The difference between good and bad debt is important to understand and recognise.

Owning your own home, cars, dining out, and generally enjoying life, all costs money and may create debt.

While debt is an essential part of everyday life, it can also wear out its welcome, and wear down your desire to dream for a better tomorrow.

One of the reasons why so many Australians are restricted in their ability to achieve their financial goals is because they are simply ‘drowning’ in debt.

When you are deep in debt, you restrict your ability to build wealth before you’ve even had the chance to start.

That’s why you need an effective debt elimination strategy, a customised plan of action, and a clear understanding of the difference between ‘good’ and ‘bad’ debt.

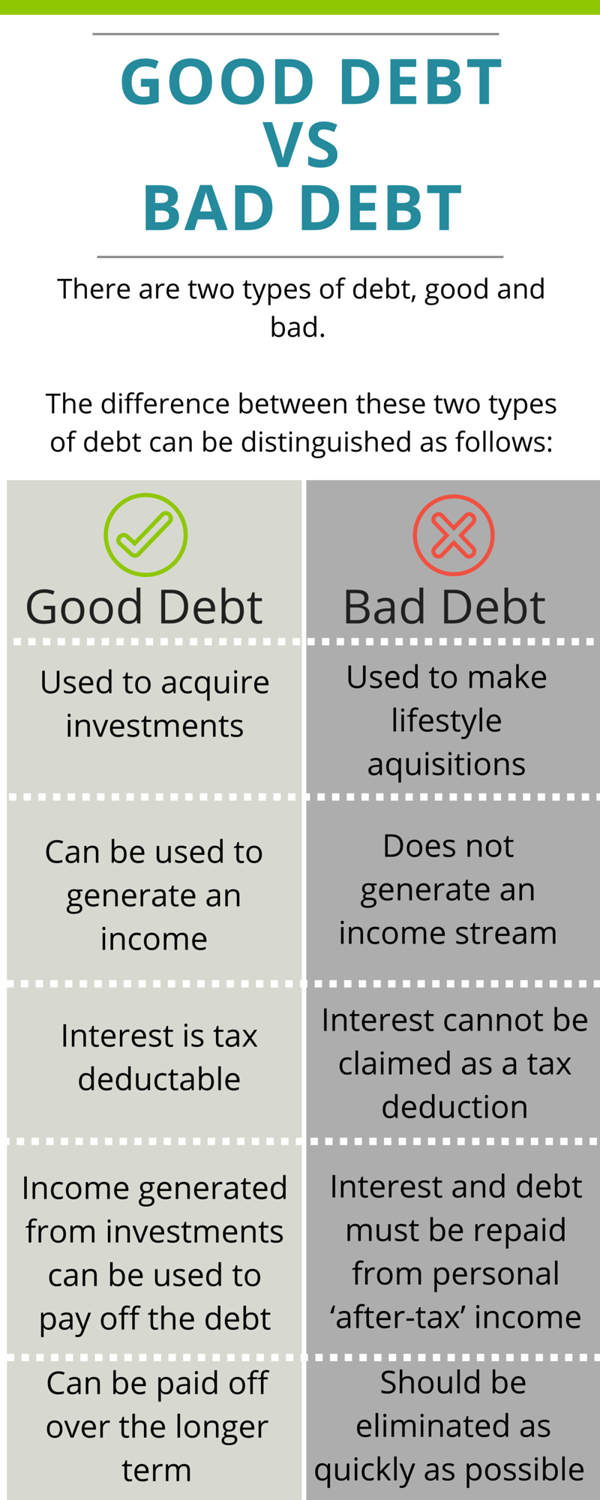

The difference between these two types of debt can be distinguished as follows:

Bad Debt

- Is used to make lifestyle acquisitions

- Does not generate an income stream

- Interest cannot be claimed as a tax deduction

- The interest and the debt needs to be repaid from personal ‘after-tax’ income

- Must be eliminated as quickly as possible

Good Debt

- Is used to acquire investments

- Generates an income and appreciates in value

- Interest is tax deductable

- Income generated from investments is used to pay off the debt

Getting into debt to finance a real estate investment is not considered bad debt, and for many people, buying a home is the single most expensive investment they will ever make and the largest amount of debt they will ever enter into.

Sometimes getting into good debt can be quite difficult - it can be hard to qualify for your first mortgage, and a difficult decision for lenders to make themselves when it comes to choosing you to loan money to.

To be granted a mortgage there are certain criteria it is necessary to qualify for before the lending institution will sign you up for that notorious 30-year loan.

To borrow money for your first mortgage you need

- Proof of income

- Proof of savings

- A deposit (in most cases)

- Strong nerves!

Always think in terms of serviceability when it comes to borrowing money for property -- even if you know it's a good debt.

Being able to service the mortgage repayments is the most important part of the battle.

Ask yourself these questions;

- Can I withstand interest rate rises? If not should I fix in my rate?

- Is my income secure enough to repay a mortgage?

- Are my expenses too steep? What can I cut down on?

- What is my back up plan if the mortgage gets to be too much?

- Do I have the right type of insurance?

- Am I borrowing this money for the right house, in the right place at the right price?

Real estate is, unfortunately, not always a good debt type transaction.

If you make the wrong decision at the outset and borrow money for a house that is overpriced and you pay too much - then you already have negative equity before you start out.

Seek advice from mortgage brokers, accountants, lending institutions, financial advisors and your legal experts before you sign on the dotted line for your first mortgage.

Start considering if each debt you incur is good or bad and make the good outweigh the bad in any way you can.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)