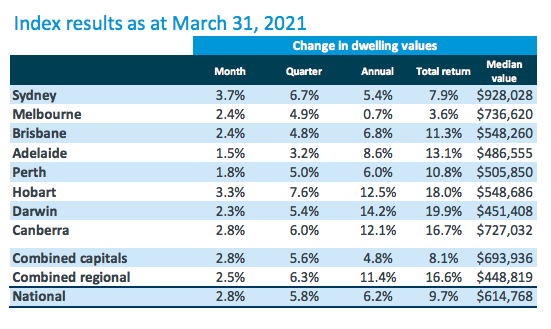

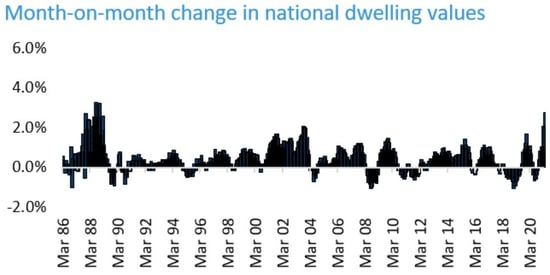

The exceptionally strong growth in house prices shows no sign of slowing down with the latest data from CoreLogic showing dwelling values are rising at the fastest rate in 32 years.

According to CoreLogic, national house prices rose at 2.8% in March, the biggest increase we’ve seen since October 1988.

All capital cities saw strong growth in March, which was led by Sydney with an incredibly strong 3.7% increase in dwelling values. While the weakest capital city was Adelaide, which still saw 1.5% growth. Regional Australia also continues to perform strongly, increasing in value by 2.5%.

The last time house prices rose this quickly in Sydney was during the last boom in 2015, prior to the credit tightening policies introduced by APRA.

The strong result in March now means that both Sydney and Melbourne have fully recovered from the small COVID-induced downturn in mid-2020.

Sydney prices are now back above their 2017 highs by 2.6% and have fully recovered from the -14.9% fall we saw after the last boom. Similarly, Melbourne house prices are also fully recovered and are also back at record high levels.

We are also starting to see the larger capital cities overtake the smaller capitals that had previously been seeing very strong growth.

The first quarter also closed with strong gains across the board, with dwelling values up by 5.8% nationally.

In terms of the units vs houses, there is still clearly stronger demand for lower density property as houses increased by twice as much as units over the first quarter.

At the same time, it is still the upper end of the market that is producing the bulk of the gains. The upper quartile of homes increased in value 3.7% in March, outpacing the lower quartile that showed a 1.6% increase.

Tight Listings Continue for Now

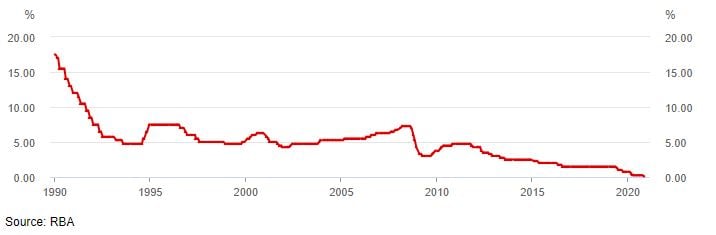

The strong gains continue to come on the back of record low interest rates and tight supply. The RBA has made it clear interests rates are likely to remain low for the next few years, while listings are also at historically low levels.

Graph of the Cash Rate Target

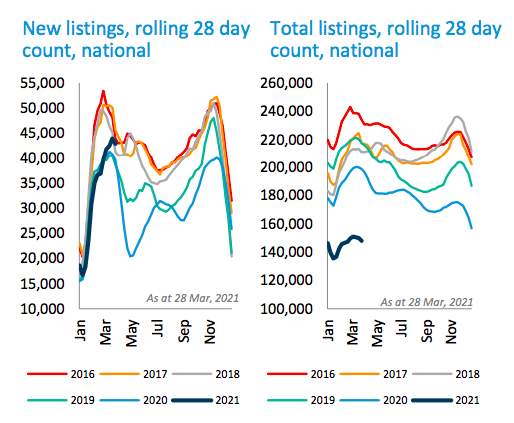

Total listings across the country are still at 25% below the five-year average. However, that could be slowly starting to change as new listings are on the rise as homeowners are gaining confidence and look to capitalise on the state of the market.

New listings are currently 3% above the five-year average and appear to be trending higher.

For time being, markets across the country are clearly favouring sellers, however, CoreLogic notes that things will likely slow down from the current record-setting pace.

So far, the strong demand from buyers has not been met by increases in inventory levels. However, at some point, the sellers will return to the market as we’ve started to already see with new listings on the rise.

Similarly, there has been a large influx of first home buyers, whose decision to purchase a property has likely been brought forward by the range of Government incentives on offer. Many of these incentives are set to end this year if they haven’t already.

While it has been stated that interest rates are likely to remain low for some time, if the housing market continues to overheat there is also some possibility that we could also see tighter credit policies, which as we know, can have an immediate impact on demand.

For the time being, house prices will likely continue to rise according to CoreLogic, however, we should expect the pace of the growth to slow down.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)