Property prices across Australia continue to surge higher with the latest house price data showing another big jump in February.

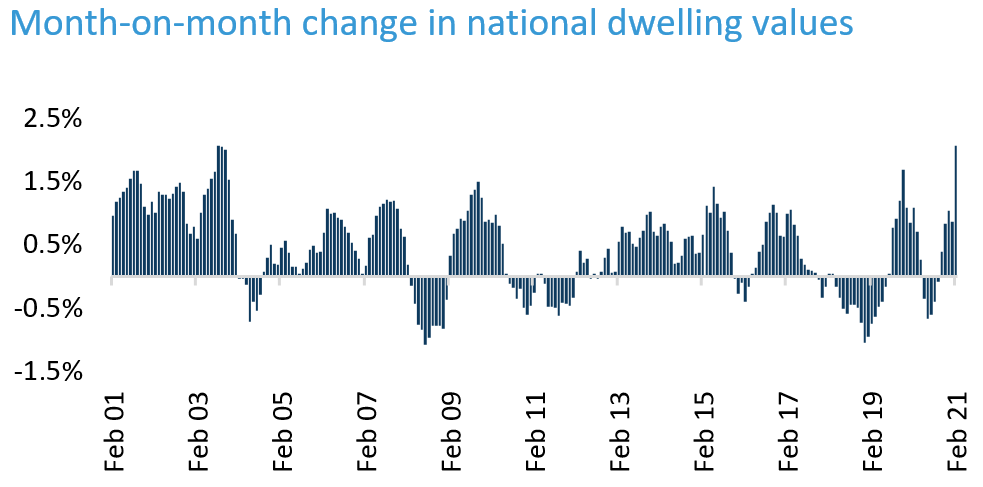

According to the latest data from CoreLogic, house prices rose by 2.1% across the nation, marking the largest jump we’ve seen since 2003.

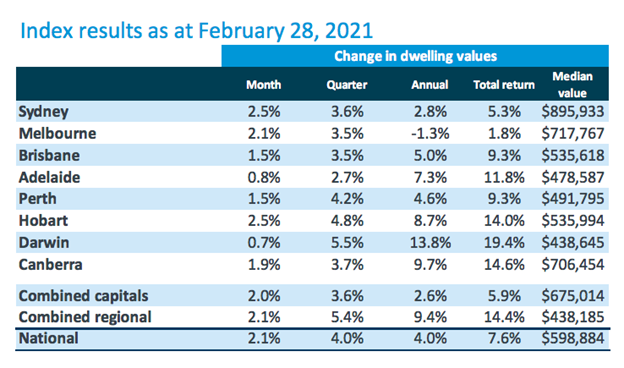

Sydney, Melbourne and Hobart were the strongest performed capital cities in February, rising by 2.5%, 2.1% and 2.5% respectively. While all other capital cities recorded gains upward of 0.7% for the month.

Over the last quarter, house prices across the nation have risen by 4.0%.

Regional areas are also continuing to see strong gains in price, jumping 2.1% in February and 5.4% over the quarter. Since the onset of COVID in March 2020, regional house prices have seen huge interest and are 9.4% higher across the country.

The last time house prices were rising at this type of rate was in 2009 and there are some key parallels to what we’re seeing in the market right now.

After the GFC, the Federal Government at the time released a host of stimulus measures in a bid to boost demand for property. During that period of time house prices rose by around the same amount as was introduced through the stimulus measures.

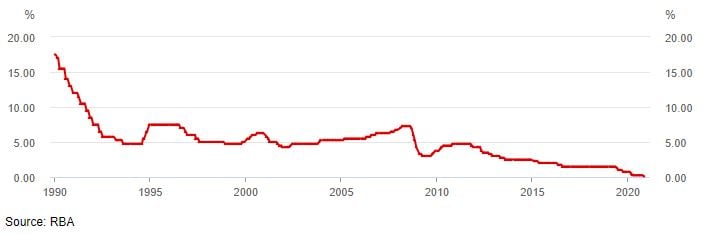

Since COVID began, we’ve seen interest rates fall to record low levels, while a range of state and federal government incentives have been rolled out including the Building Bonus and stamp duty relief.

Graph of the Cash Rate Target

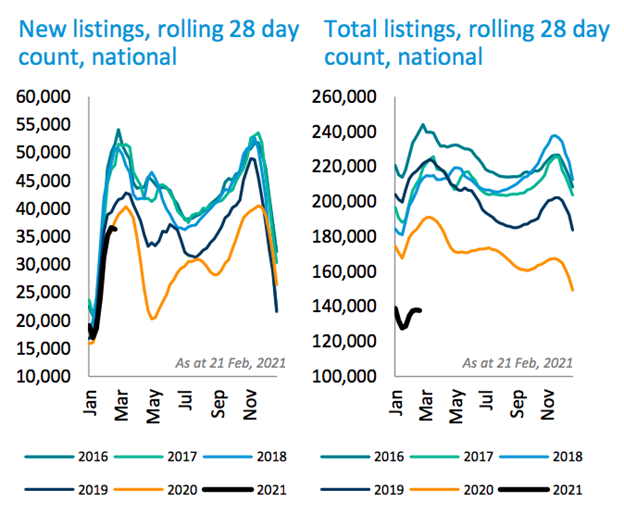

The Australian market is also seeing a widespread shortage of stock, with listings continuing to sit at very low levels.

Many Australian’s are choosing not to sell, and those properties that are put on the market are finding buyers as many expats choose to return home, while others look to take advantage of the low interest rate environment.

Total Listings in 2021, sit at around 140,000 compared to 180,000 this time last year. In the last five years, we’ve seen periods where total listings have been as high as 240,000 across the country, reflecting just how tight stock levels are in the current market.

According to CoreLogic, there is evidence to suggest that listings could be about to rise given how active real estate agents have been in recent months.

Rental markets are also seeing renewed levels of interest in 2021. Perth and Darwin are experiencing extremely low rental vacancy rates, bought about by a lack of investor activity over the past five years.

Now that both cities are seeing strong levels of interstate migration, both are likely to see further pressure on rental markets in the months ahead.

Meanwhile, the unit rental market in Sydney and Melbourne is also starting to turn around as confidence is coming back with lockdowns continuing to ease in Australia's two largest cities.

According to CoreLogic, ‘Australia’s housing market is now well entrenched in one

of the strongest growth phases on record’.

CoreLogic believes that there are a number of conditions that continue to underpin the market strength including the low interest rate environment, economic conditions rapidly improving and the ongoing supply shortage in the form of low listings.

They do caution that even though this is a strong growth phase, there could still be some headwinds. The federal government will continue to taper off its fiscal support in the months ahead while the home loan deferral arrangements will also be coming to an end.

For the time being, CoreLogic believes,

‘housing price momentum looks to be skewed towards the upside, with the tailwinds of low rates, improving economic conditions and consumer confidence, low supply and high consumer demand likely to outweigh the headwinds associated with the coming wind-down of fiscal support.’

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)