydney's waterfront locations, even when moving from one side of the street to the other can command a substantial premium as these types of homes are in demand from both local buyers and international investors.

Victoria only has six of the national top 50 waterfront property classes. West Australia and Queensland only have two each. People pay more for waterfront property in Sydney than anywhere else in Australia.

For many buyers, purchasing a waterfront home is both a life goal and a status symbol, and would-be homeowners are prepared to pay a significant premium when the opportunity arises to purchase a waterfront property.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)