The great thing about investing in property is that there are a multitude of ways that everyday investors can make money.

There are different property investment strategies that can be used, depending on what your goals are and what you’re trying to achieve.

These strategies can also be used on a range of different priced properties in different locations, meaning that there is always a strategy that you can use in most market conditions to help achieve some great returns.

Here are five property investment strategies that you can consider using on your next property purchase.

1. Renovation / Adding Value

One of the great things that property offers as an asset class is the ability to add value.

If you buy shares in a company, there’s not much you as the investor can do to change the overall value of the company.

With property, you can.

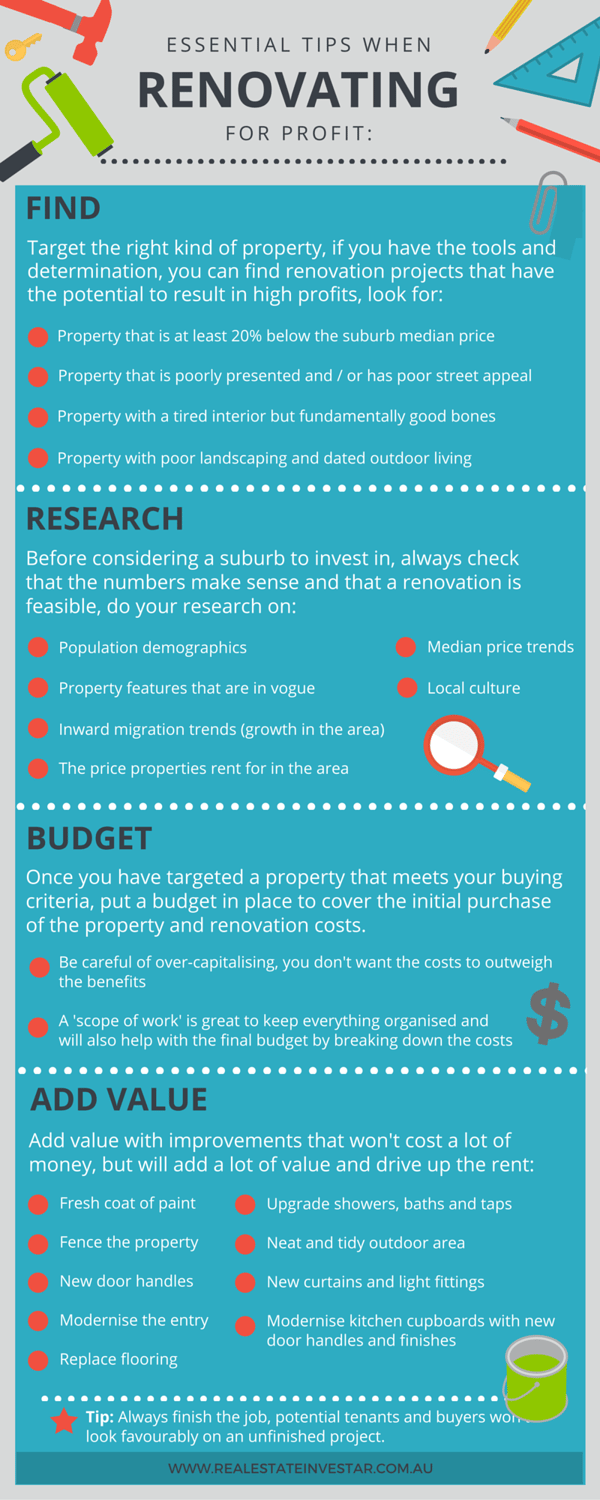

The most common way to add value is through renovation. If you update the property it can go from an unappealing money pit to a highly desirable place to live.

Renovations can differ between small cosmetic changes, which would include things like kitchen and bathroom renovations, new floors and window coverings, or even just a coat of paint.

Larger structural renovations might mean something like knocking out walls or adding or converting rooms.

The goal is obviously to increase the value of the property, to a point that you are making more than you spend. The other real benefit of this strategy is that it also will likely boost your rental yield.

Renters love brand new kitchens and bathrooms and are willing to pay more. You’ll also get a better quality tenant.

The key to doing a renovation is that you need to do your research well before you open a can of paint.

Compare the prices of renovated homes or apartments with unrenovated ones.

Ideally, you need to see a large price discrepancy here, so you know that after costs, you’ll be able to make a profit or see an uplift in your rental price.

If you are planning a renovation, here's a free budget calculator to help you keep your spend on track.

2. Cash flow

Robert Kiyosaki famously said that your family home is not an asset. What he meant was because it costs you money every month, it is not adding anything to the bottom line and is effectively a liability.

Learn more about the differences between good debt and bad debt here.

The same thinking applies when looking at investment properties.

If you have to pay money each month to hold a property, it is going to be far more difficult to buy multiple properties down the track. Both from a cash flow perspective and a serviceability one.

The key here is to use a cash flow strategy. What this means is that your property should be making you money each month. That means the rent you receive is greater than all the costs and interest payments.

This gives you what is known as a cash flow positive property.

The key to finding a cash flow positive property is to look at areas that already have high rental yields and have low fees such as strata costs.

You can start your research and target suburbs with the highest yields by downloading our free pack of suburb reports.

Generally speaking, you won’t find these properties in places like the inner city of Sydney and Melbourne. They are more common in larger regional areas.

These properties generally start at lower prices and this is a great way to get started investing in property as it gives you a chance to build up your equity base while someone else covers the costs for you.

3. Buying at a discount

We all want to get a bargain, but in property, it is very important to pay the lowest amount you possibly can.

Transactions costs are high when you buy property in Australia thanks to stamp duty, so you are effectively behind from the beginning.

To counter that and also to give yourself instant equity, you should look to buy at a discount.

Normally to buy at a discount, means you need to be buying off a highly motivated seller. These types of vendors might need to sell quickly for financial or family reasons and may be willing to accept a lower price for a quick sale.

There are plenty of different types of sellers that are motivated for a quick sale and you can use a number of different tools to identify where you might be able to grab a bargain.

Real Estate Investar members can use Investar Search and our Discount Strategy keyword search to instantly find and filter discounted properties throughout Australia.

4. Capital Growth Potential

One of the things that make Australian residential property so appealing is its long history of capital growth.

Over many generations, property has increased in value. On average property increases in value by around 2% more than the current level of inflation.

However, as property investors, we want to get a better than average result. Fortunately, there are ways to outperform and achieve higher growth.

The rate at which a property performs is a product of underlying supply and demand.

This can vary dramatically from state to state and even suburb to suburb. If there is a steady stream of demand that is larger than supply, that means prices will rise.

Identifying areas that have these drivers of demand and limited supply is key here.

From a demand side, we want to see areas that have high owner-occupier appeal with plenty of amenity.

That means things like good school zones, great lifestyle such as access to beaches and restaurants and cafes as well as good shopping and plenty of access to transport.

Similarly, we don’t want to invest in areas that have unlimited supply, such as new housing estates or high rise buildings as this could hamper future growth.

As an investor, it’s also critical to identify what the market wants. There’s no point investing in a one-bedroom apartment in a suburb that’s in a great school zone as the market simply won’t want that type of property.

5. Subdivision

Subdividing a property can be one of the fastest ways to create equity and boost your long term profits.

It provides property owners with a number of options - land banking, sell the land or build to sell and/or hold.

Learn more in this quick video.

The Best Investment Strategy

There is no one right property investment strategy and what is right for you will come down to your personal goals and financial situation.

However, there is no reason you can’t aim to combine multiple strategies at the same time to achieve maximum growth in the value of your property.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)