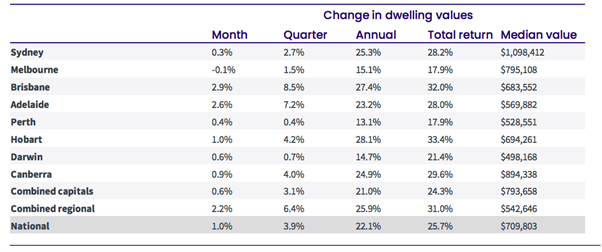

House prices across Australia have capped a stellar 12 months, closing the year with housing prices 22.4% higher than it began.

The latest data from CoreLogic shows that in December, dwelling values finished the year strongly gaining 1.0% down from 1.3% in November. While the overall level of growth has been high, CoreLogic notes that the rate of growth is starting to fade.

Brisbane and Adelaide continue to be the two strongest capital city markets in the country and in December house prices increased by 2.9% and 2.6% respectively. While the level of growth in Sydney and Melbourne continues to fall away, with the latter being the only city to record a negative reading (-0.1%) last month.

Over the past 12 months, Hobart has been the standout performer, with dwelling values increasing by 28.1%, with Brisbane next best at 27.4%.

Regional house prices have also had a great year with gains of 25.9% and a strong finish with 2.4% growth in December. Regional markets outpaced the capital cities that saw overall growth of 21.0%.

Source: CoreLogic

While the pace of capital gains has been easing in Sydney, Melbourne and Perth, conditions across the Brisbane and Adelaide housing markets have gathered momentum. CoreLogic believes, there are signs that Brisbane and Adelaide, along with regional Queensland, are the only broad regions where there is no evidence of value growth easing.

CoreLogic’s Research Director Tim Lawless says tight supply and robust demand are behind the continual surge in Queensland and South Australia.

“These regions show less of an affordability challenge relative to the larger capitals, as well as better support for housing demand with Queensland, in particular, showing strong interstate migration.”

“Additionally, we haven’t seen the same level of supply response seen in other regions, with the trend in advertised supply remaining well below average in these markets.”

On the flip side, momentum has slowed sharply in Melbourne and Sydney, with both cities recording the softest monthly reading since October 2020.

“A surge in freshly advertised listings through December has been a key factor in taking some heat out of the Melbourne and Sydney housing markets, along with some demand headwinds caused by significant affordability constraints and negative interstate migration,” Mr Lawless said.

After leading the upswing, it is clear the upper quartile of the housing market is now leading the slowdown. Across the combined capitals, upper quartile dwelling values were up 2.6% in the December quarter compared with a 3.7% rise across the lower quartile and broad middle of the market.

“We have seen this trend in previous growth cycles, where more expensive housing markets have shown greater levels of volatility; housing values tend to rise more through the upswing but record a larger decline through the down phase of the cycle,” Mr Lawless said.

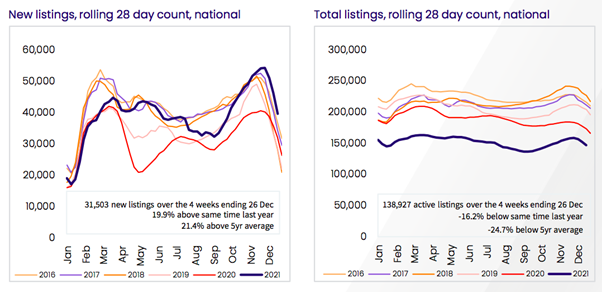

Listings Starting to Increase

One of the key reasons for the sharp rate of house price increases has been the low level of stock for the past 18 months. In positive news for home buyers, listings have now started to increase, taking the urgency out of some markets - particularly, Sydney and Melbourne.

Nationally, the number of new listings added to the Australian housing market through December was 21.4% above the five-year average, demonstrating strong vendor confidence amidst quick selling times and high auction clearance rates. As new listings surged higher through spring and early summer, buyers have benefitted from more choice and reduced urgency.

Meanwhile, CoreLogic estimates there were approximately 653,000 house and unit settlements over the calendar year, the highest number of annual sales on record.

“Such a significant mismatch between available housing supply and the level of demand is a fundamental reason why housing prices have risen so sharply over the year. As stock levels normalise and affordability constraints along with tighter credit conditions drag down demand, it’s reasonable to expect growth conditions will be more subdued in 2022,” Mr Lawless said.

Source: CoreLogic

In terms of rental increases, dwelling rents increased by 9.4% over the 2021 calendar year. Unit rents were up 7.5% over the year compared to the 10.1% lift recorded in house rents.

With national housing values recording an annual rise of 22.1% compared with a 9.4% rise in rents, rental yields have decreased as a consequence.

What’s in Store for 2022?

While 2021 has been a record year for house price growth, CoreLogic believes there is still strength in the housing market, although it expects the rate of growth to continue to slow.

Sellers have been in control of the market for the past 12 months, however, buyers are now finally getting some power back as more listings come online. This has been highlighted by falling auction clearance rates and the increasing time it takes to sell a property.

CoreLogic believes one the biggest downside risks for housing markets will be rising interest rates and any further macroprudential measures. They note, ‘ an early lift in the cash rate implies the economy has improved enough to tighten monetary policy, however, housing markets are likely to be sensitive to any increase in the cost of debt.’

However, even if interest rates rise earlier than expected, with the cost of debt well below long term averages, there will still be support for housing for an extended period of time.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)