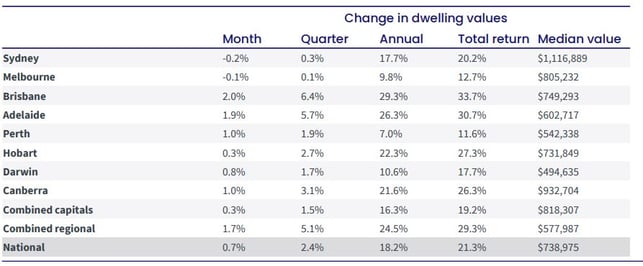

The roaring housing market in Sydney and Melbourne has started to slow down, while growth remains incredibly strong in Adelaide and Brisbane.

The latest data from CoreLogic has highlighted the current two-speed property market with values up 1.8 per cent in Brisbane last month, while Adelaide increased by 1.5 per cent and Hobart 1.2 per cent.

Darwin and Canberra saw modest growth at 0.4 per cent with Perth values inching higher by 0.3 per cent.

However, most of the attention has been on Sydney and Melbourne markets where values didn’t increase in the past month.

Source: CoreLogic

After a record-setting year of growth, Sydney and Melbourne's markets are now starting to feel the effects of affordability issues and an increase in listings.

According to CoreLogic’s director of research, Tim Lawless, said most areas are now starting to see declining growth rates.

“Sydney and Melbourne have shown the sharpest slowdown, with Sydney (-0.1 per cent) posting the first decline in housing values since September 2020, while Melbourne housing values (0.0 per cent) were unchanged over the month, following similar results in December (- 0.1 per cent) and January (+0.2 per cent),” he said.

“Conditions are easing less noticeably across the smaller capitals, especially Brisbane, Adelaide and Hobart, where housing values rose by more than 1 per cent in February. Similarly, regional markets have been somewhat insulated to slowing growth conditions, with five of the six rest-of-state regions continuing to record monthly gains in excess of 1.2 per cent.”

Nationally, home values were 20.6 per cent higher over the past 12 months, down from what is likely to be the peak rate of annual growth recorded at 22.4 per cent last month.

According to CoreLogic, regional Australia continues to record a substantially higher rate of growth than the capital cities. Over the past three months, housing values across the combined rest-of–state regions increased at more than three times the speed of housing values across the combined capital cities; 5.7 per cent and 1.8 per cent respectively.

Mr Lawless said house prices in the regional areas are holding up well, however, they too are seeing slowing rates of growth.

“Regional housing markets aren’t immune from the higher cost of debt as fixed-term mortgage rates rise. These markets are also increasingly impacted by worsening affordability constraints as housing prices consistently outpace incomes. However, demographic tailwinds, low inventory levels and ongoing demand for coastal or treechange housing options are continuing to support strong upwards price pressures across regional housing markets,” he said.

“The slower growth conditions in Australian housing values goes well beyond the rising expectation of interest rate hikes later this year.

“The pace of growth in housing values started to ease in April last year when fixed-term mortgage rates began to face upwards pressure, fiscal support was expiring and housing affordability was becoming more stretched.

“With rising global uncertainty and the potential for weaker consumer sentiment amidst tighter monetary policy settings, the downside risk for housing markets has become more pronounced in recent months.”

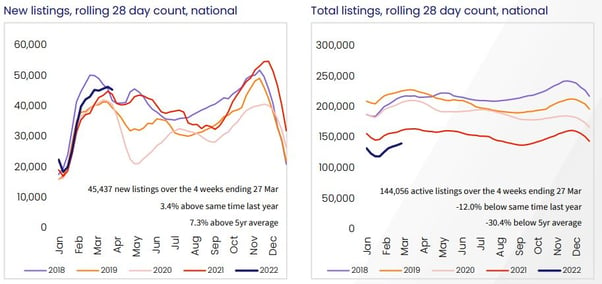

Despite slowing momentum, housing stock continues to remain incredibly tight.

Across the country, the total number of properties advertised for sale over the four weeks ending 27 February was 13.3 per cent lower than the same period a year ago, demonstrating an ongoing shortage of available housing said CoreLogic.

Despite the low total listing count, advertised supply levels are gradually normalising after tracking close to 25 per cent below the prior years’ level before spring 2021. While some cities, such as Melbourne and Sydney, have seen advertised stock return to more normal levels, other Australian capitals are continuing to record extremely low inventory.

Mr Lawless said locations that are seeing an increase in new listings are making conditions better for buyers.

“The cities where housing values are rising more rapidly continue to show a clear lack of available properties to purchase. Total listings across Brisbane and Adelaide remain more than 20 per cent lower than a year ago and more than 40 per cent below the previous five-year average. Similarly, the combined rest-of-state markets continue to see low advertised supply, 24.9 per cent below last year and almost 45 per cent below the five-year average,” he said.

Source: CoreLogic

Nationally, rents are also continuing to drift higher with CoreLogic’s rental value index, up 0.8 per cent in February, holding firm from January (0.8 per cent) and up from the 0.6 per cent growth recorded in December.

Mr Lawless, there has been increased demand for units in Sydney and Melbourne which has been driving up national rents.

“Anecdotally, demand for unit rentals in these cities has been bolstered by a combination of worsening rental affordability deflecting more demand towards the higher density sector, where rents tend to be lower, and demand starting to return from overseas arrivals,” he said.

Mr Lawless notes that after having increased 24.6 per cent, national houses prices are starting to lose momentum because many of the factors that led to the price surge are deteriorating.

Interest rates are already at record lows, with nowhere else to go, Government incentives have been wound back and the imbalance of supply and demand is now starting to ease. And even with interest rates expected to main relatively low, housing affordability has already been eroded.

However, open borders, both domestically and internationally, should support housing demand while a strong economy and solid wage growth should put a floor under the property market.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)