Housing markets across the country continue to see slowing rates of growth while on a national level, prices fell by -0.1% according to new data from CoreLogic.

Once again it was Adelaide and Brisbane with the strongest growth in the country in May, rising 1.8% and 0.8% respectively.

However, Sydney (-1.0%) and Melbourne (-0.7%) dwelling values continued to record the most significant month-on-month falls, while Canberra (-0.1%) recorded its first monthly decline since July 2019.

Source: CoreLogic

Sydney has been recording progressively larger monthly value declines since February, while Melbourne has fallen across four of the past six months.

Since peaking in January, Sydney housing values are down -1.5%, but remain 22.7% above pre-COVID levels, while Melbourne has recorded a smaller peak-to-date decline of -0.8%, with housing values now 9.8% higher compared to the pre-COVID level.

CoreLogic’s Research Director, Tim Lawless, said Sydney and Melbourne have been dragging the broader index lower, despite growth in the smaller capital cities.

“There’s been significant speculation around the impact of rising interest rates on the property market and last month’s increase to the cash rate is only one factor causing growth in housing prices to slow or reverse,” Mr Lawless said.

“It is important to remember housing market conditions have been weakening over the past year, at least at a macro level.”

Mr Lawless said home prices have been seeing slowing growth on a quarterly level since values peaked in May 2021.

“Since then, housing has been getting more unaffordable, households have become increasingly sensitive to higher interest rates as debt levels increased, savings have reduced and lending conditions have tightened.” he said.

“Now we are also seeing high inflation and a higher cost of debt flowing through to less housing demand.”

Regional Australia has also come off its record high growth rates Mr Lawless said, with the annual growth trend easing to 22.1%, down from its January peak of 26.1% and likely to trend lower through the rest of the year.

“Considering we are already seeing the pace of growth easing across most regional markets, it is likely we will see growth conditions softening in line with higher interest rates and worsening affordability pressures,” he said.

“Arguably some regional markets will be somewhat insulated from a material downturn in housing values due to an ongoing imbalance between supply and demand as we continue to see advertised stock levels remain extraordinarily low across regional Australia.”

Listings Increase

One of the key reasons for the slowing rate of growth in home prices has been the surge in new listings.

Sydney’s advertised listings are 5.1% higher than a year ago and 1.5% above the five-year average with Melbourne’s advertised stock levels up 1.3% on last year and 8.1% above average based on the previous five years.

“With stock levels now higher than normal across Australia’s two largest cities, buyers are back in the driver’s seat,” Mr Lawless said.

“Higher listings add to tougher selling conditions more broadly.

Vendors in Sydney and Melbourne have faced lower auction clearance rates since mid-April and those selling via private treaty are taking longer to sell with higher rates of discounting.”

Stock levels remain below average across the rest of the country, especially in the cities where housing values are rising the fastest such as Adelaide (-39.5%) and Brisbane (-38.2%).

Mr Lawless also noted that transactions are continuing to slow across the country in a sign that demand is cooling.

“Our estimate of homes sales nationally over the three months to May is -19.2% below the same period a year ago, but still 12.1% above the five year average,” he said.

“A combination of higher interest rates, lower rates of household saving and a potentially more cautious lending environment is likely to reduce housing demand further just as total advertised stock levels are likely to continue rising, further empowering buyers by creating increased competition amongst vendors.”

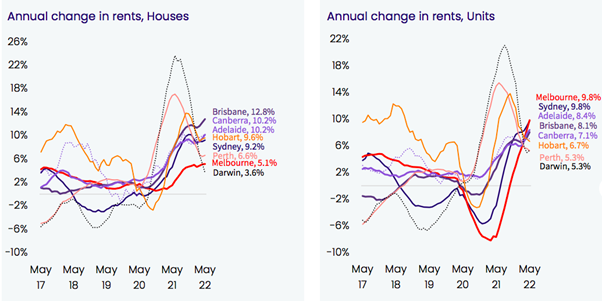

While housing value growth has slowed, rents continue to rise across the country with rents up 1.0% in May, taking the quarterly rate of growth to 3.0%.

Source: CoreLogic

Cooler Conditions Ahead

As interest rates normalise over the next 12 to 18 months, the expectation is most of Australia’s capital cities will move into a period of decline brought about by less demand according to Mr Lawless.

“With the housing debt to household income ratio at record highs, household balance sheets are likely to be more sensitive to rising interest rates,” he said.

“High inflation could be another factor contributing to softer growth conditions in the housing sector.

“These factors, together with stretched housing affordability and a more conservative approach from lenders, especially towards borrowers with high debt levels, are likely to contribute towards less housing demand over the medium term.”

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)