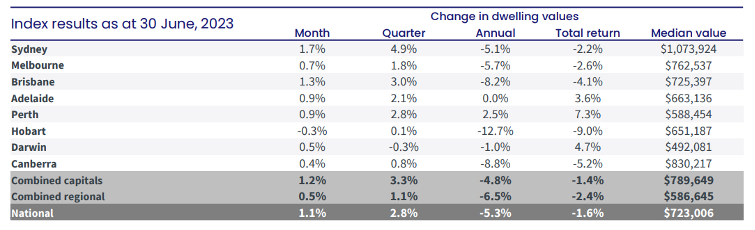

Property prices have continued their recovery in June, with values rising 1.1%, but the pace of growth is now starting to ease.

According to CoreLogic, growth was once again strongest in Sydney where values surged 1.7% over the course of the month, with prices now 6.7% higher than their January lows

Brisbane also performed strongly, with values climbing 1.3%, followed by Adelaide and Perth with a 0.9% rise and Melbourne with 0.7%. All the capital cities managed to see an increase in prices with the exception of Hobart, where property prices declined 0.3% for the month.

CoreLogic Research Director, Tim Lawless said a lack of available supply continues to be the main factor keeping upwards pressure on housing values

“Through June, the flow of new capital city listings was nearly -10% below the previous five-year average and total inventory levels are more than a quarter below average,” Mr Lawless said.

“Simultaneously, our June quarter estimate of capital city sales has increased to be 2.1% above the previous five-year average.”

He said that although housing values continue to record a broad-based upswing, the pace of growth across most capitals eased in June.

“A slowdown in the pace of capital gains could be a reflection of a change in sentiment as interest rate expectations revise higher,” he said.

“Higher interest rates and lower sentiment will likely weigh on the number of active home buyers, helping to rebalance the disconnect between demand and supply.”

Source: CoreLogic

Market conditions across regional Australia also remain steady, with values rising 0.5% in June to be 1.2% off their prior lows. However, there are now fewer people moving to the regions.

Mr Lawless said after regional population growth boomed through the worst of the pandemic, internal migration trends have normalised over the past year, resulting in less housing demand across regional markets.

“Additionally, housing demand from overseas migration is skewed towards the capital cities rather than the regions,” he said.

Lack of supply

Tight levels of supply, continue to be the key driver of prices in the current market according to Mr Lawless.

He said the number of capital city homes advertised for sale was almost -20% lower than at the same time last year and -26.4% below the average for this time of the year.

Regional listings also trended lower through the month, down -32.9% from the previous five-year average.

“Despite low inventory levels, the estimated volume of home sales is roughly in line with the previous five-year average,” Mr Lawless said.

“Capital city homes sales were estimated to be 2.1% above the previous five-year average through the June quarter, while regional homes sales were - 8.9% below average levels.”

He said the recovery in home prices is occurring on relatively thin volumes.

“Although homes sales are around average levels, available supply is well below.

“It is this disconnect between available supply and demonstrated demand that is driving housing values higher.

“The imbalance between supply and demand has seen selling conditions turn in favour of vendors rather than buyers.”

Rents slow

Conditions remain tight across the country for renters, but there are signs that things are slowly starting to improve.

Mr Lawless said the national rental index increased a further 0.7% in June, still well above the pre-COVID decade average of 0.2%, but a continued deceleration and the smallest monthly rise since January 2023.

He said the slowdown in rents can be seen in most cities and regional markets to different extents.

“Canberra is the only capital to record a fall in rents over the past 12 months, down -2.8%, while declines in Hobart rents over the past two months have dragged the annual trend to just 1.3%,” he said.

“Both these markets have seen a loosening in supply and increase in vacancy rates.

“Although easing, the larger capitals continue to record stronger rental appreciation, especially across unit markets, where overseas migration and insufficient rental supply is continuing to place upwards pressure on rents.

Uncertain outlook

Despite prices trending higher, Mr Lawless said the outlook for property remains uncertain given so much is dependent on what happens with interest rates.

“Forecasts on where the cash rate will land and how long it will stay elevated vary, but it’s likely there is at least one more rate hike to come, potentially more,” he said.

“It’s hard to imagine the recent pace of growth in housing values being sustained while sentiment is close to recessionary lows and the full complement of borrowers are yet to experience the rate hiking cycle in full.

Mr Lawless said there was also increased risk, given the huge number of borrowers who are about to roll off their fixed rate loans and onto much higher variable rates.

While credit conditions also remain restrictive to new buyers.

“As we saw through the periods of tighter macro-prudential policies and higher serviceability assessments, credit availability plays an important role in housing markets, so further reductions in available credit will likely weigh on buyer demand,” Mr Lawless said.

Mr Lawless said low inventory levels have arguably been the most important factor placing upwards pressure on housing prices.

“A change in the supply dynamic could become evident in spring when the flow of listings would typically ramp up,” he said.

“We could also see more listing flow onto the market if mortgage stress becomes widespread.”

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)