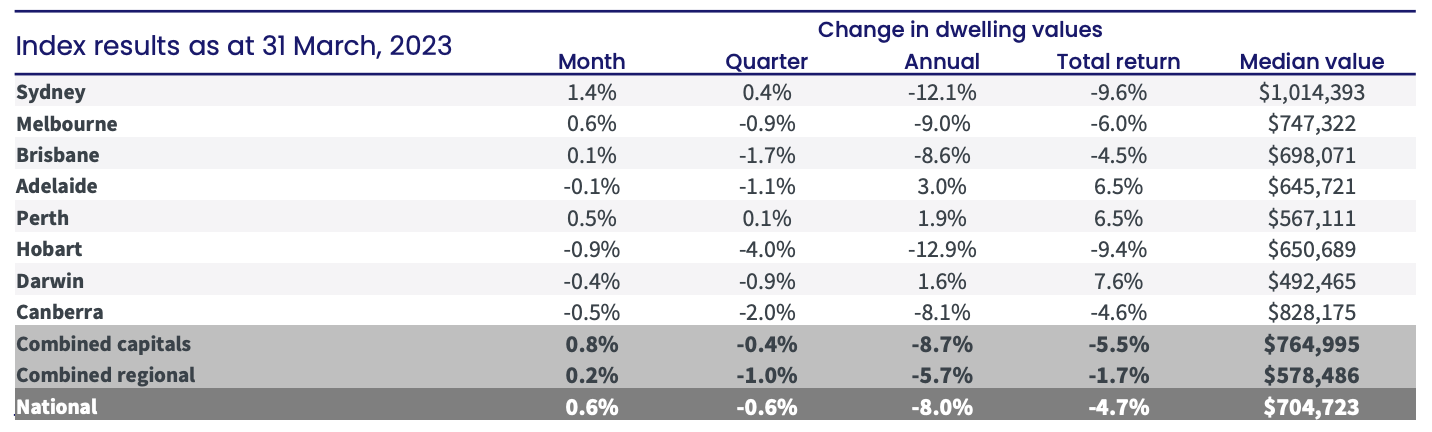

Property prices across the country are continuing their recovery, as value rose 0.5% in April following a 0.6% rise in March, according to the latest data from CoreLogic.

Home prices across the nation had dropped 9.1% after the COVID period boom, but recent signs suggest the housing market's decline may be ending. But even with the recent drop in values, the median value of a capital city dwelling remains 12% or roughly $83,000 higher than it was at the onset of COVID in March 2020.

Leading the property price rebound is Sydney, where prices rose 1.3% in April and dwelling values have been increasing each month since February. Sydney values are now 3% higher than their lowest point in January.

Prices in Brisbane increased by 0.3%, in Melbourne by 0.1%, in Adelaide by 0.2%, and in Perth by 0.6%. Darwin was the only capital city to experience a decline, with prices falling by 1.2%. While across regional Australia, values also rose by 0.1%.

Source: CoreLogic

CoreLogic's Research Director, Tim Lawless, said that the housing market appears to have reached a turning point.

"Various indicators are supporting the positive shift, such as housing values stabilizing or rising in most parts of the country, auction clearance rates staying slightly above the long-term average, improved sentiment, and home sales trending around the previous five-year average," Mr Lawless said

Mr Lawless attributes the increased demand to a rise in immigration that is reaching record levels.

"A significant increase in net overseas migration has collided with a shortage of housing supply," he said.

Though housing conditions are looking more favourable, values in most regions remain below their recent cyclical peaks.

Hobart is experiencing the largest drop from its recent market peak, with a decline of 13%. Sydney dwelling values had seen a 13.8% drop from their market peak to their recent low point, but a 3% increase in values over the last three months has left the market 11.2% below its recent high. Brisbane has seen the third-largest decline, with values remaining 10.7% below their recent peak.

Stock levels remain below average

A primary factor supporting the housing market has been the limited supply of stock which has been a common theme over the past few years.

Mr Lawless said that with the flow of new listings remaining below average, total advertised inventory is tracking 21.8% below the previous five-year average for this time of the year.

“The flow of new listings is highly seasonal, typically trending lower through winter before rising into spring and early summer,” Mr Lawless said.

“At the moment it looks like this seasonal trend is holding true, with the flow of new listings once again falling into winter. This will be an important trend to watch."

“As market conditions improve we could see prospective vendors becoming more willing to test the market and beat the spring rush when competition among vendors is likely to be more apparent.”

Rental markets are tight

CoreLogic's rental index recorded a further 1.1% increase across the combined capital cities in April, while regional rents saw a smaller 0.5% rise.

Mr Lawless believes immigration is making life very hard for tenants all across the country.

“There is also the additional rental demand from overseas migration, especially students, which tends to be more pronounced in inner city areas as well as precincts close to universities and transport hubs that are typically associated with higher density styles of rental accommodation.”

“Another factor playing out is a lack of new unit supply. Medium to high density dwelling approvals have mostly held below average since 2018, setting the scene for a chronic undersupply across the medium to high density sector a few years from now.”

Outlook

According to Mr Lawless, the Australian housing market seems to have passed through a relatively brief but severe downturn.

"The primary drivers of this positive shift appear to be the larger than expected increase in net overseas migration, which has generated additional housing demand during a period of exceptionally tight rental conditions and well below average levels of advertised supply," said Mr Lawless.

He said that while the downturn's end seems convincing, housing values are unlikely to increase significantly until interest rates drop, credit policies are relaxed, or housing-focused stimulus measures are introduced, or possibly a combination of these factors.

Mr Lawless said the outlook for housing markets largely rests with the trajectory of interest rates.

“The timing of a rate cut remains highly uncertain, however, once we see rates coming down, that is when we could see more sustained momentum gather in housing markets,” he said.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)