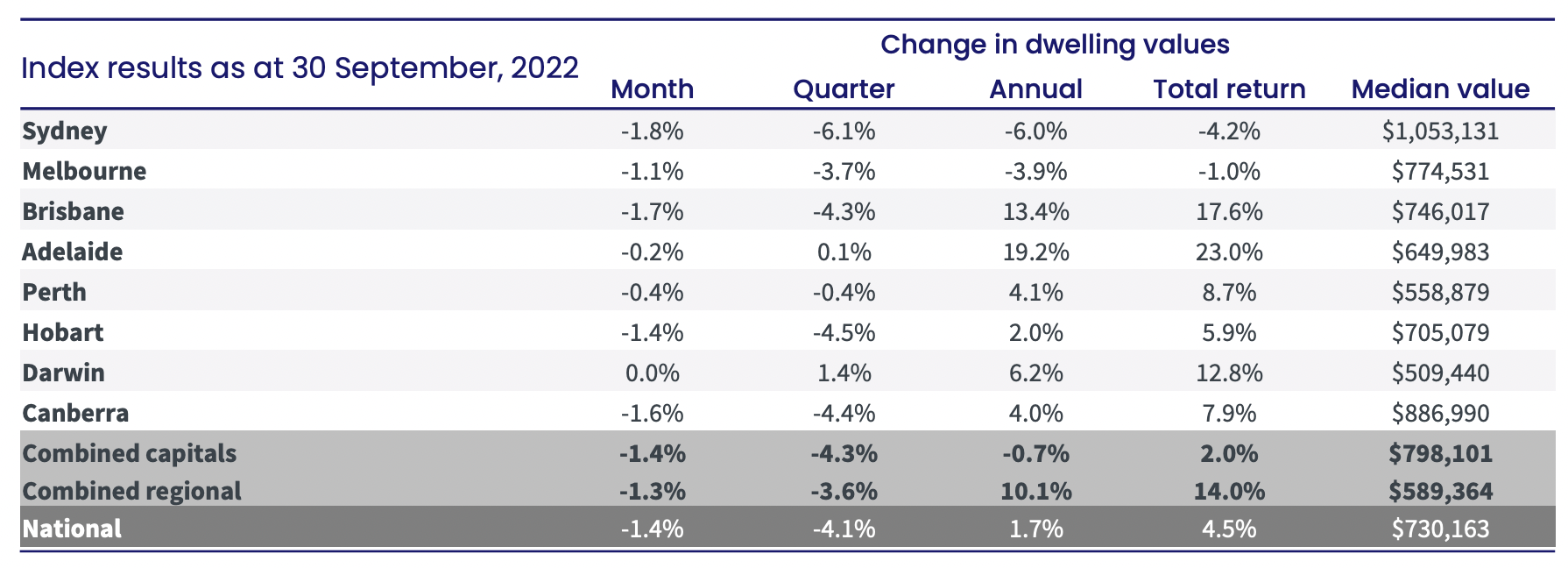

Property price declines are starting to ease off across the country, led by Sydney, Melbourne and Brisbane which all saw a decreased rate of decline last month.

According to CoreLogic, national property prices declined 1.4% in the month of September, which was smaller than the 1.6% decline recorded in August.

Sydney prices continued to drop, falling 1.8%, Brisbane prices were off 1.7% and Melbourne was down 1.1%. Canberra and Hobart also saw values fall, down 1.6% and 1.4%.

Perth and Adelaide, the two most resilient cities throughout the downturn, have now started to see prices begin to roll over as well, dropping 0.4% and 0.1%.

Darwin remains the only capital city where housing values haven’t started to trend lower, although dwelling values remain 10.1% below the 2014 peak.

Source: CoreLogic

According to CoreLogic’s research director, Tim Lawless, it is too early to suggest the housing market has moved through the worst of the downturn.

“It’s possible we have seen the initial shock of a rapid rise in interest rates pass through the market and most borrowers and prospective home buyers have now ‘priced in’ further rate hikes,” Mr Lawless said.

“However, if interest rates continue to rise as rapidly as they have since May, we could see the rate of decline in housing values accelerate once again.”

Mr Lawless said there were a number of positive indicators over the month of September, aside from slowing declines.

“Auction clearance rates also trended upwards, albeit subtly, in September and consumer sentiment nudged a little higher as well on the back of strong labour market conditions,” he said.

