Housing prices around Australia continue to see steady growth with momentum remaining strong for the time being.

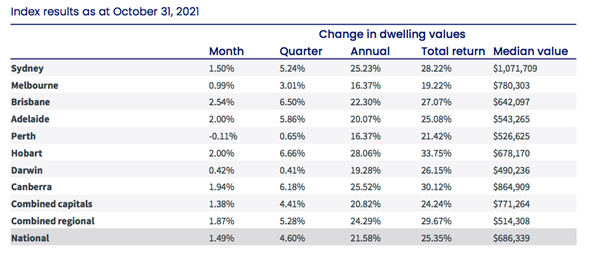

The latest data from CoreLogic has shown that in October, dwelling values rose by 1.5%, making it the third straight month to see a similar level of growth.

Last month, Brisbane was the standout performer from the capital cities, with a 2.54% increase in house prices. While Canberra, Hobart and Adelaide all saw growth of around 2.0% for the month.

Perth was the only capital city to record a negative result in October, with values slipping -0.11%.

On an annual basis, house prices across Australia have risen 21.58%, with the capital cities seeing growth of 20.82%. Hobart, Canberra and Sydney have had the biggest increase in house prices over the past 12 months, increasing by 28.06%, 25.52% and 25.23% respectively.

Head of Research at CoreLogic, Tim Lawless notes that the sharp rise in values is starting to price some people out of the market which could slow momentum.

Source: CoreLogic

Head of Research at CoreLogic, Tim Lawless notes that the sharp rise in values is starting to price some people out of the market which could slow momentum.

“House prices continue to outpace wages by a ratio of about 12:1. This is one of the reasons why first home buyers are becoming a progressively smaller component of housing demand. New listings have surged by 47% since the recent low in September and housing focused stimulus such as HomeBuilder and stamp duty concessions have now expired.”

“Combining these factors with the subtle tightening of credit assessments set for November 1, and it’s highly likely the housing market will continue to gradually lose momentum.”

CoreLogic also notes that unit markets have continued to record a lower rate of growth relative to houses. In the largest capitals, Sydney house values are up 30.4% compared to a 13.6% rise in unit values, while in Melbourne house values rose 19.5% over the year compared with a 9.2% gain in unit values. This trend is less evident across regional areas of Australia where the performance gap between houses and units is relatively small.

Tim Lawless believes that with house prices rising so much, there will be a shift back towards more affordable options.

“As housing becomes less affordable, we expect to see more demand deflected towards the higher density sectors of the market, especially in Sydney where the gap between the median house and unit value is now close to $500,000. With investors becoming a larger component of new housing finance, we may see more demand flowing into medium to high density properties. Investor demand across the unit sector could be bolstered as overseas borders open, which is likely to have a positive impact on rental demand, especially across inner city unit precincts.”

Spring Selling Surge

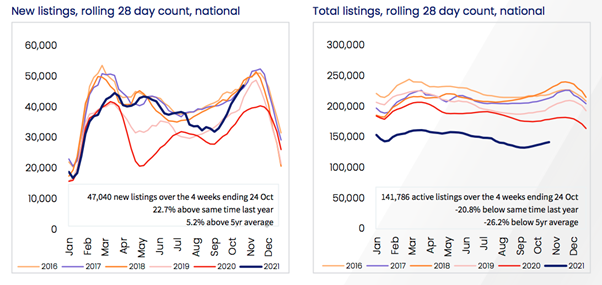

With Spring selling season now in full flight, there is some relief out there for buyers as listings have started to increase.

Since September 5th, CoreLogic notes that new listings have increased by 47%. Listings are now 5.2% above the five-year average.

Tim Lawless believes this is a good thing for buyers given the tight conditions we’ve seen for many months

“More listings mean more choice for buyers and less urgency in their purchasing decisions. FOMO is likely to remain a feature of the market while listings remain so far below average. There is a good chance however, that advertised supply will rise further through spring and early summer which, due to worsening housing affordability and a subtle tightening in credit availability, may not be met by a commensurate lift in demand.”

“Vendor metrics such as auction clearance rates, days on market and vendor discounting rates remain at above average levels, indicating this is still a sellers’ market, however conditions may start to rebalance towards buyers late this year or early next year,” Mr Lawless said.

Source: CoreLogic

Looking forward CoreLogic believes the housing market will continue to see prices rise, however, there are signs that momentum could be slowing.

Tightening of lending standards through APRA’s servicing buffers and the potential for the RBA to hike rates could be a factor that might impact buyer demand. While worsening affordability is also contributing to some sectors of the market being priced out.

CoreLogic notes, ‘higher interest rates have typically been an inflection point for housing markets, with a lift in rates generally corresponding with less growth in housing values or the commencement of a downturn. With household debt near record highs, borrowers are likely to be more sensitive than normal to the cost of debt. A rise in interest rates is likely to be the cue for the housing market moving into a downswing.’

However, with ever-improving consumer sentiment and restrictions easing on the East Coast, the short-term outlook for property prices remains positive.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)