Property price falls across the country are starting to slow down, despite the RBA continuing to lift interest rates.

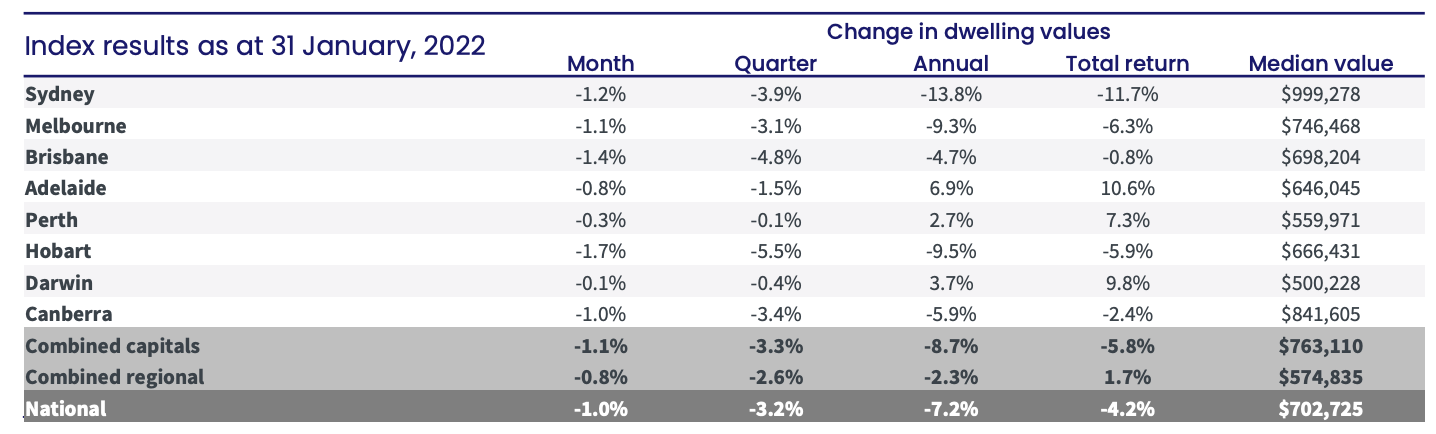

According to CoreLogic, property prices fell 1% across the country in January, again led by a large decline in Hobart (-1.7%), Brisbane (-1.4%), Sydney (-1.2%) and Melbourne (-1.1%).

The smaller capital cities continued to hold up well, with Darwin the best-performed city market over the month remaining relatively flat (-0.1%) while the buoyant Adelaide market declined 0.8%.

Source: CoreLogic

CoreLogic Research Director Tim Lawless said although the housing downturn remains geographically broad-based there are signs some momentum has left the housing downturn.

“The quarterly trend in housing values is clearly pointing to a reduction in the pace of decline across most regions, however at -1.0% over the month and -3.2% over the rolling quarter, national housing values are still falling quite rapidly compared to previous downturns,” Mr Lawless said.

Mr Lawless said the most noticeable easing in value falls can be seen across the premium end of the housing market, where the country’s most expensive properties have led both the recent upswing as well as the current downturn.

“While this trend towards improving conditions across premium markets is not evident in all cities, it is most apparent in Sydney’s detached house market,” he said.

“The improvement could be reflective of more buyers taking advantage of larger price drops across the premium sector, where house values are down -17.4% since peaking in January 2022.”

Regional property prices also fell 0.8% in January and continue to hold up better than their city counterparts.

Across the combined non-capital city areas of Australia, housing values surged 41.6% higher through the upswing compared with a 25.5% rise in values across the combined capital cities.

Since peaking in June, the combined regionals index is down -7.4%, while capital city values are now -9.6% below their April peak.

“Despite easing rates of internal migration and a partial erosion of the pre-pandemic affordability advantage, regional housing values are holding up better than capital city markets,” Mr Lawless said.

"This will be an interesting trend to watch over the longer term, but at the moment it seems regional housing markets have seen a structural shift in the underlying demand profile.

“With more Australians willing to base themselves outside of the capital cities and remote working remaining a viable option across some sectors of the labour force, it’s unlikely we’ll see a mass exodus from regional markets.”