“We’ve also seen the flow of fresh listings continue to slide through the first month of spring, which is uncommon for this time of the year.”

After rising 25.5% over the recent growth cycle, housing values across the combined capitals index are now 5.5% below the recent peak, while regional prices, which recorded stronger growth conditions through the upswing (41.6%), are now down 3.6%.

Mr Lawless said there continue to be substantial differences between different markets around the country.

“We are still seeing some resilience to value falls around the more affordable areas of Adelaide and Perth, as well as some regional markets associated with agriculture, mining and tourism,” he said.

The largest cumulative falls have been concentrated in areas of Sydney’s Northern Beaches, including Warringah, Pittwater and Manly where housing values are down at least 14.5% since moving through a peak in early 2022, as well as flood-affected areas across Richmond - Tweed.

“These areas saw housing values rise between 38% and 62% through the growth cycle, so most home owners are still well ahead in terms of equity in their home,” Mr Lawless said.

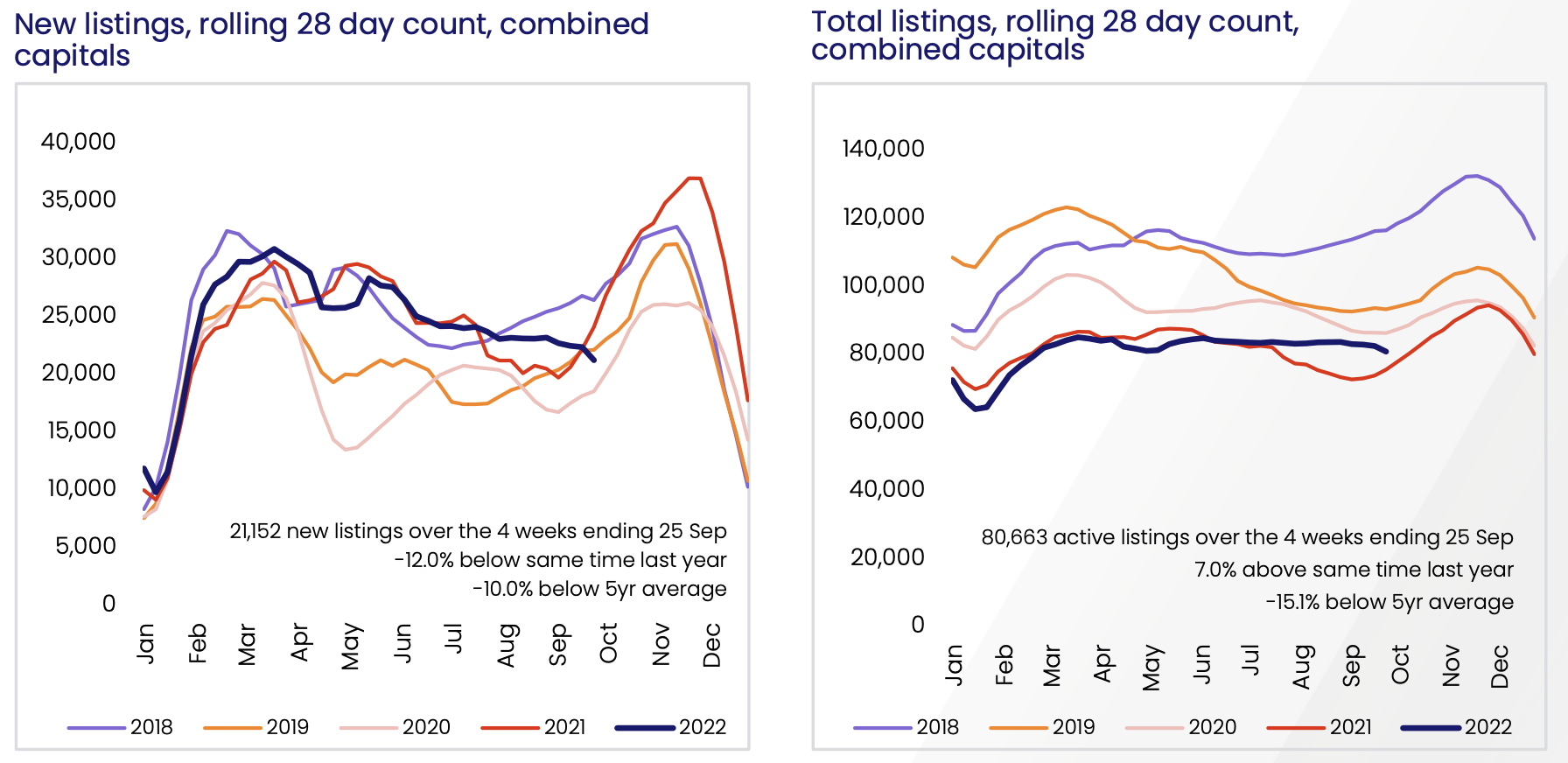

One of the reasons for the resilience of many property markets around the country has been the slowdown in new listings hitting the market.

