Distressed properties can provide an excellent source of instant equity, through the purchase of a property at a price below the deemed market value.

Finding distressed properties can be a difficult task as they are often only on the market for a short amount of time and are in high demand.

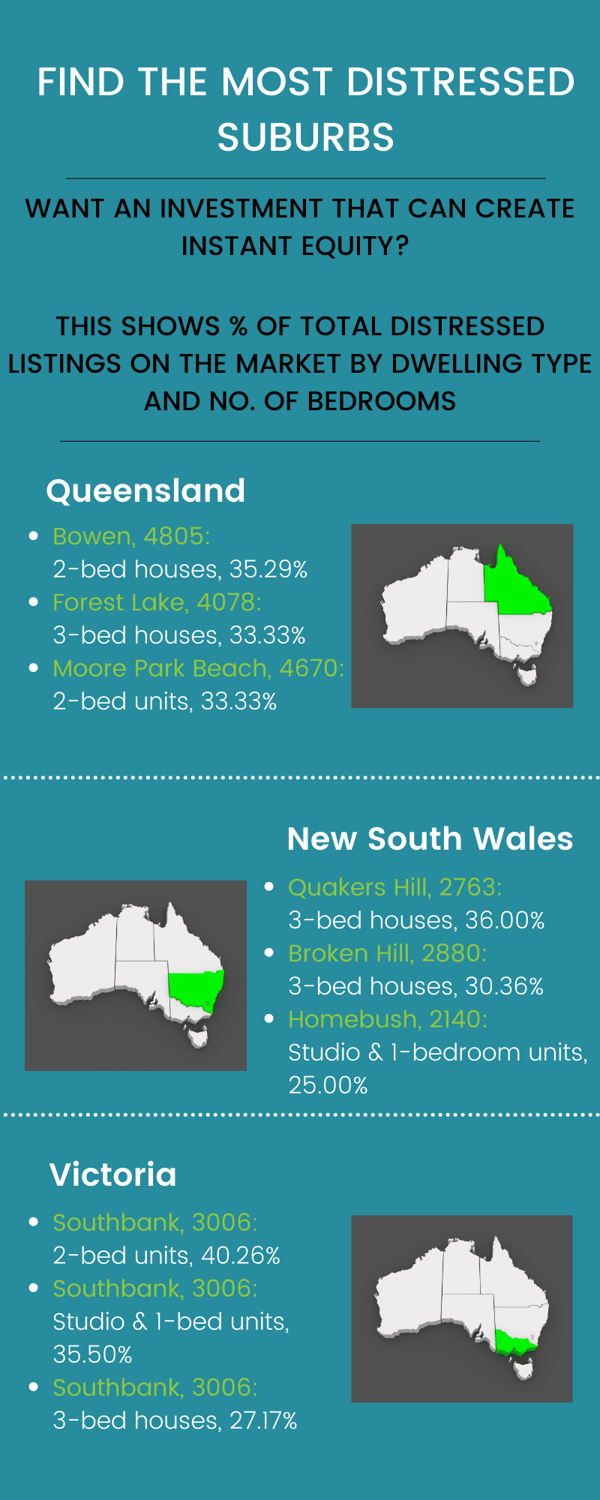

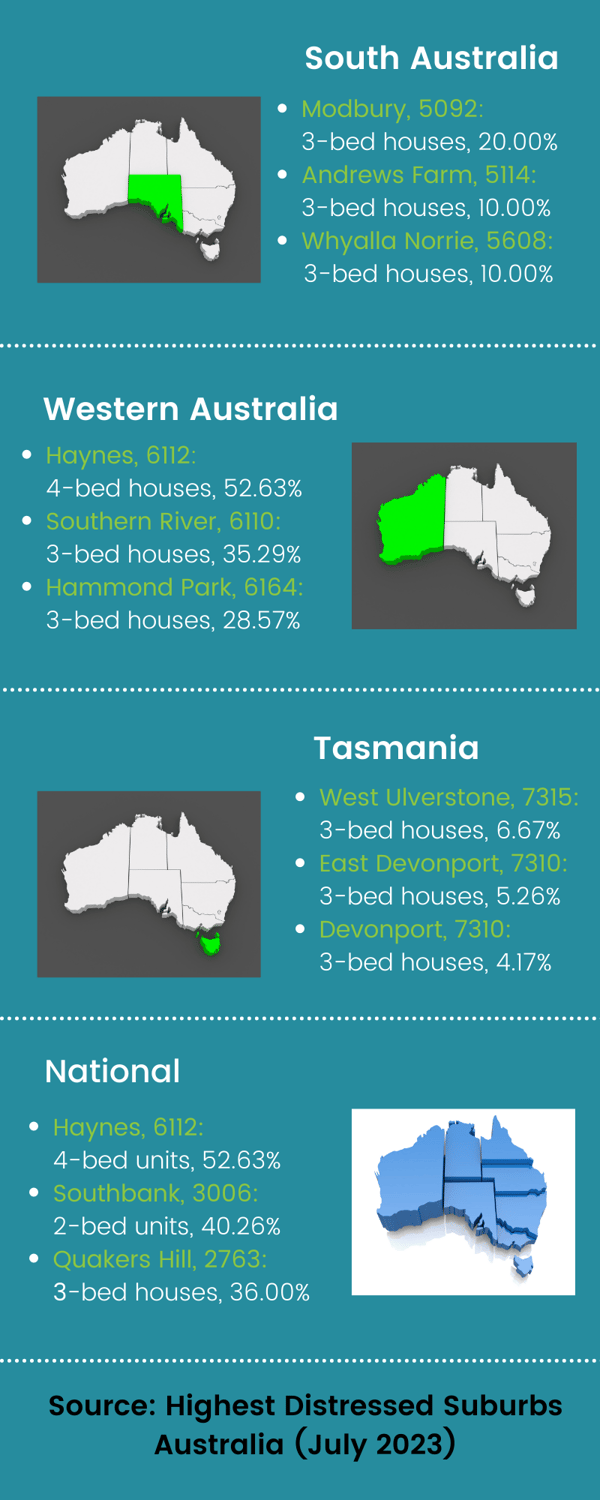

To help your search, we have compiled a list of Australia's suburbs with the highest proportion of distressed properties. This infographic shows the percentage of total distressed listings on the market by dwelling type and number of bedrooms.

To download the full list of the top 50 suburbs, please check our Movers and Faders Suburb Report Pack. This data is updated at the start of each month.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)