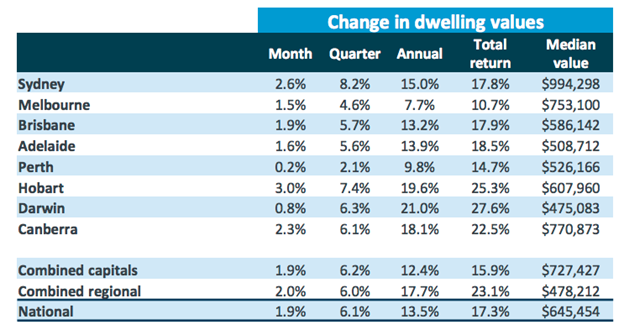

Australian house prices officially grew by 13.5% over the past 12 months, making it the biggest annual gain we’ve seen since 2004.

Once again it has been houses that have strongly outperformed units with Sydney, Hobart, Darwin and Canberra the standout performers over the last financial year, seeing gains of nearly 20% across the board according to the latest data from CoreLogic.

In the month of June, dwelling values increased in all the major capital cities, and regional Australia, however, there are certain areas that are starting to see momentum slowing down. Each of the capital cities saw an uplift in dwelling values, ranging from a 3.0% rise in Hobart to a more subdued 0.2% increase in Perth.

Source: CoreLogic

It continues to be the top-end of the housing market, particularly in places like Sydney and Melbourne, which is leading the uptrend in price appreciation. Notably, the bottom end of the market, which is normally built around the first home buyer market, has clearly started to ease off.

Much of the gains from this end of the market, came on the back of the numerous Government incentives, which effectively bought demand forward.

The record low cost of finance continues to be the main driver of the upper end of the market along with the fact that supply levels are still very tight.

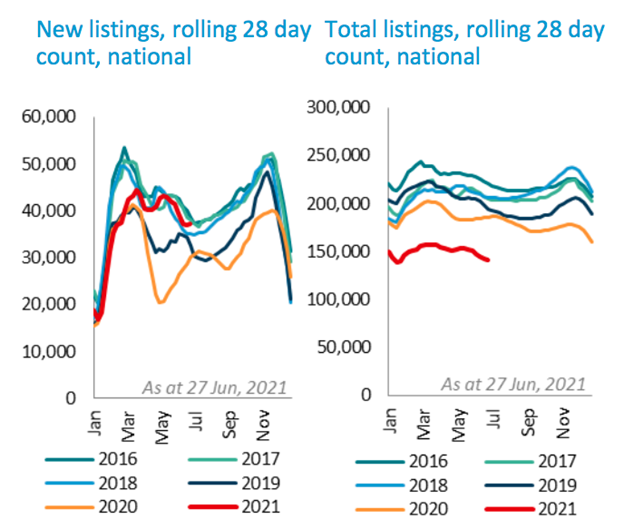

Source: CoreLogic

Head of Research at CoreLogic, Elize Owen, notes that supply levels are still well below historical levels.

“The latest listings count from CoreLogic indicates that in the 28 days to June 27th, total advertised stock remained 24.4% below the five-year average. This dynamic of strong consumer demand, and low housing supply, continues to create some urgency among buyers.”

Perth and Darwin Lagging

The loss of momentum is also being seen most clearly in the two mining states of WA and the Northern Territory.

For Perth dwellings, the monthly growth rate in values had averaged 1.4% between January and May 2021, but fell to 0.2% through June. Across Darwin, the monthly growth rate in dwelling values averaged 2.1% between January and May, but was just 0.8% through June.

“The key to understanding the softer performance in these resource-based markets may be a slightly different supply-demand dynamic compared to the other capital cities and regions,” says Ms Owen.

“CoreLogic monitors a ‘sales to new listings’ ratio, which divides the monthly volume of settled sales by new listings brought to market. For the past three months, the sales to new listings ratio has averaged 1.1 across Darwin and Perth. While the implication is that there is 1.1 sales for each new listing, which could be enough to elicit further growth in dwelling values, these are the lowest sales to new listings results of the capital city markets.”

Momentum is Slowing

Despite the strong 12 months in house price growth, the data would indicate that price growth is now starting to ease off.

CoreLogic notes, ‘... the housing market has clearly lost some growth momentum. Persistently high housing value growth rates are proving unsustainable, from both an affordability perspective, and renewed headwinds amid a lockdown in Sydney and other parts of the country’.

It’s also clear that while lockdown measures impact transaction volumes, they are not having a negative impact on price at this point in time according to CoreLogic.

Going forward, the main issues appear to be surrounding affordability and the outlook for interest rates. CoreLogic says, ‘affordability constraints and the potential for tighter lending conditions and rising mortgage rates remain the primary headwinds for property market performance’.

‘Already through June, several of the major banks have forecast cash rate increases earlier than has previously been indicated by the RBA. A sooner-than-expected uplift in the cash rate would bring forward mortgage rate rises, and reduce demand for credit. Furthermore, off the back of APRA writing to major lenders to ensure proactive risk management in home lending, there have been early signs of more conservative home loan assessments’.

‘Any reduction in credit availability is likely to contribute to a downside shift in market conditions.‘

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)