There are many myths and misconceptions thrown around when it comes to property investment.

Believing these property investing myths and making purchasing decisions because of them can increase your exposure to risk and affect your ability to build a profitable and sustainable property portfolio.

So here are some common property investment myths that you need to be aware of in order to help you plan a successful property investment strategy.

Myth 1: Property prices always increase

You may have heard this claim before, but it's not true.Depending on the price paid at the time and the location, the property value may not rise significantly enough to ever turn a profit.

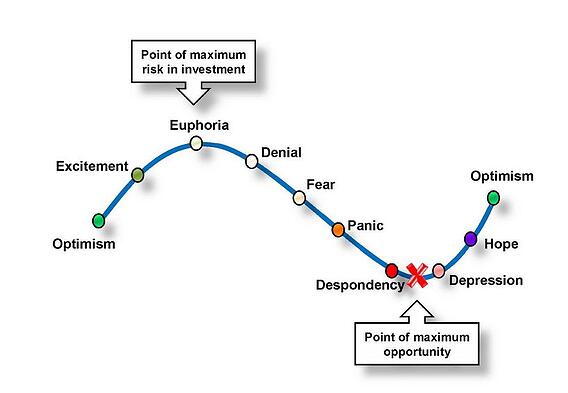

It's important to remember that the property market is cyclical with periods of booms and declines. Mining towns are notorious for this, with very clear periods of boom and bust cycles.

Depending on the economy, the shift can happen quickly and result in property prices quickly falling as demand falls.

Myth 2: Only the wealthy can afford to invest in property

This depends on your definition of wealthy and all prosperity is relative. What is true is that Australia's love affair with property is well known, there are now more than 1.8 million property investors in Australia and lots of those will have "average incomes" yet still build profitable portfolios.

Many investors can take their first steps into property by leveraging existing equity in their home or by accessing hard earned savings.

Others may buy off-the-plan which can involve securing a property at today's prices yet not having to settle until a future date – this is often a period of up to 18 months or in some cases even longer.

Always enter into any investment with a financially responsible attitude and do not over-stretch yourself, especially in the early stages.

If you are a first time property investor, this on-demand webinar can show you how to get started in property investment.

Myth 3: Cash flow is always king

It is true that high yielding properties can help you create a passive income, but experienced property investors will tell you that while cash flow is the oxygen that can help you build your portfolio, capital growth is what will make you wealthy in the long term.

The whole point of any investment is to see an increase of the asset value, but in order to hold your assets long term you will obviously need to service your debt, which strong rental yields and good cash flow can help you achieve.

This pack of free suburb reports can help you target high cash flow and growth suburbs and can get your next property search off to the perfect start.

Myth 4: Only purchase properties within a few kilometres of the CBD

Location is important when purchasing investment property, but that doesn't mean there aren't great investments outside of the CBD.Look for the intrinsic growth indicators within a suburb including:

- Population growth

- Future infrastructure plans

- The suburb's past performance in terms of median growth rates

- Increasing wage levels in the area

- Rising weekly rental prices

- Comparing prices in neighbouring suburbs

All these indicators can help you ascertain the investment fundamentals of a suburb to determine whether it could deliver long term growth.

If you are a Real Estate Investar member, you can check the suburb fundamentals of any suburb nationally using Investar Search.

.png)

.png?width=229&height=115&name=RE%20Investar-Logo-MRI_Colour%20web%20229x115px%20(1).png)