The number of new listings added to capital city housing markets over the four weeks ending September 25th was 12% lower than the same period a year ago and 10% below the previous five-year average. Darwin and Canberra are the only exceptions, with both cities recording a higher than average flow of new listings over the past four weeks.

“It seems prospective vendors are prepared to wait out the housing downturn, rather than try to sell under more challenging market conditions,” Mr Lawless said.

“We haven’t seeing any evidence of distressed sales or panicked selling through the downturn to date; in fact, it has been the opposite, with the trend in newly listed properties continuing to diminish at a time when freshly advertised stock levels would normally be moving through a seasonal ramp up.”

Source: CoreLogic

Meanwhile, after a record-setting pace of rent growth over the past few years, increases are also starting to begin to stagnate.

The national rental index increased by 0.6% in September, the lowest monthly rise in rents since December 2021. At the national level, rental growth moved through a peak in May 2022 with a 1.0% rise; since that time, the monthly pace of rental growth has been easing.

This trend in rents is evident across most regions, but has been clearest across regional Australia where monthly rental increases have reduced from a peak of 1.4% in January 2021 to just 0.3% in September 2022.

Mr Lawless said the slowdown in rental growth came as a bit of a surprise given the lack of rental supply around the country.

“A gradual slowdown in rental growth in the face of such low vacancy rates could be an early sign that renters are reaching an affordability ceiling,” he said.

“Since the onset of COVID, capital city rents have risen 16.5% and regional rents are up 25.1%."

“It’s likely renters will be progressively seeking rental options across the medium to high density sector, where renting is cheaper, or maximising the number of people in the tenancy in an effort to spread higher rental costs across a larger household.”

“A material rise in rental supply seems a long way off, considering private sector investment activity is trending lower and a larger than normal portion of for sale listings are investor-owned properties.”

Looking forward, the most important factor influencing housing markets will be the trajectory of interest rates, which remains highly uncertain Mr Lawless said.

The cash rate has surged 225 basis points higher through the tightening cycle to-date; interest rates have not risen at this fast a pace since 1994, when households were arguably less sensitive to a sharp rise in the cost of debt.

“In the September quarter of ’94, the ratio of housing debt to household disposable income was just 46.8. The impact of a higher cost of debt is far more meaningful now, with a housing debt to household income ratio of 143.7 recorded in March 2022,” Mr Lawless said.

The good news is that inflation may be moving through a peak. With the recent release of a monthly CPI indicator, it looks like headline inflationary pressures may have eased a little through the September quarter, with the ABS reporting a reduction in annual inflation from 7.0% over the year ending July to 6.8% over the year ending August.

According to Mr Lawless, If inflation is slowing, we could see the RBA start to ease back on the aggressive rate hiking cycle that commenced in May and once interest rates stabilise, housing prices are likely to find a floor.

Strong labour market conditions should help to contain any material rise in mortgage distress. With the national unemployment rate at 3.5% in August and wages growth picking up, we aren’t expecting to see a material rise in distressed listings or forced sales.

“We will be watching for any signs of market distress as the dual impact of higher interest rates and high inflation impact household budgets. To date, the flow of new ‘for sale’ listings has actually trended lower as vendors retreat to the sidelines, a good indicator that home owners are weathering the downturn,” Mr Lawless said.

“As interest rates continue to rise and inflation remains high, it’s reasonable to expect household spending will pull back...While we are yet to see any evidence that household spending is being reined in, it’s likely that households will need to curtail their discretionary spending in order to maintain their debt servicing obligations while also dealing with higher prices on non-discretionary goods such as food and fuel.”

For buyers, stock levels have normalised across the more expensive capital city markets, providing more choice and a better negotiation position, while for sellers, conditions have become more challenging amid lower demand.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)