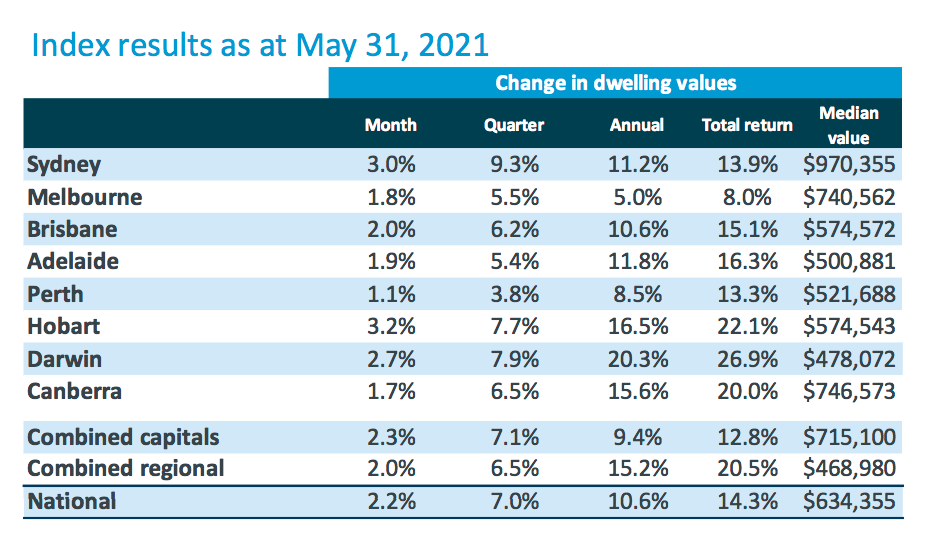

House prices across the country have continued to boom in May, with the latest data showing values increased by 2.2% and 10.6% annually.

According to CoreLogic, it was Sydney that continues to lead the nationwide surge in prices, increasing by 3.0% in May. All the capital cities increased in value, with Brisbane up 2.0% and Melbourne by 1.8%. While Hobart and Darwin continued their strong recent performances as well. Perth remains the weakest capital city market but still saw an increase of 1.1% last month.

Over the past three months, national house prices rose by 7% with the median house price in Australia now sitting at $634,355.

Source: CoreLogic

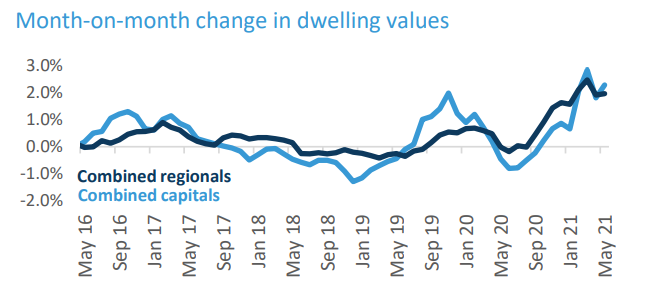

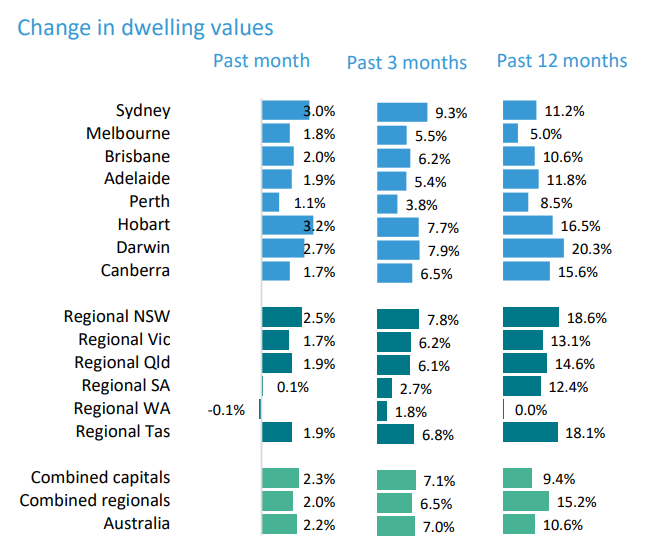

After lagging last year, prices in the capital cities have now started to outpace the regional areas. We saw a big shift from people looking to move away from capital cities last year, however, now many homebuyers are making it clear that the time is right to be jumping back into the capital city markets ahead of regional areas.

