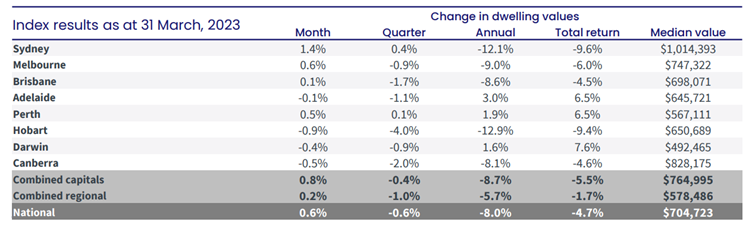

After ten straight months of declines, national home prices have rebounded 0.6% in March, ahead of the RBA’s decision to hold interest rates steady at this month's policy meeting.

Once again the rebound was led by Sydney, which bounced 1.4%, however, this month Melbourne prices also rose 0.6%.

The rest of the smaller capital cities were mixed with Perth (0.5%) and Brisbane (0.1%) the only other cities to record an increase. While Canberra (-0.5%), Darwin (-0.4%) and Adelaide (-0.1%) also recorded a decline in values over the month, as did Regional Victoria (-0.1%) and Regional Tasmania (-0.7%).

CoreLogic’s Research Director, Tim Lawless, put the rise down to a combination of low advertised stock levels, extremely tight rental conditions and additional demand from overseas migration.

“Although interest rates are high and there is an expectation the economy will slow through the year, it’s clear other factors are now placing upwards pressure on home prices,” Mr Lawless said.

“Advertised supply has been below average since September last year, with capital city listing numbers ending March almost -20% below the previous five-year average.

Mr Lawless said purchasing activity has also fallen but not as much as available supply.

“With rental markets this tight, it’s likely we are seeing some spillover from renting into purchasing, although, with mortgage rates so high, not everyone who wants to buy will be able to qualify for a loan.

“Similarly, with net overseas migration at record levels and rising, there is a chance more permanent or long-term migrants who can afford to, will skip the rental phase and fast track a home purchase simply because they can’t find rental accommodation.”

The lift in housing values has been most evident across the upper quartile of Sydney’s housing market Mr Lawless said.

The lift in housing values has been most evident across the upper quartile of Sydney’s housing market Mr Lawless said.

House values within the most expensive quarter of Sydney’s market were up 2.0% in March and the upper quartile of the Sydney unit market was 1.4% higher over the month.

“Sydney upper quartile house values fell by -17.4% from their peak in January 2022 to a recent low in January 2023, the largest drop from the market peak of any capital city market segment,” he said.

“We may be seeing some opportunistic buyers coming back into the market where prices have fallen the most.”

Regional housing markets have mostly shown firmer housing conditions as well, with the combined regionals index rising 0.2% over the month.

The best performing regional markets are quite different to what we were seeing through the recent growth cycle,” Mr Lawless said.

“In today’s market it is mainly rural areas that are seeing the strongest increases, rather than the commutable coastal and lifestyle markets that were booming through the upswing.

“However, we are seeing some subtle growth return to regions within commuting distance of the major capitals, after many recorded a sharp drop in values.”

Tight supply

The flow of new listings has held at below-average levels since September last year, which coincided with the initial loss of momentum in the downward trend of housing values. Every capital city except Hobart (+39.8%) is recording a total advertised listing count lower relative to the previous five-year average.

New listings are likely to trend lower in the cooler months, which is normal for this time of the year, before ramping up into spring Mr Lawelss said.

“Given that new listing counts have trended below average since spring last year, it’s reasonable to assume there is some pent-up supply that has accumulated behind the scenes. Whether the flow of new listings starts to pick up with improved housing confidence will be a trend to watch,” he said.

Immigration hurting renters

Rental markets are becoming increasingly diverse but vacancy rates across most regions remain extremely tight according to Mr Lawless.

The general trend across the largest capitals is towards an acceleration in rental growth, especially across the unit sector, but slowing growth across the smaller capitals, particularly for houses.

“As rental affordability becomes more pressing we are likely to see group households reforming, reversing the trend towards smaller households seen through the pandemic,” he said.

“Additionally, tenants are likely to be maximising their tenancy, sacrificing the spare room or home office to spread rental costs across a larger number of tenants.

“CoreLogic data has also shown a continued lift in rental hold periods, suggesting tenants may have a preference for holding onto their existing lease, rather than braving the search for a new rental.”

However, not all cities and regions are still recording a rise in rents. Over the March quarter rents fell for Darwin houses (-1.5%) and units (-0.4%) as well as ACT houses (-1.3%). After historically being one of the most expensive rental markets in the country, the quarterly decline now has Canberra recording an annual reduction in house rents, down -0.8% over the past 12 months.

Cautious outlook

Although the recent trend in housing markets is looking increasingly positive, Mr Lawless said he is still cautious about calling a trough in the cycle.

He said that a number of factors including the full impact of 10 consecutive rate rises and the fixed rate cliff are yet to be fully realised and that will continue to play out for the remainder of the year.

Mr Lawless also said that the record immigration push will continue to help put upward pressure on prices and make rental markets even tighter over the next few years. While the pause from the RBA also suggests inflation is headed in the right direction.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)