LVR is an acronym that stands for Loan to Value Ratio.

It is the proportion of money you borrow compared to the value of the property, and expressed as a percentage.

Lenders use this to help assess the risk factor of borrowers before deciding whether to approve a loan.

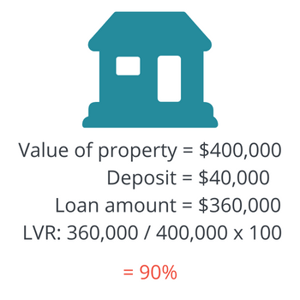

How to calculate LVR

In this example, the value of the property is $400,000 and a deposit of $40,000 is available.

A LVR of 80% is considered to be a benchmark for many lenders, above which you may have to pay extra fees, including Lenders Mortgage Insurance (LMI).

What is LMI?

LMI protects the lender in the event of a customer defaulting on a home loan.

Whenever a lender loans a customer money for a property, there is a risk that they wont get the money back if the customer cannot afford the repayments.

Although the lender has the property as security, there is a chance that the value of the property could decline, so it would not cover the value of the loan if the lender had to sell it. LMI covers the lender in this eventuality.

How will the LVR affect you as a property investor?

Lenders place a large emphasis on the LVR.

As well as influencing whether or not you will have to pay LMI, it can also impact the interest rate you will be paying on your loan.

The lower the LVR, the lower the lender's risk, which can result in the customer receiving other benefits such as lower interest rates or reduced fees on their loan package.

Learn more in this quick video

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)