While the pace of house price growth might be slowing, property markets are clearly still in a strong bull market.

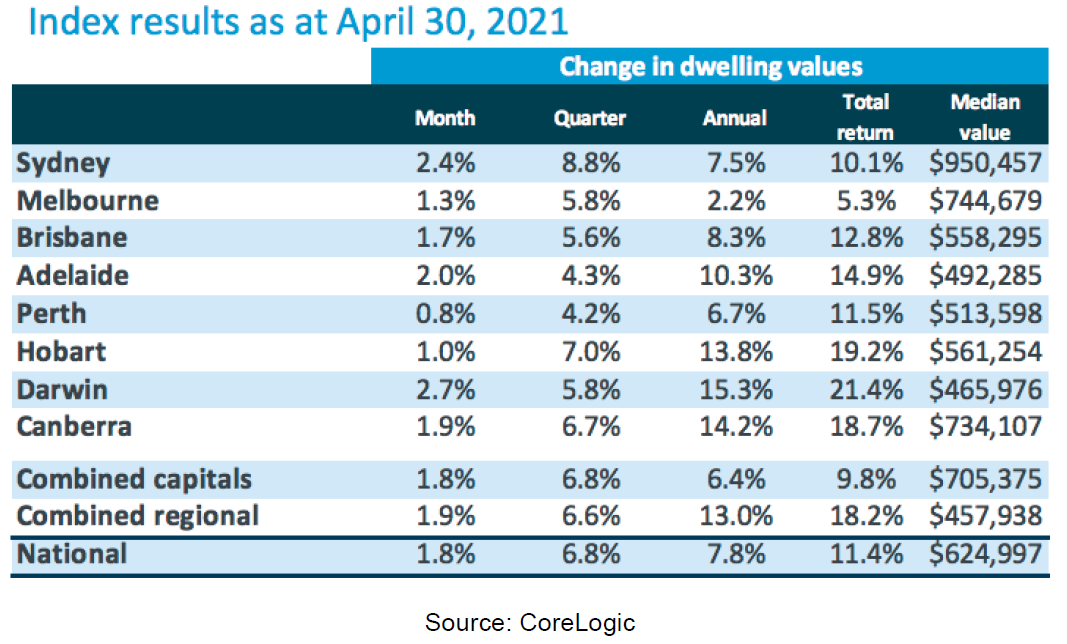

At least, that’s the belief of CoreLogic, with the latest data showing that the property market across the nation rose by 1.8% in April, down slightly from the record-setting 2.8% in March. It’s worth noting that the March growth figures, were the highest in 32-years and that 1.8% growth still translates into annual growth of more than 20%.

Once again it was Sydney that continues to lead the country this year, with values jumping a further 2.4% while the quarterly growth is now at 8.8%.

All state capitals saw strong growth last month, with Darwin putting in another solid result with a 2.7% increase, while the weakest was Perth that still saw growth of 0.8%.

CoreLogic notes that it continues to be the upper quartile (most expensive) properties that are driving the market, particularly in Sydney, Melbourne, Brisbane and Adelaide.

The same trend with freestanding homes over units is also prevalent across the country and it’s something we’ve been witnessing for quite some time.

It’s also clear that the smaller capitals have had the best annual growth rates on the back of COVID, while now the larger capitals are playing catch up.

CoreLogic also noted that the boom in first home buyers is finally starting to ease off, with lending to that section of the market falling by 4.0%. Much of the demand from first home buyers was bought forward with the host of Government incentives from both state and federal programs.

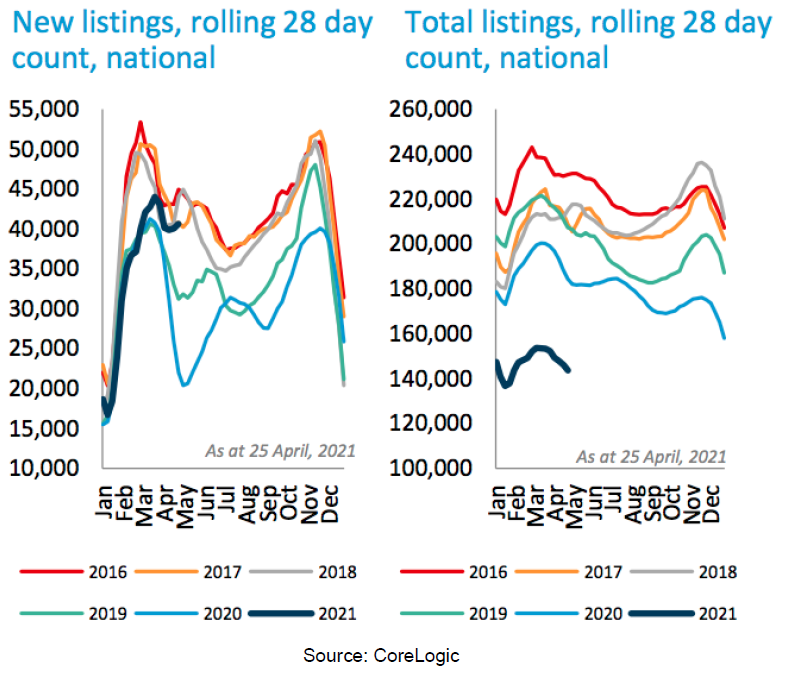

At the same time, the number of new listings coming to market continues to be high, however, those new properties are being quickly absorbed by the market. While vendors are now capitalising on rising prices, there is still a shortage of quality properties across the country, especially in the upper-end of the market.

Growth Rate to Ease

According to Head of Research at CoreLogic, Tim Lawless, the rate of growth that we’ve seen over the past six months is unsustainable and he expects to see that normalise in the months ahead.

Lawless does note that he expects house prices to continue to increase throughout 2021 and 2022, just at a slower pace than what we’ve seen.

In terms of risk factors, CoreLogic notes that they still expect interest rates to remain at low levels for the foreseeable future and this should help ease any pressure on those coming out of their loan deferral periods.

Similarly, the increase in property prices across the country has also likely eased the pressure for many that had been underwater with their loans.

Given that Australia has seen a strong v-shaped recovery in the jobs market, bodes well for property in the short term.

With APRA unlikely to act to try and cool the housing market, CoreLogic expects to see more growth ahead, albeit at a slower rate than what we’ve been seeing in the past six months.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)