While many people assume the property market across the country rises and falls in sync with one another, the reality is that the values in each state, and even each suburb move at slightly different rates.

Over the past 18 months, we’ve seen broad-based property price growth across the country. Fuelled by ultra-low interest rates, Government stimulus and a lack of supply leading to prices rising by approximately 30%. However, different areas of the market have performed incredibly well, including houses in regional locations and cities like Brisbane while other segments such as units have not kept pace.

In terms of the housing market, virtually all segments have been in the growth phase over the past few years, but now with rising interest rates and issues with affordability, a number of markets across the country have begun to slow down.

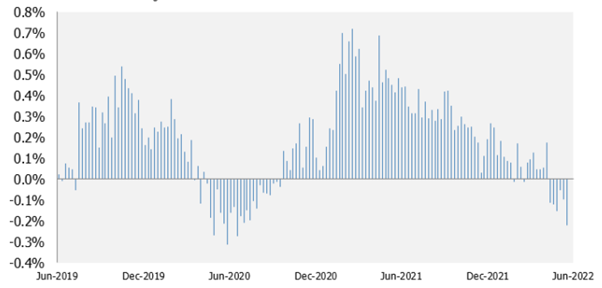

Looking at the latest data from CoreLogic, we can see that national dwelling prices have started to slow down across the major capital cities, suggesting that we are at the peak on a national level.

Source: CoreLogic

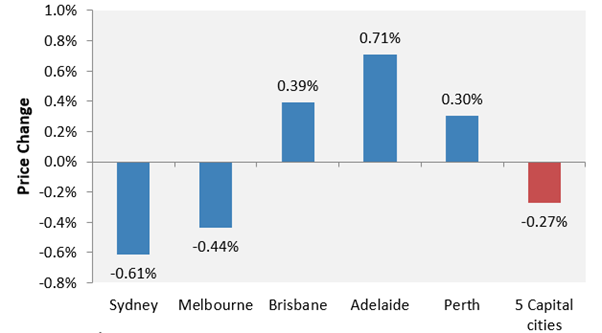

Looking at the different capital cities and the most recent falls are being led by Sydney and Melbourne. Over the past month, dwelling values are down -0.27% across the five major capital city markets.

Sydney prices are lower by -0.61% while Melbourne prices are -0.44% lower. The smaller capital cities are still seeing modest rises, however, Adelaide is outperforming the rest of the country at the moment, up 0.71% on the month.

However, across all the capital city markets and regional markets, the rate of growth is continuing to slow down.

This suggests that while Adelaide, Brisbane, Perth and regional Australia are still moving higher, the growth is now starting to slow down. This would put them nearing the top of the property clock.

Markets such as Hobart, Canberra and Darwin appear to be at the top of the property cycle and are showing the first signs of negative monthly growth based on CoreLogic data, which will likely increase in the months ahead.

The largest falls are occurring in Sydney and Melbourne which means they are likely already past their peak and in declining markets.

Source: CoreLogic

These two cities are the ones with the highest property prices and also the most sensitive to rising interest rates.

The property cycle moves from periods where prices are rising to periods of no growth and even declines. The current slowdown comes as interest rate rises have made borrowing harder which has been combined with higher living costs in the form of inflation.

While on a national level, property prices are now moving into the stage where they are declining, there is a wide disparity between the large capital cities and the smaller capitals and even regional centres.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)