UPDATE: Queensland Scraps New Land Tax Changes

Land tax changes in Queensland could soon make it more expensive to own property in the sunshine state if you also own property in other parts of the country.

The Revenue Legislation Amendment Act 2022 (QLD) will make changes to the Land Tax 2010 (QLD) which will require that the value of a taxpayer's total landholding in Australia (not just in Queensland) be taken into account in determining the tax payer's land tax liability in Queensland.

The changes are set to come into effect from 30 June 2023 and mean that if you own a property portfolio around the country, you'll be paying more land tax than if you own a property in Queensland alone.

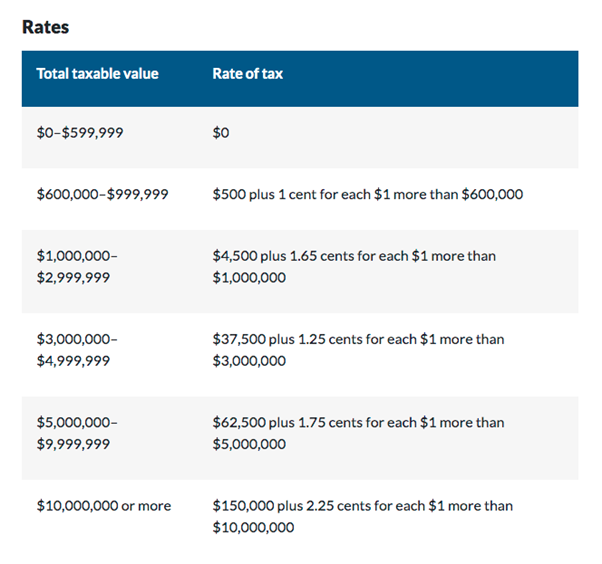

The way the changes will work is that by owning interstate property, the total value of your holdings will be taken into account and also move you into the higher rates of property tax, which work on a sliding scale.

In practice, this means that taxpayers will still be taxed only on the value of their Queensland landholdings, but in determining the 'rate' of land tax they pay, the total statutory value of their "Australian Land" will be used. This will push Queensland landowners into a higher lad tax bracket.

There will be no change to land tax liability for taxpayers who own land in Queensland only.

Property tax rates increase substantially when the value of your non-exempt holdings exceeds $599,999.

Source: Queensland Government

"This new land tax regime is as unique as it is illogical," Ms Mercorella, CEO of REIQ (Real Estate Institute of Queensland) told realestate.com.au.

"There is no other state or territory that charges state land tax based on the value of properties held across Australia and outside the jurisdiction where the tax is collected...It's unprecedented and unheard of for a reason."

"It is irreconcilable that the Treasury expects to legitimately raise tax on the basis of value of property held outside of Queensland, for the purpose of funding infrastructure within Queensland."

Many experts in the property sector have also shared their concerns about the unintended consequences of land tax changes.

It's possible, that increases in land tax will discourage investment in the state which would see fewer rental properties available for renters, putting even more pressure on what is one of the most under-pressure rental markets in the country. It's also likely that many current owners will be forced to sell due to higher holding costs.

At a time when interstate rates are rising, many QLD landlords could find themselves under even more pressure thanks to rising costs and these new tax changes.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)