In years gone by deciding whether to buy a first home or invest wasn’t a choice. When it was time to settle down and have a family, it was expected that you took out a loan and bought your forever home, where you could raise your kids and live until retirement.

These days, the landscape has changed and younger generations are looking at the situation through a different lens.

In recent times, there’s been a big shift towards ‘rentvesting’, where people rent where they want to live and invest elsewhere.

This has been a product of young investors getting smarter, as well as the rise in house prices, particularly in Sydney and Melbourne, that made it unaffordable for many young people, to buy in good areas.

So what’s the best approach? In reality, there are pros and cons to each option.

Investing First

Capital Growth

One of the main reasons to invest first is that you can locate areas and suburbs that are ripe for future capital growth.

You can find the suburbs with the fastest levels of median price growth by downloading our free pack of reports.

Perhaps the suburb where you want to live has already been through a growth cycle which would suggest it could be many years before there is more growth on the horizon.

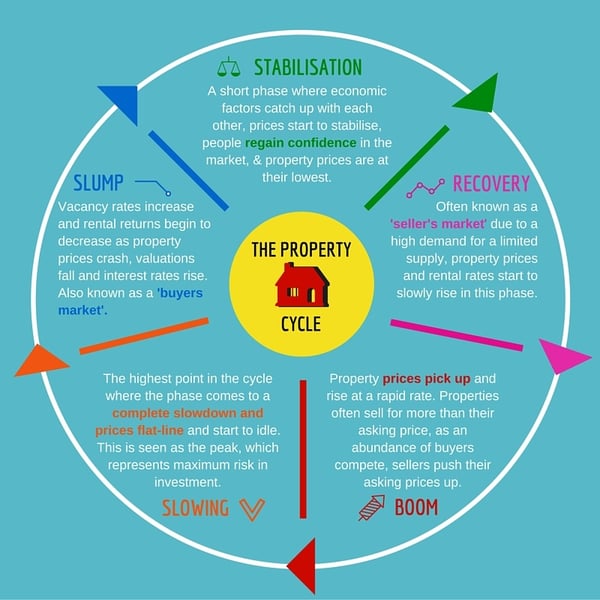

The Property Cycle

By renting in the area you want to live in, and buying an investment property elsewhere, you get the opportunity to have your cake and eat it too.

By renting in the area you want to live in, and buying an investment property elsewhere, you get the opportunity to have your cake and eat it too.

Capitalising on the growth, while enjoying the great amenities in the suburb you want to live in.

After seeing some growth in your investment property, you can use that equity or even sell it, to get yourself into your chosen family home at the right time in the growth cycle.

Positive Cash Flow

The problem with buying your family home is that you actually have to pay for it. Why not let someone else pay off your mortgage for you?

If you’re looking to areas that have strong positive cash flow, not only will the rent potentially cover your mortgage, but it will leave you with some money in your pocket every month.

Better Amenities

Despite the fact that interest rates are low, you are almost always going to be able to rent in a better location, than you could conceivably buy.

Why not rent in the blue-chip suburbs, that are close to great lifestyle and entertainment instead of being stuck out of the city in your own home?

Lack of Security

The main downside of investing first is that you won’t have the security of owning your home and that might be something that is important to you on a personal level. If you’ve got a young family that might be a reason to buy first.

If security is something you value, you can always still rent, but simply look for longer lease terms.

The landlord might very well be open to a 3-5 year lease, with rental increases built-in, which would add some real stability and security.

Buying Your First Home

Access to Government Incentives

As we’ve seen in the current environment, the Government is making a big push to help first home buyers. Most states will have some form of first home buyer grant and many also give massive stamp duty reductions to those building or buying their first home.

Stamp duty is a tax on a property transaction. The amount varies according to the state and territory, the value of the property, if it is your primary residence and your residency status.

These incentives can be very appealing for someone with not that much money for a deposit. However, as we’ve seen in the past, just because you can access these programs, doesn’t mean you should.

Buying a property in the wrong area, just because you don’t have to pay stamp duty is not a good investment decision.

Remember, buying in an area that has capital growth potential or strong cash flow will increase your equity and cash position far more than the small upfront savings that might be on offer.

Borrowing Capacity Takes a Hit

The real issue with buying a property to live in is that your borrowing capacity and serviceability can dry up. Most people will access almost all the money they are able to borrow, but that means your mortgage payments will make it very difficult to afford an investment property in the near future.

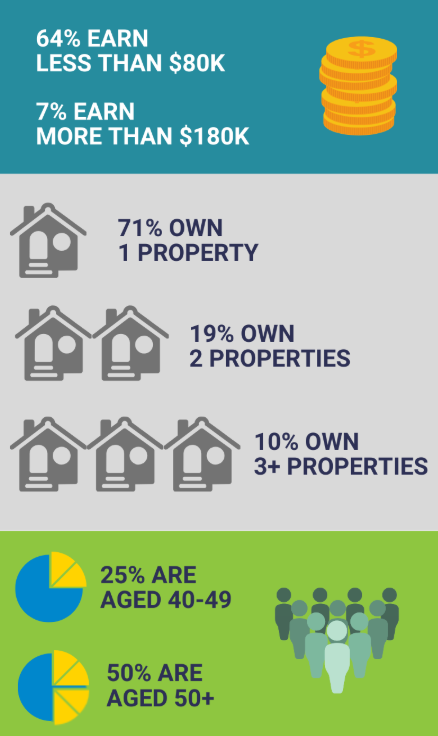

It’s one reason why the vast majority of people in Australia don’t own any investment properties, and of those that do, 71% only own one. The only way you will be able to invest in the future is when your earnings increase.

The following infographic shows a snapshot of the typical property investor according to the FY 2016/17 statistics (source ATO).

If you want to build a large investment property portfolio to set you up for the future, looking to invest first is the smarter way from a borrowing perspective.

Use a Data-Driven Approach

Whichever option you choose it’s important to make sure your decisions are based on data and not emotion.

Look to use the right tools to see how the area you want to buy into has performed in the past. Then compare that to other investment property options.

Think about where you want to be in 5, 10 or 20 years and then make a plan for how you’re going to be able to get there.

Selecting the right investment properties early on that offer either strong growth, positive cash flow or even by finding really good discounted properties is the very best way to get ahead and will ultimately put you in a stronger position than simply buying on emotion.

Interested in Learning More?

We have a website page dedicated to helping first home buyers. You will find helpful articles, videos and free downloads.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)