House prices across the country have increased by 16.1% over the past 12 months, making it the strongest property market we’ve seen since 2004.

While the latest data from CoreLogic paints a positive picture for the current state of the market, it’s also clear that momentum is slowing down.

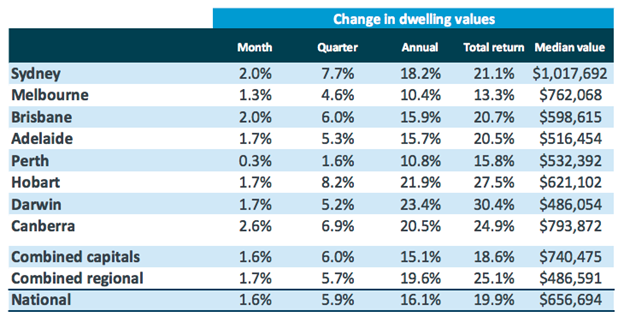

Over the month of July, property prices increased in all states and territories and once again it was the same capital cities that performed strongly.

Source: CoreLogic

Canberra was the best-performed property market last month, increasing in value by 2.6% and adding to what was a 20.5% increase in the past 12 months. Hobart and Darwin both increased in value by 1.7% in July and grew in value by 21.9% and 23.4% respectively over the past year, making them the two strongest markets in the country.

Sydney jumped by 2.0% and has seen 18.2% annual growth, however, CoreLogic has noted that the market here is finally starting to cool down. After seeing peak monthly growth of 3.7%, Sydney has since had the largest relative fall in growth rates.

Meanwhile, Brisbane continues to perform well, growing at 2.0% in July and 15.9% over the last 12 months.

Once again it’s Perth that is clearly underperforming all other property markets at the moment, having seen only 10.8% growth since this time last year.

Head of Research at CoreLogic, Tim Lawless notes that affordability is also becoming an issue in many areas as well as negative sentiment thanks to ongoing lockdowns.

“With dwelling values rising more in a month than incomes are rising in a year, housing is moving out of reach for many members of the community.”

“Along with declining home affordability, much of the earlier COVID related fiscal support has expired. It is, however, encouraging to see additional measures being rolled out for households and businesses as the latest COVID outbreak worsens.”

“On the flip side, demand is being stocked by record-low mortgage rates and the prospect that interest rates will remain low for an extended period of time. Dwelling sales are tracking approximately 40% above the five-year average while active listings remain about -26% below the five-year average. The mismatch between demand and advertised supply remains a key factor placing upwards pressure on housing prices,” Mr Lawless said.

After performing well above expectations in 2020, regional markets have slowly started coming back to growth levels similar to that of the metro areas. In the first seven months of 2021, CoreLogic data shows an almost equal rate of growth in dwelling values across the combined regional and capital markets with values up 14.5% and 14.0% respectively.

In terms of types of properties that are performing well, it continues to be the detached housing that is outperforming units and apartments.

Houses increased in value by two to three times units in most cities with the expectation of Hobart over the last year as buyers continue to more space and lower density living.

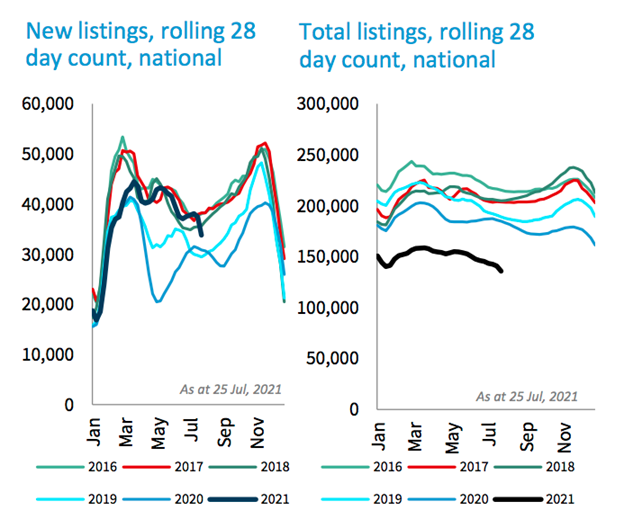

The other factor that continues to help prop up property markets around the country is still the low levels of stock.

Advertised listing numbers remain well below average across most parts of the country. Recently the number of newly advertised properties has fallen sharply across Sydney and Melbourne amidst lockdowns with many vendors choosing to wait until conditions ease.

Source: CoreLogic

Mr Lawless believes that while listings are low, demand could also potentially change going forward.

“With buyer demand so strong and active listings well below average, prospective buyers are likely to be feeling a sense of urgency due to the level of competition in the market.”

“However, with affordability constraints starting to impact purchasing capacity, it’s possible market activity could reduce through the second half of the year, helping to rebalance the market and take some heat out of the rate of house price growth,” Mr Lawless said.

Looking forward, Australia's housing market remains in a strong position, however, signs of a slowing rate of appreciation have become more evident.

According to CoreLogic, the rate of growth will continue to taper through the second half of 2021 as affordability constraints become more pressing and housing supply gradually increases. Other potential headwinds are apparent, including the possibility of tighter credit policies and an earlier than expected lift in interest rates, which could also dent sentiment and translate into lower growth.

For the time being, lockdowns will continue to contribute to some of the loss of momentum as well, particularly from a transactional perspective in Sydney which is enduring an extended period of restrictions.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)