Tight supply

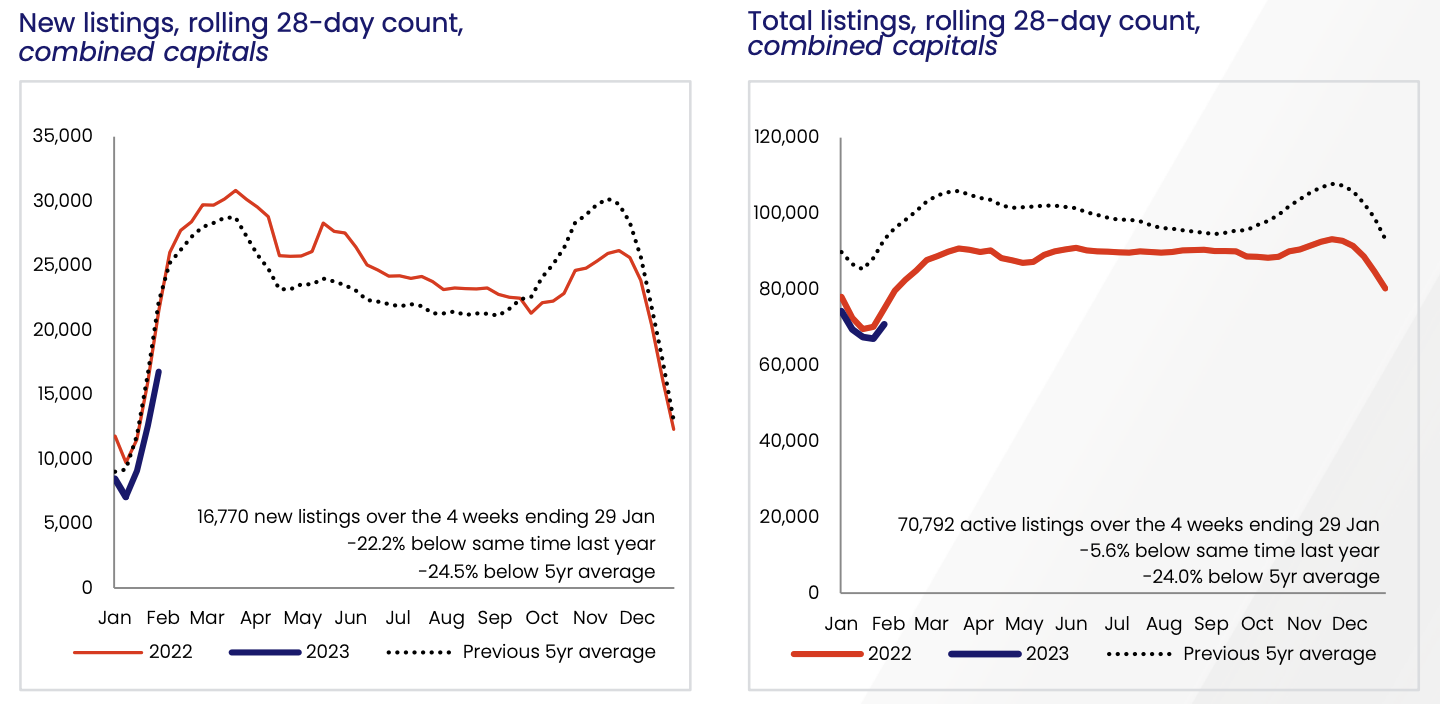

Despite pressure on affordability and ever-increasing interest rates, listings are still not seeing a significant increase according to CoreLogic.

New capital city listings are -22.2% lower than over the same period last year and -24.5% below the previous five-year average. Every capital city recorded a below average number of new listings through January, reflecting an ongoing reluctance from prospective vendors to test the market.

“Such a low number of new listings implies most homeowners don’t need to sell, rather, they seem to be prepared to wait this downturn out,” Mr Lawless said.

“This trend of lower than normal levels of new listings has been persistent through spring and early summer and looks to be continuing into 2023.”

Mr Lawless said it’s unlikely listing and purchasing activity will return to average levels until consumer sentiment starts to improve.

“There is a strong relationship between consumer attitudes and the number of homes sales.

“With sentiment remaining around recessionary lows, it’s harder for consumers to make high commitment decisions such as buying or selling a home.”

Source: CoreLogic

Rents still high

The monthly pace of rental growth picked up a little in January, with national rents up 0.7% compared with a 0.6% rise in December, but it is down from the record high levels.

“After recording substantially larger increases through the worst of the pandemic, the rate of growth in house rents is generally easing in most regions, reflecting a transition of demand towards more affordable, higher density types of rental stock,” Mr Lawless said.

“In contrast, unit rents have seen a surge in rental growth over the past year.”

Housing outlook

Mr Lawless said once interest rates move through a peak, it’s likely that housing values will stabilise.

He said there may be a few month’s lag before declines flatten out, and the market would need some form of stimulus before a new growth cycle commenced.

“The most obvious stimulus would come from a drop in interest rates, but any cut to the cash rate probably won’t occur until late this year at the earliest,” he said.

“Other factors that could support housing activity would be a rise in consumer sentiment, an easing in credit policy, such as a reduction to APRA’s serviceability buffer, or fiscal incentives aimed at stimulating housing demand.”

According to Mr Lawless, there is also a risk to the property market as a large number of borrowers roll off their low fixed-rate loans and onto higher variable rates.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)