The declines in property prices have slowed down for now, with the latest data from

CoreLogic showing the smallest monthly fall since May 2022.

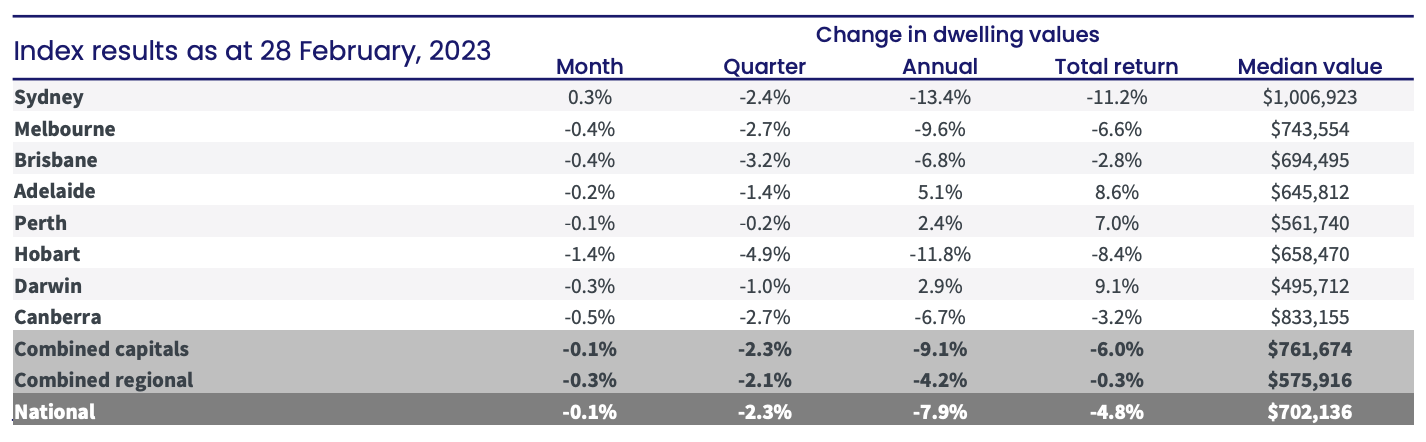

National property prices declined just 0.14% over the month of February, with Sydney

leading the turnaround on the back of a 0.3% increase in the median price. All other capital cities recorded falling values in February, with Melbourne and Brisbane both declining 0.4%, Canberra down 0.5%, Darwin 0.4%, Adelaide 0.2% and Perth 0.1% while Hobart had the biggest drop, tumbling 1.4%.

