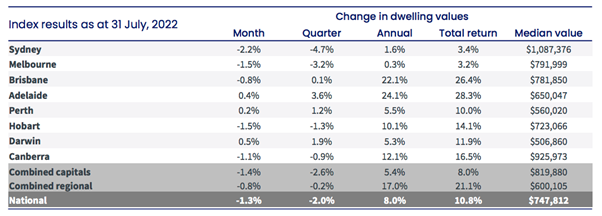

Property prices across the country have continue to slow down, with the latest data from CoreLogic showing national values declined 1.3% in the last month.

The downturn is being led by Australia's two largest cities, with Sydney values down 2.2% in July, while Melbourne prices fell 1.5%.

Brisbane also edged into negative growth territory for the first time since August 2020, with values down 0.8%, while Canberra (-1.1%) and Hobart (-1.5%) were also down over the month.

Perth (+0.2%), Adelaide (+0.4%) and Darwin (+0.5%) did show positive growth last month, however, most of these markets have recorded a sharp slowdown in the pace of capital gains since the first interest rate hike in May.

Source: CoreLogic

CoreLogic's Research Director, Time Lawless, said housing market conditions are likely to worsen as interest rates surge higher through the remainder of the year.

"The rate of growth in housing values was slowing well before interest rates started to rise, however, it's abundantly clear markets have weakened quite sharply since the first rate rise on May 5," Mr Lawless said.

"Although the housing market is only three months into a decline, the national Home Value Index shows that the rate of decline is comparable with the onset of the global financial crisis (GFC) in 2008, and the sharp downswing of the early 1980s."

"In Sydney, where the downturn has been particularly accelerated, we are seeing the sharpest value falls in almost 40 years."

Mr Lawless said highly indebted households are more sensitive to higher interest rates, as well as the additional downside impact from very high inflation on balance sheets and sentiment.

After a record-setting pace of growth in regional Australia over the past few years, values are also starting to slow down.

Regional values recorded the first monthly decline (-0.8%) since August 2020, with prices down across regional New South Wales (-1.1%), regional Victoria (-0.7%), regional Queensland (-0.7%) and regional Tasmania (-0.6%), while values continued to trend higher in regional South Australia (1.1%), and regional Western Australia (0.1%).

"Dwelling values across CoreLogic's combined regionals index were up 41.1% from the pandemic trough through to the June peak, compared with a 25.5% rise across the combined capitals index," Mr Lawless said.

"The stronger growth reflects a significant demographic shift towards commutable regional markets, which is likely to have some permanency as more workers take advantage of formalised hybrid employment arrangements."

Most of the major regional centres adjacent to Sydney, Melbourne, and Brisbane (including Geelong, Ballarat, Illawarra, Newcastle, and Lake Macquarie, the Southern Highlands and Shoalhaven, the Gold Coast and Sunshine Coast) recorded a decline in home values over the three months to July, marketing the end of nearly two years of significant capital gains.

Unit values across the combined capitals are generally recording smaller falls relative to house values, down -1.0% and -1.5% in July respectively.

"This trend is most apparent across the three largest capitals as well as Canberra, where housing affordability challenges may be deflecting more demand towards the medium to high density sector," Mr Lawless said.

"Additionally, firmer interest from investors should favour the unit market over houses where demand has historically been more concentrated."

Source: CoreLogic

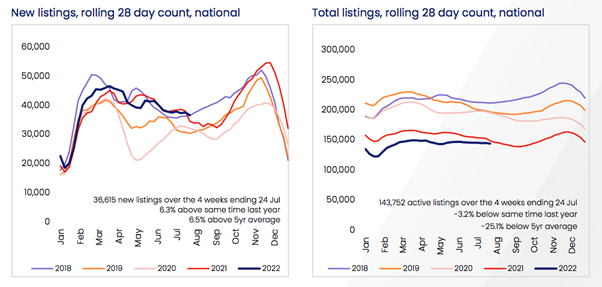

Listings to Rise in Spring

While listings have been steadily rising since early in the year, Mr Lawless said he's closely watching what happens when the influx of spring listings hits the market.

"Based on the pre-COVID average, we have typically seen an 18.9% rise in the number of new listings between the winter and spring seasons," he said.

"A more substantial flow of advertised stock against a backdrop of falling demand is great news for active buyers, who will have more choice and less urgency, but bad news for vendors, who could find selling conditions become more challenging as advertised stock levels rise."

In Sydney and Melbourne, total listings are already 8 to 10% above five-year averages, however Brisbane, Adelaide and Perth are recording advertised supply levels that are more than -30% below the five-year average, suggesting a faster rate of absorption through the growth cycle to-date.

Meanwhile, rents continue to push higher, driven by tight vacancy rates, rising 0.9% nationally over the month to be 2.8% higher over the quarter, and 9.8% higher over the past 12 months.

"Rental markets are extremely tight, with vacancy rates around 1% or lower across many parts of Australia," Mr Lawless said.

"The number of rental listings available nationally has dropped by a third compared to the five-year average, with no signs on a lift in rental supply.

"On top already tight rental supply, it's likely demand will continue to increase as overseas arrival numbers climb."

Outlook

Mr Lawless said that as the RBA continues to raise rates at a rapid pace, property markets will continue to feel the impact.

"As borrowing power is eroded by higher interest rates, and rising household expenses due to inflation, it's reasonable to expect a further loss of momentum in housing demand," Mr Lawless said.

"When interest rates start to stabilise, or potentially reduce next year, this could be the cue for housing values to find a floor."

"Similar to the trajectory of the upswing, this downswing phase could be a short but sharp one, depending on how high and fast interest rate settings go."

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)