Source: CoreLogic

Capital cities have outperformed regional areas twice in the past three months and in May, were 2.3% higher, compared to the 2.0% increase in regional areas. Over the quarter, regional areas have lagged with a 6.5% increase versus 7.1% in the capital cities.

Source: CoreLogic

Top End of the Market is Moving

While the boom in house prices is evident for all to see, CoreLogic’s Tim Lawless notes that it is now the premium end of the market, notably in Sydney and Melbourne, that is really driving the gains.

“Despite the consistently strong headline results, the underlying trends have shifted over the past year,” Mr Lawless said.

“The most expensive end of the market is now driving the highest rate of price appreciation across most of the capital cities, whereas early in the growth cycle it was the most affordable end of the market that was the strongest.”

“From a geographic perspective, it was the smaller capital cities that led the housing market out of the COVID slump, but now Sydney has risen through the ranks to record the largest capital gain over the past three months with values up 9.3%.”

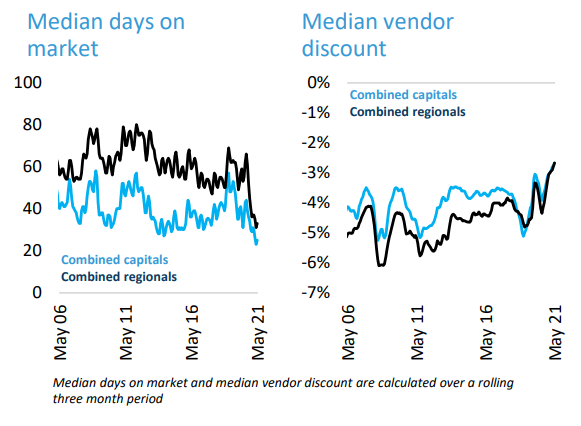

Stock Levels Remain Low

Low stock and high demand, coupled with record-low interest rates are continuing to create a seller’s market in most areas.

CoreLogic notes, that while there has been an increase in supply, demand is still outpacing supply in most locations.

The median time on market remains around its record low of 25 days, while vendor discounting rates are also around record lows with the typical discount from the original asking price recorded at -2.7% over the past three months.

Source: CoreLogic

“The sales to new listings ratio remain around 1.1, meaning for every new listing there is more than one sale occurring,” said Mr Lawless.

“This rapid rate of absorption is keeping advertised inventory levels extremely low, despite the rise in new listings. As a consequence, vendors remain in a strong selling position while buyers have a weak position at the negotiation table.”

Positive Cashflow Opportunities

With values rising CoreLogic believes there are still a number of opportunities for investors to locate positively geared properties. With the average mortgage rate now around 2.5%, there are still many cities and regional areas that are showing increasing rental yields, making them more cashflow positive than in previous years.

Notably, Perth and Darwin have seen 15-20% increases in rental yields over the past 12 months on the back of extremely tight supply for rentals. CoreLogic notes that the opportunity for positively geared properties in Sydney and Melbourne remains limited with prices rising and rental vacancies still high in many areas.

Housing Boom Rolls On

CoreLogic says that the housing boom is in full swing across the country and for now it is not slowing down.

They state that the winding back of fiscal support has had virtually no impact on housing markets and the overall jobs market is improving.

CoreLogic is expecting housing values will continue to rise throughout 2021 and into 2022, albeit at a gradually slower pace.

For the full CoreLogic Hedonic Home Value Index, please click here (PDF file)

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)