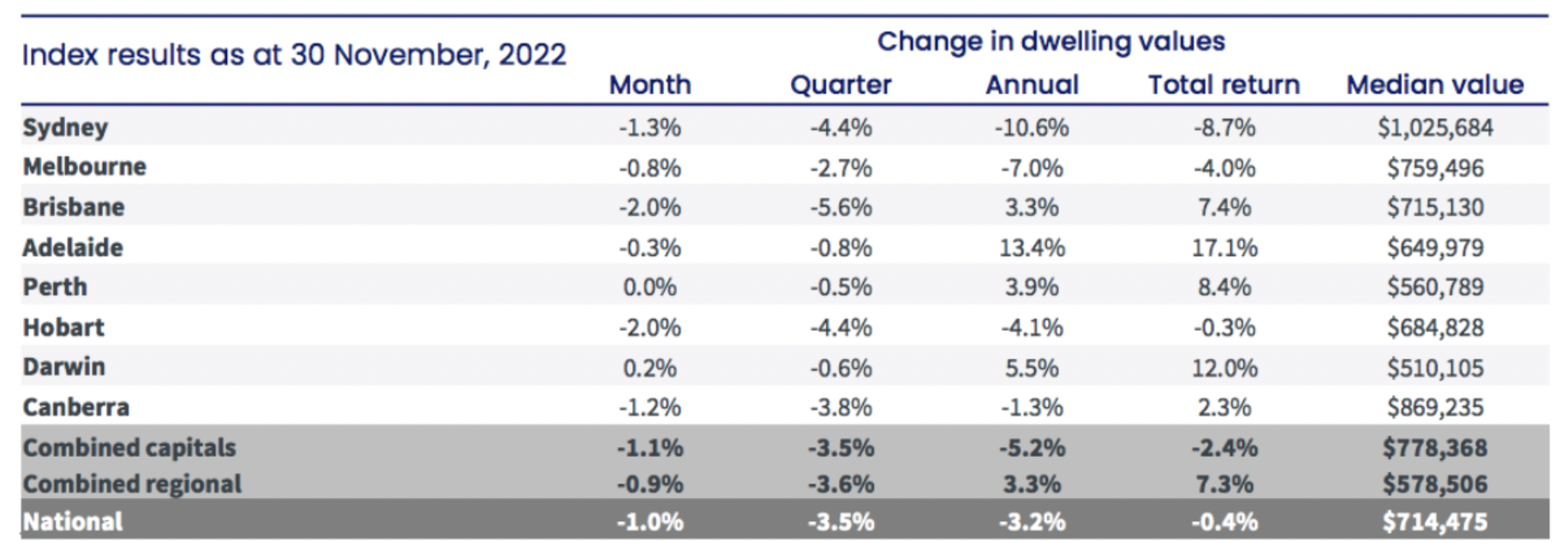

Home prices fell for the seventh straight month in November, with values down 1% across the country, however, the good news for homeowners is that the rate of decline is slowing down in some areas.

According to CoreLogic, Brisbane and Hobart recorded the sharpest falls in November, with both capital cities seeing a decline of 2%, while Sydney values dropped 1.3%, Canberra 1.2% and Melbourne 0.8%.

At the other end of the scale, Darwin, Perth and Adelaide all remained relatively flat over the course of the month. Adelaide continues to be the strongest property market in the country, with the city growing at a 13.4% annualised rate.

Source: CoreLogic

CoreLogic’s research director, Tim Lawless, said the easing in the rate of decline is mostly coming out from the Sydney and Melbourne markets but is also evident across many of the smaller capitals and most regional markets.

“Three months ago, Sydney housing values were falling at the monthly rate of -2.3%,” Mr Lawless said.

“That has now reduced by a full percentage point to a decline of -1.3% in November. In July, Melbourne home values were down -1.5% over the month, with the monthly decline almost halving last month to -0.8%.”

Mr Lawless said the rate of decline has also eased across the ACT (from a -1.7% fall in August) and is no longer accelerating in Brisbane.

“Most of the broad rest-of-state markets have also seen the pace of declines decelerate,” he said.

Mr Lawless said we are potentially seeing the initial uncertainty around buying in a higher interest rate environment wearing off, while persistently low advertised stock levels have likely contributed to this trend towards smaller value falls.

“However, it’s fair to say housing risk remains skewed to the downside while interest rates are still rising and household balance sheets become more thinly stretched,” he said.

“There is still the possibility that the pace of declines could reaccelerate, especially if the current rate hiking cycle persists longer than expected.

“Next year will be a particular test of serviceability and housing market stability, as the

record-low fixed rate terms secured in 2021 start to expire.”

Sydney remains the only city where housing values have fallen by more than 10% from their peak. Through the upswing, Sydney values increased by 27.7% before peaking in January.

Despite the sharp fall in values through the downturn to-date (-11.4%), Sydney home values remain 10.3% above pre-COVID levels (March 2020).

Due to a weaker upswing, Melbourne values are only 2.8% above where they were at the onset of COVID. If housing values continue to fall at the current pace of -0.8% month-on-month, Melbourne’s dwelling values could fall to pre-COVID levels by March next year. Most of the other capital city and broad rest-of-state regions are still recording dwelling values at least 25% above March 2020 levels.