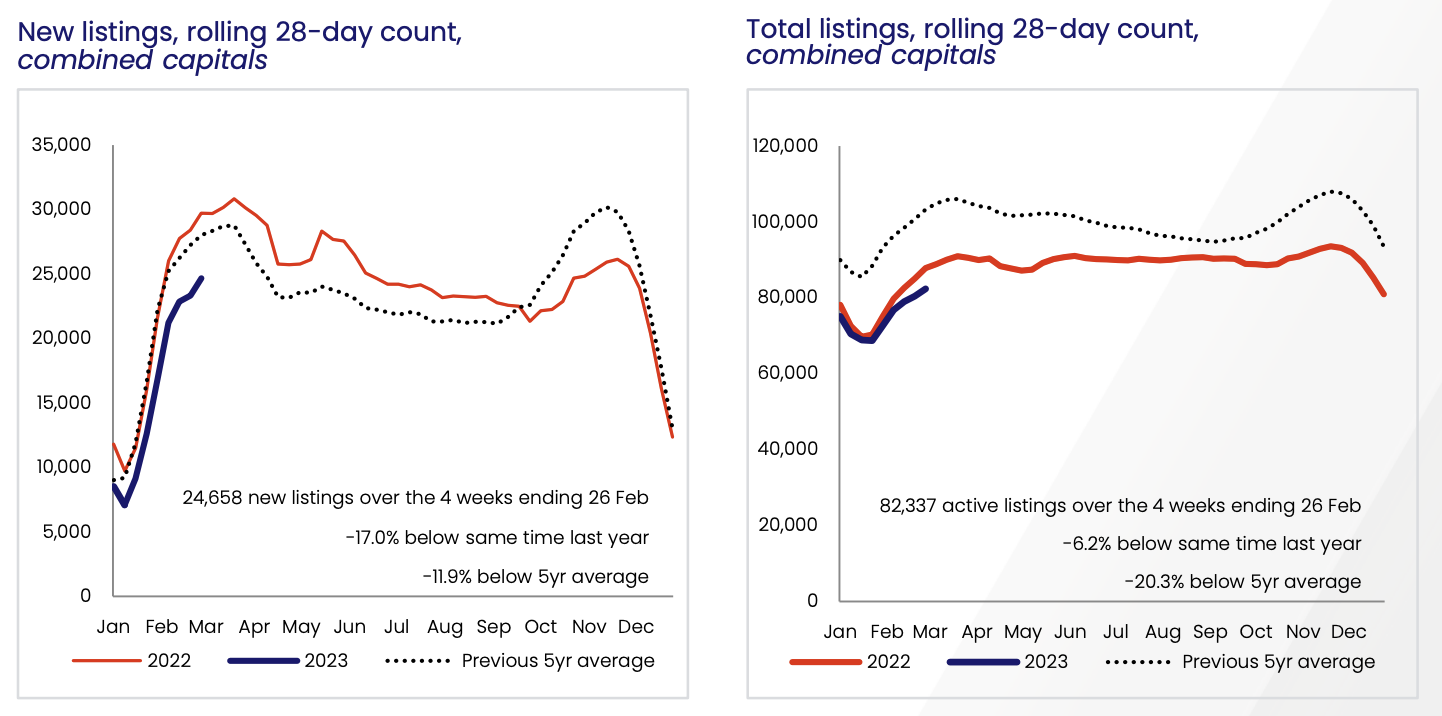

CoreLogic’s research director, Tim Lawless, said the stabilisation in housing values over the month coincides with consistently low advertised supply levels and a rise in auction clearance rates.

“The past four weeks have seen the flow of new capital city listings tracking 17.0% lower than a year ago and 11.9% below the previous five-year average,” Mr Lawless said. “This trend towards a below average flow of new listings has been evident since September last year, coinciding with a loss of momentum in the rate of value decline.”

Source: CoreLogic

Auction clearance rates also bounced back last month, with the capital cities reaching the high 60% range through the second half of the month, while Sydney clearance rates rose to above 70% for the first time since February 2022.

The upper end of the market in the capital cities drove this month’s stabilising trend, increasing by 0.1% in February. While still falling, declines across the lower end of the market also stabilised, down 0.1%.

Once again it was Sydney’s premium properties leading the way with a 0.7% rise in values over the month, compared with a 0.2% fall in values across the lower quartile of the Sydney market.

Meanwhile, regional prices were down 0.3% in February compared with a 0.1% fall across the combined capital cities. Since peaking in June last year, the combined regionals index is down 7.7%, compared with a 9.7% drop in the combined capital cities index, which peaked slightly earlier in April 2022.

Despite the positive result, Mr Lawless warned that the uptick in prices might not last.

“Considering the RBA’s move to a more hawkish stance at the February board meeting, along with an expectation for a weaker economic performance and a loosening in labour markets, there is a good chance this reprieve in the housing downturn could be short-lived,” Mr Lawless said.

“We also have the fixed-rate cliff ahead of us; arguably the full impact of the aggressive rate hiking cycle is yet to play out.”

Listings remain low

One of the main factors contributing to the jump in the national index has been the tight level of stock on the market.

During February, there was a notable rise in the number of new listings, increasing by roughly 11,250 more than the previous month. However, this is still 12.6% below the previous five-year average for this time of year.

“So far, it seems prospective vendors are prepared to wait this downturn out,” Mr Lawless said.

“The flow of new listings is well below average for this time of the year across each of the major capitals. The flow of new listings will be a key trend to watch over the coming months."

“Any signs of listings activity moving to above average levels could weigh on housing prices.”

Source: CoreLogic

Unit rents are surging

According to CoreLogic, the highest rental growth is now occurring in the unit sector across the three largest capitals, led by a 16.7% jump in Sydney unit rents over the past year.

“Although unit rents in the largest cities showed a period of weakness through the early phase of the pandemic, weekly rental values for units are now 19.0% higher than at the onset of COVID in Sydney, 10.4% higher across Melbourne and 23.6% up in Brisbane,” Mr Lawless said.

“Several factors are likely to be contributing to the surge in unit rents.

“Rental affordability pressures may be forcing a transition of demand towards higher density rental options.

“Additionally, the strong rebound in foreign student and international migrant arrivals would be adding to rental demand, particularly in inner city precincts as well as areas within close proximity to universities and transport hubs.”

Downside risk remains

Mr Lawless said despite the recent trend towards stabilisation, housing risks remain skewed to the downside.

The February housing market performance suggested some renewed strength in market conditions, while the flow of new listings has been at below-average levels since September last year, which has helped to support a reduction in the pace of value falls.

But, it’s probably too early to call a trough in the cycle considering there are several factors which could trigger a ‘re-acceleration’ of housing value declines over the course of the year.

On the back of the latest increase in the cash rate, Mr Lawless said there are still more rate hikes expected over the course of the year, and a further decline in borrowing capacity is on the cards, which could reaccelerate housing market declines.

Low advertised stock levels are likely to persist as homeowners resist selling in a declining market. However, there may be a small portion of prospective vendors who become more motivated or are forced to sell amid growing challenges to serviceability.

These challenges include an ongoing increase in interest rates, more borrowers being exposed to higher rates as the majority of fixed terms end, rising unemployment and a higher cost of living.

Mr Lawless said longer term, the market is poised for recovery and despite the headwinds accumulating for the housing market in 2023, there is no denying the fundamental under-supply of housing stock.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)