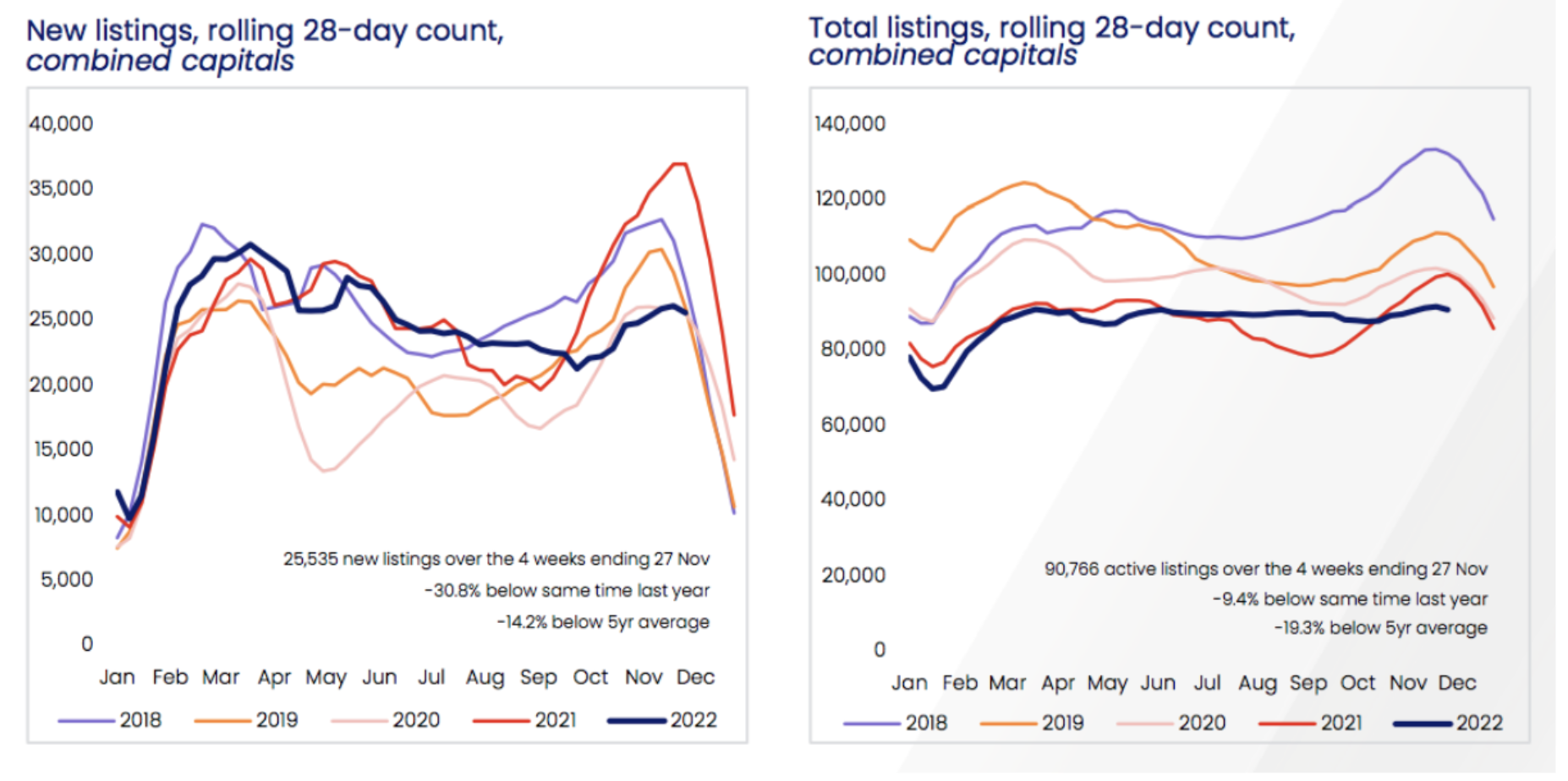

A Slow Spring

The trend in new listings added to the housing market drifted higher through November, however, this year’s spring listing season has been mild. Over the four weeks ending November 27, the flow of new capital city listings was -30.8% lower than a year ago and -14.2% below the previous five-year average.

Mr Lawless said the lower than normal number of new listings coming onto the market has helped to keep total advertised stock below average as well.

“Across the capitals, total listings haven’t been this low at this time of the year since 2010, and regional listings are at their lowest level since 2007,” he said.

“This is likely a key factor offsetting the negative impact of higher interest rates and low consumer sentiment.”

Every capital city apart from Hobart is recording total advertised stock levels below the previous five-year average.

Source: CoreLogic

Tight Vacancy Rates

Rental markets around Australia remain extremely tight, with vacancy rates holding around 1% or lower in most regions.

Despite such tight rental conditions, there is some evidence that rental growth is easing across some cities according to Mr Lawless. The quarterly trend in capital city rental growth peaked at 3.1% in July and has since reduced to 2.5%.

“The softening in rental growth is more apparent for house rents than units,” Mr Lawless said.

“This could be a sign that rental demand is transitioning towards more affordable rental options such as the higher density sector.”

Housing outlook

According to Mr Lawless, the trajectory of interest rates remains the most important factor for housing market conditions.

He said the latest rate hike from the RBA, takes the cash rate up to the upper limit of the serviceability test that borrowers were faced with when qualifying for a loan. Any further rate hikes would push them beyond that limit and theoretically into a more difficult financial situation.

Mr Lawless also said a lift in fixed mortgage rate refinancing activity in the second half of 2023 adds to the downside risk of higher mortgage distress. The RBA recently estimated around 35% of outstanding housing credit was on fixed term rates, which is above the 20% long term average. Further, the RBA expects about two thirds of these loan terms will expire by the end of 2023, with borrowers facing a three to four percentage point rise in their mortgage rate.

According to Mr Lawless, long term savings, strong employment and tight stock levels will continue to help keep a floor under house prices in the short term.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)